Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

Member of

More Info

Rights

Digital Provenance

Publisher

Transcription

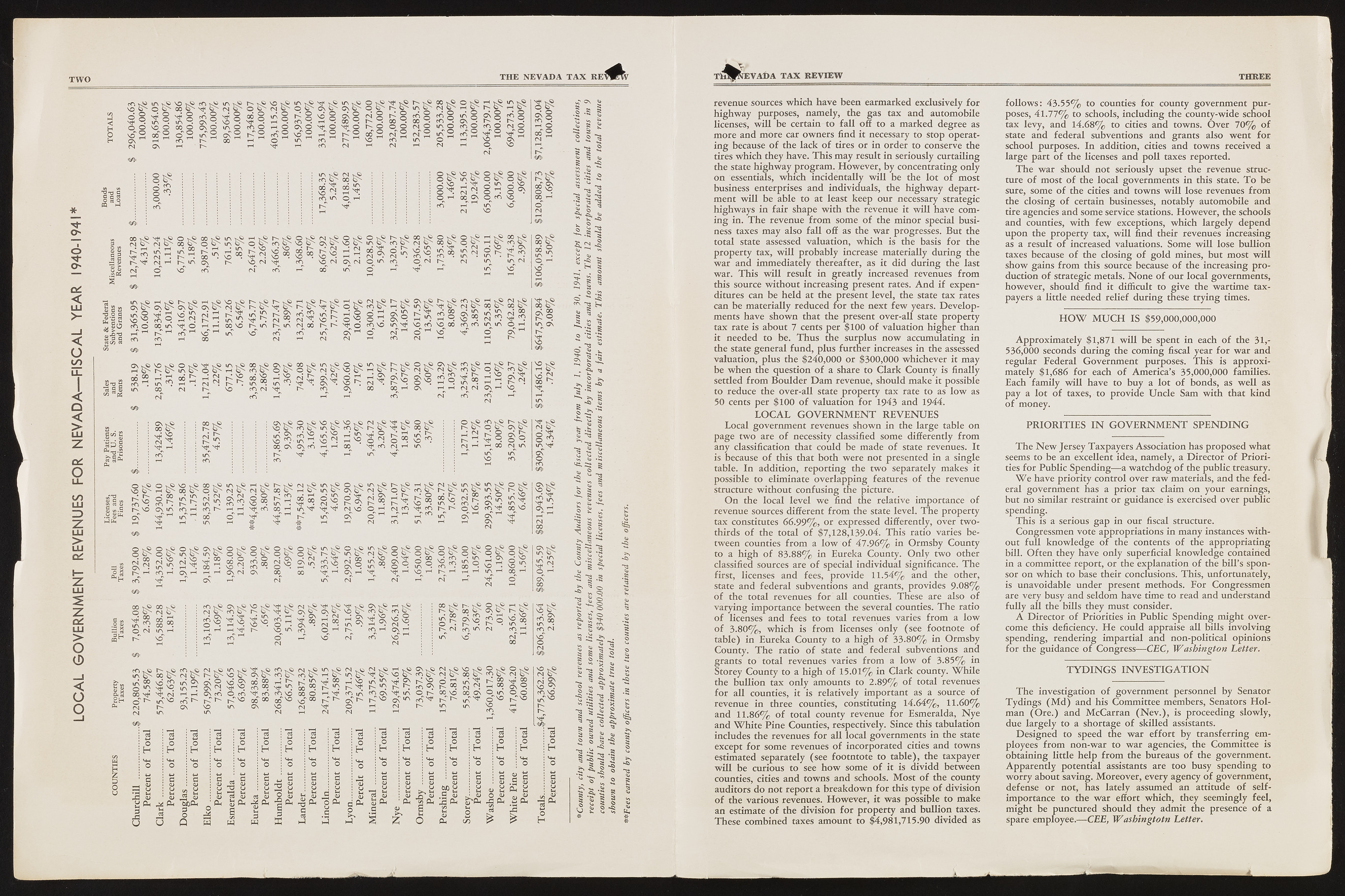

LO CAL GOVERNMENT REVENUES FOR NEVADA— FISCAL YEAR 1940-1941* T W O T H E N E V A D A T A X R E <5 H OH c a ^ VO ^ 6 § o o3 C \ AJ lA iia o . VO o HCN ~ ^ O 8® 00 o r A y^> i a AJ £® C s o ?a v ©6 : o ^mB aEmi mm mo mm af A CN O mm l A ^ 1 8 *A ^ CN ^ CN § X H a o D ^ O So ® CM O f£A O . O &§ Ni cr> O c n o t-H O i l l oo 2 o i 2 m m m m m Nt4" o rH Nt4 CA A - ^ NO cA IA o rH NO C n c A <N rH <N rH CN rH O NO a T £®Oo I t i—i o 0 0 'S CN ^ *1 o ^ § 'O ©f A » \S® AJ Ys$ i 0 s X 5 s ! '5? vo fA UN O r - i A @ i a * £ X OS CN 8^ H O r-l o ^ 0 2 O o • o o to VO l A VO vo 8^vo CN mX rH © CN ^ 'NS *» t r - a tgjg g a a -o o a 4>*a w &K*Hi d4>f(KJ 00 > tnM’V S d d rt C/3 w <$J £ Nt4 CN o GO 00 o UN IA rH o A - cA £ O NO A1 CN s i o NO oI A A - CA XA J ©X ©© rH X f A rH CA IA CM rH rH I A A - 00 rH K X I A rH NO i n 00 A^ Nt4 NO A ] NO NO NO 00 00 NO A - GO NO A1 NO rH A1 00 A1 Nt4 ON ©A 1 A« IA NO c A IA NO IA cA N f X I A lA AJ AJ ©I A NO A ; 1 1 A* C n CA rH A ^ IA CN I s a a ! g i CA g g a i CN a J © IA cA ©^ a ! A ^ AJ IA IA AJ O rH NO c A a T c A rH 00 lA © rH rH rH IA NO" l A T” < y - S ^ V-S* ^ 1 O N ^ C V ^ C N ^ C N ^ i a ° m ! h > ; i n - ! 1 S 'O S o S n fA © $> NO y$> CN VO . . . . rH X l A ^ © a 1” 1 c o rH f A rH I't Ja " 0 x vo M 4 . A I A vo 1^ CN a f A CN oarH<6r^'^otHoa(']y-or^sS>osv-®r'-vOr<S't O ]^ t S >M t !J £ s t ^ t s ' i f 6 s o ^ ! < S f t s H b S i r > ^ S f 6 s N S s 0 0 & ' X « v XSj Scs6n fi£SH} vtrf,' iAi >*-,i Svo cc~>i ^d cc-ns NgO r-h- C*^A c_6, Wg sorss |^£ rsl A«s* 'crHm gA* IA f A I P CN^ X c A »A VO • irC CN O O ^ Nt4 O CN ^ CN Oo . c A VO O OH A ^ ON ori rr\ CN in '^ H SO c ri s o oo c o r r i i n i n o ( s f ' -1 o ' 1-1 s o ' ' s f O ' c A CN tH ^ CN A - 2 # ^gC /3? SM Wh3 o 5*g& vo ^ A - i X I a T Ovo ^ r ^ v o CN o ^ c A 1 . CN IA Nt4 1 b$ Nt4 vv$ ^ o b x VO VO X X IA c A CN XM vo N 4 v^W CN % P! ^ IA c A C> NO X CN © X© lA AJ I © NO IA £ A - A^ ©A J CN AJ f A f A # rH IA NO CA a ! ^t4 A - CN CN AJ © NO rH A ; rH AJ C n CN A* NO CN © © NO f A f A © ^J4 IA A 00 m A~ f A CN X 00^ rH CN rH rH AJ^ AJ rH rH f A Aj" f A CN NO £ © f A NO IA NO f A AJ A^ £ © 00 £ ©I V IA NO CN c A f A IA NO rH IA NO NO AJ rH rH IA NO © ©A J © rH X lA NO f A A - AJ rH 00 CN CN f A rH rH 00 | g f A AJ rH IA AJ^ rH A ^t4" 1 # rH l A ^t4" r H * ^ rH . CN ^ f A CN ^ §X vo A* CN o ® CN *A >vV (X C 8 1 ......................... i—( c A A H H ^ 00 I A IA AJ rH AJ £ A X AJ rH IA IA © CN IA AJ A © rH f A AJ A l A IA l A I A ©A CN f A AJ f A © NO ©X AI A f A rH 00 N^4 rH X ©A J IA NO ©A M 4 q AJ A CN X rH A A A NO ©X 00 IA A VO AJ f A XA f A CN ©I A IA lA NO rH rH § g f A 00 rH IA j P NO ©^ rH f A g g f A A A ©^ NO f A X ^ NO © rH H rH A I A CN © " rH rH rH rH f A IA CN rH CN rH t-H ? 3f * 4 rH r 'i AJ f A I A rH rH CN AJ ON K * X O s I-4 vo" o Nt4 Ys© X UN CN A ^ NJ4 VO l A - CN d ^ o ^ l A Nt4 CV o c A CN VO <$> UN a ^ .» S ^ 1 "NS o ^CN aK I? l~H O . «a a - 8^ /SI* 00 Mr. A*«s 1 A c A ^ 8 UN c A Nl4' N rH ON rH 8^ vrH 00 8 * 0 O CN A ^ X Yv© CN QQ x . UN rH vo M 4 X CN s® ©© © © ©© ©O IA A © l A IA AJ ©© f ©© © © ©© ©© ©© CN l A . X rH 00 NO ©A J f A f A ©X AJ © C n NO CN AJ IA f A f A NO AJ CN X © l A IA NO X CN © © ©I A X © NO f A f A f A I A X IA © NO C n rH © NO NO lA lA HJ4 IA AJ rH CN AJ CN 00 X rH q rH m rH N q r-H A rH rH rH l A rH X rH q _ rH rH a T IA a T r-T aj" rH a T rH ^J4" © CN 4^ CN f A NO A £ AJ C n £ M 4 C\ VO CN f A s rH f A i l rH M 4 VO M 4 NO IA VO f A © rH rH m CN C n X rH AJ AJ 00 rH I A CN CN rH NO CN NO AJ © NO rH ^t4 A N q l A f A © rH A f A rH q rH f A rH © " rH NO A j" f A NO rH AJ AJ s ” A - CN UN • c A CA »A vo o -v>> CN V ^ * rH P ® CN CN X X ? €% IA CA CN s ? & "ns a s ^ * o m m M o o -Si -s. m—, k i n i2 "N<4S> f A lA A X f A AJ AJ A l A VO £ q f A f A AJ f A IA rH AJ IA AJ rH NO CN f A AJ AJ NO X © f A ©A J NO AJ V l A o Xl A NO f A NO I A I A CN rH CN CN ©A J NO M 4 CN NO 00 f A XX rH ^t4 A l A A X IA X B A X IA rH A NO l A A l A IA A CN A A f A NO q ©A rH X I A AJ M 4 AJ A rH X X M 4 CN X © AJ NO Cn q X X N q AJ rH rH q f A ©^ f A f A f A NO °°CV © rH cA I A f A CN m I A ©^ A 00 NO CN O I A © © f A NO H o " A l A NO f A A A A A NO 00 X 00 NO no" X A A CN A A NO CN l A f A A A IA Ht4 © " NO A NO IA NO AJ A CN NO IA CN NO AJ ^t4 © rH AJ A 1 IA IA NO rH A AJ l A I A AJ AJ AJ rH rH rH f A rH M 4 A W HZ5ou ctJ +-» O H MH O ? M n ^—H 4C>J *S u r C <U U Q . U *** 3 mrC r ^ PH » Ci 0 rS S GJDPh H0 1 o H Mh O G CU CJ »H <L> PH G 5 aS cd 8* S 2o ? rH C<3 I Ctf ESA -M ! 4h o O -O H H Hh Mh : mh o O i ° 4-» ! -w CGD CGD EB <Gt> U O H u A8T dJJr U 2 8 o H CD C/5 w G W G W G cjG O 1 3 CJ i3 a g p < G G <j CJ A s ^H rH _d> - P CCS ? w O H G 0) & A H a) A> n O) . 3 cu s ! cu " O. j=S Ph ^ P h n c/) G 0) CJ 0) Ui O <u rG Ph U5 CCS rG o H O ' mm o H "NS S a ^ a -ns "8 3 ^ -52) H<N s* - a a 3 - 1 T f ia P fE V A t lA T A X R E V IE W THREE revenue sources w hich have been earm arked exclusively fo r h igh w ay purposes, namely, the gas tax and autom obile licenses, w ill be certain to fa ll o ff to a m arked degree as m ore and m ore car ow ners find it necessary to stop operatin g because o f the lack o f tires or in order to conserve the tires w hich they have. T h is m ay result in seriously curtailing the state h igh w ay p rogram . H o w ever, by concentrating only on essentials, w hich incidentally w ill be the lot o f most business enterprises and individuals, the h igh w ay departm ent w ill be able to at least keep our necessary strategic highw ays in fa ir shape w ith the revenue it w ill have comin g in. T h e revenue fro m some o f the m inor special business taxes m ay also fa ll o ff as the w a r progresses. B ut the total state assessed valuation, w hich is the basis fo r the property tax, w ill p robably increase m aterially d u rin g the w a r and im m ediately thereafter, as it did du rin g the last w ar. T h is w ill result in greatly increased revenues from this source w ithout increasing present rates. A n d if expenditures can be h eld at the present level, the state tax rates can be m aterially reduced fo r the next fe w years. D e v e lo p ments have show n that the present over-all state property tax rate is about 7 cents per $100 o f valuation higher than it needed to be. T h u s the surplus n o w accumulating in the state gen eral fu n d, plus further increases in the assessed valuation, plus the $240,000 o r $300,000 whichever it may be w h en the question o f a share to C lark County is finally settled from B o u ld e r D a m revenue, should make it possible to reduce the o ver-all state property tax rate to as lo w as 50 cents per $100 o f valuation fo r 1943 and 1944. L O C A L G O V E R N M E N T R E V E N U E S Local governm ent revenues show n in the large table on page tw o are o f necessity classified some differently from any classification that could be m ade o f state revenues. It is because o f this that both w ere not presented in a single table. In addition, reporting the tw o separately makes it possible to eliminate o verlappin g features o f the revenue Structure w ithout confusing the picture. O n the local level w e find the relative importance o f revenue sources different from the state level. T h e property tax constitutes 66.99% , or expressed differently, over tw o-thirds o f the total o f $7,128,139-04. This ratio varies between counties fro m a lo w o f 4 7 .9 6 % in O rm sby County to a h igh o f 8 3 .88% in Eureka County. O n ly tw o other classified sources are o f special individual significance. T h e first, licenses and fees, provide 11.54% and the other, state and federal subventions and grants, provides 9 -08% o f the total revenues fo r all counties. These are also o f varying importance between the several counties. T h e ratio o f licenses and fees to total revenues varies from a lo w o f 3.80% , w hich is from licenses only (see footnote o f ta b le ) in Eureka County to a h igh o f 33.80% in O rm sby County. T h e ratio o f state and federal subventions and grants to total revenues varies from a lo w o f 3.85% in Storey County to a h igh o f 15.01% in C lark county. W h ile the bu llion tax only amounts to 2.8 9 % o f total revenues fo r all counties, it is relatively im portant as a source o f revenue in three counties, constituting 14.64%, 11.60% and 11.86% o f total county revenue fo r Esmeralda, N y e and W h it e Pine Counties, respectively. Since this tabulation includes the revenues fo r all local governm ents in the state except fo r some revenues o f incorporated cities and towns estimated separately (see footntote to ta b le ), the taxpayer w ill be curious to see h o w some o f it is dividd between counties, cities and towns and schools. M o st o f the county auditors do not report a breakdow n fo r this type o f division o f the various revenues. H o w ever, it w as possible to make an estimate o f the division fo r property and bu llion taxes. These com bined taxes am ount to $4,981,715.90 divided as fo llo w s : 4 3 .5 5 % to counties fo r county governm ent p u rposes, 4 1 .7 7 % to schools, including the county-wide school tax levy, and 14.68% to cities an d towns. O v e r 7 0 % o f state and federal subventions and grants also w ent fo r school purposes. In addition, cities and towns received a large part o f the licenses and p o ll taxes reported. T h e w a r should not seriously upset the revenue structure o f most o f the local governm ents in this state. T o be sure, some o f the cities and towns w ill lose revenues from the closing o f certain businesses, notably autom obile and tire agencies and some service stations. H o w e v e r, the schools and counties, w ith fe w exceptions, w hich largely depend u pon the property tax, w ill find their revenues increasing as a result o f increased valuations. Some w ill lose bu llion taxes because o f the closing o f g o ld mines, but most w ill show gains from this source because o f the increasing p ro duction o f strategic metals. N o n e o f ou r local governments, how ever, should find it difficult to give the wartim e taxpayers a little needed relief du rin g these trying times. H O W M U C H IS $59,000,000,000 A pproxim ately $1,871 w ill be spent in each o f the 31,- 536,000 seconds d u rin g the com ing fiscal year fo r w a r and regular Federal G overnm ent purposes. T h is is approximately $1,686 fo r each o f Am erica’s 35,000,000 families. Each fam ily w ill have to buy a lot o f bonds, as w e ll as pay a lot o f taxes, to provide U n cle Sam w ith that kind o f money. P R IO R IT IE S I N G O V E R N M E N T S P E N D I N G T h e N e w Jersey Taxpayers Association has proposed w hat seems to be an excellent idea, namely, a D irector o f P rio rities fo r P u blic Spending— a w atch dog o f the public treasury. W e have priority control over ra w materials, and the fe d eral governm ent has a p rior tax claim on your earnings, but no similar restraint or guidance is exercised over public spending. T his is a serious gap in our fiscal structure. Congressmen vote appropriations in many instances w ith out fu ll k n ow ledge o f the contents o f the appropriating bill. O ften they have only superficial k n ow ledge contained in a committee report, or the explanation o f the b ill’s sponsor on w hich to base their conclusions. T h is, unfortunately, is unavoidable under present methods. F or Congressm en are very busy and seldom have time to read and understand fu lly all the bills they must consider. A D irector o f Priorities in P u blic Spending m ight overcome this deficiency. H e could appraise all bills in volvin g spending, rendering im partial and non-political opinions fo r the guidance o f Congress— CEC, W a sh in g ton Letter. T Y D I N G S I N V E S T I G A T I O N T h e investigation o f governm ent personnel by Senator T ydin gs ( M d ) and his Committee members, Senators H o lman (O r e .) and M cC arran (N e v . ) , is proceeding slow ly, due largely to a shortage o f skilled assistants. D esign ed to speed the w a r e ffo rt by transferring employees from n on -w ar to w a r agencies, the Committee is obtaining little help fro m the bureaus o f the government. A p paren tly potential assistants are too busy spending to w o rry about saving. M o reover, every agency o f governm ent, defense or not, has lately assumed an attitude o f self-importance to the w a r effort which, they seemingly feel, m ight be punctured should they adm it the presence o f a Spare employee.-— -CEE, W a sh in g to tn Letter.