Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

Member of

More Info

Rights

Digital Provenance

Publisher

Transcription

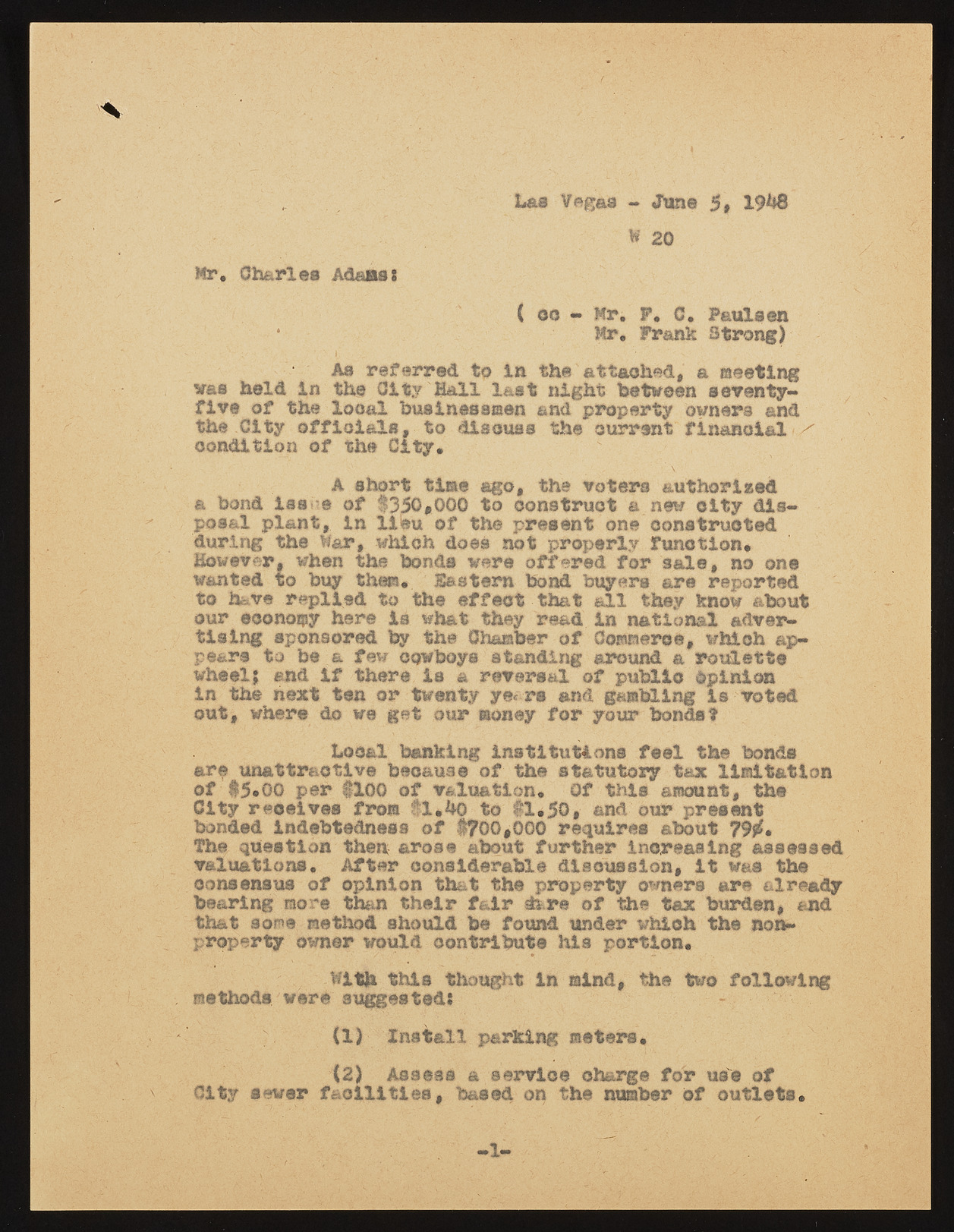

m k Las Vegas - June 5# 1948 W 20 Mr. Charles Adams: ( oo - Mr. F. C. Paulsen Mr. Frank Strong) As referred to in the attached, a meeting was held In the City Hall last night between seventy-five of the looal businessmen and property owners and the City officials, to dlsouss the current financial ^ condition of the City. ?rS f ' - 3, V'- 5SU ' * !''1 ^ I ' || '' ||| ‘ ||(|| A short time ago, the voters authorised a bond las e of #350*000 to construct a new city disposal plant, in lieu of the present one construeted during the Mar, which does not properly function. However, when the bonds were offered for sale, no one wanted to buy then. Eastern bond buyers are reported to have replied to the effect that all they know about our economy here is what they read in national advertising sponsored by the Chamber of Commerce, which appears to be a few cowboys standing around a roulette wheel} and if there is a reversal of publio opinion in the next ten or twenty ye*re and gambling is voted out, where do we get our money for your bonds? Local banking institutions feel the bonds are unattractive because of the statutory tax limitation of #5.00 per $100 of valuation. Of this amount, the City receives from #1.40 to #1.50, and our present bonded indebtedness of $700*000 requires about 79#. the question then arose about further increasing assessed valuations. After considerable discussion* it was the consensus of opinion that the property owners are already bearing more than their fair safer® of the tax burden, and that some method should be found under which the non-property owner would contribute his portion. with this thought in mind, the two following . methods were suggested: (1) Install parking meters. (2) Assess a service charge for use of City sever facilities, based on the number of outlets. 1-