Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

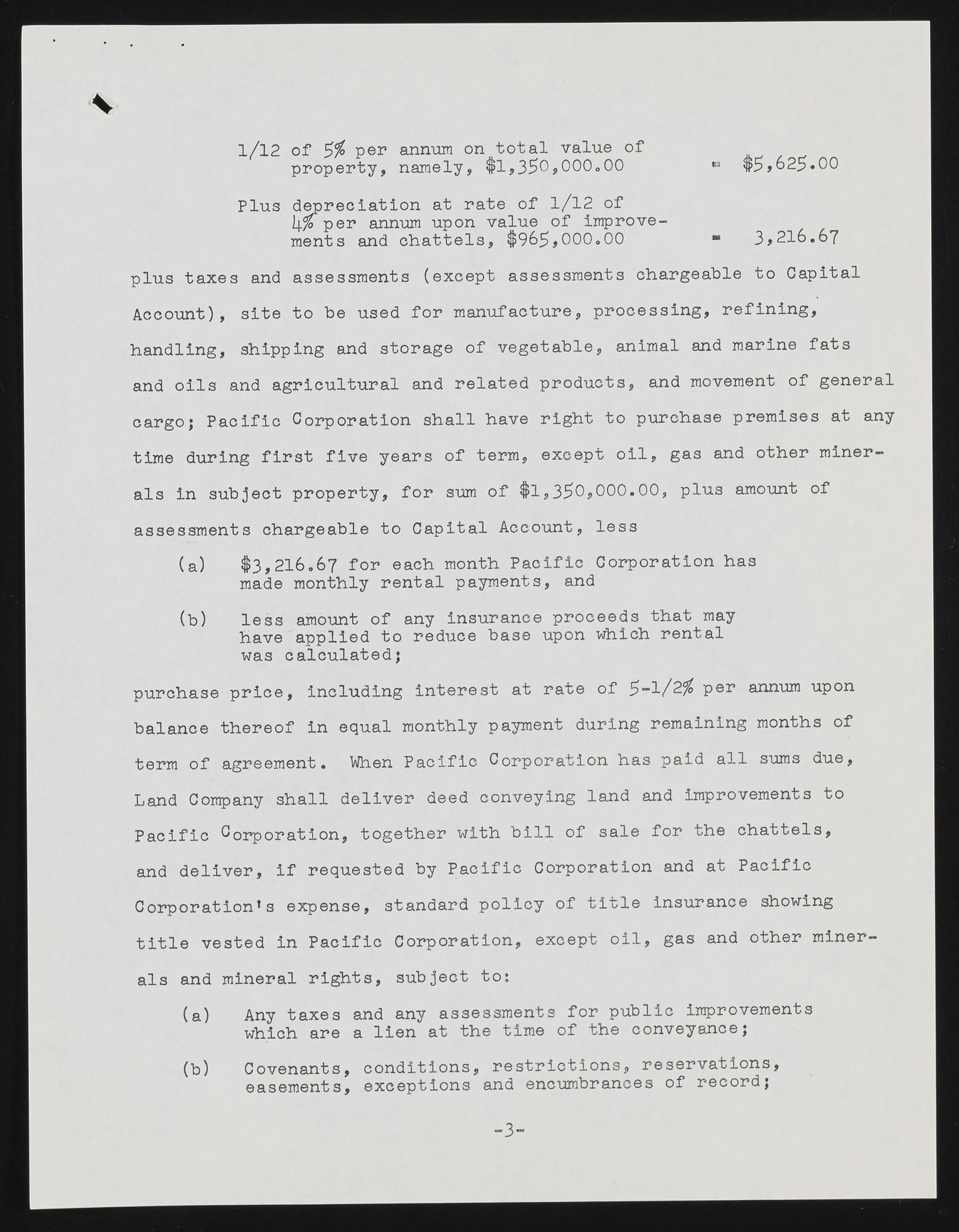

1/12 of per annum on total value of property, namely, $1 ,350,000.00 83 $5,625*00 Plus depreciation at rate of l/l2 of per annum upon value of improvements and chattels, $965,000.00 ** 3,216.67 plus taxes and assessments (except assessments chargeable to Capital Account), site to be used for manufacture, processing, refining, handling, shipping and storage of vegetable, animal and marine fats and oils and agricultural and related products, and movement of general cargo; Pacific Corporation shall have right to purchase premises at any time during first five years of term, except oil, gas and other minerals in subject property, for sum of $1 ,350,000.00, plus amount of assessments chargeable to Capital Account, less (a) $3,216.67 for each month Pacific Corporation has made monthly rental payments, and (b) less amount of any insurance proceeds that may have applied to reduce base upon which rental was calculated; purchase price, including Interest at rate of 5—1/2^ per annum upon balance thereof in equal monthly payment during remaining months of term of agreement. When Pacific Corporation has paid all sums due, Land Company shall deliver deed conveying land and improvements to Pacific Corporation, together with bill of sale for the chattels, and deliver, if requested by Pacific Corporation and at Pacific Corporation’s expense, standard policy of title insurance showing title vested in Pacific Corporation, except oil, gas and other minerals and mineral rights, subject to: (a) Any taxes and any assessments for public improvements which are a lien at the time of the conveyance; (b) Covenants, conditions, restrictions, reservations, easements, exceptions and encumbrances of record; -3-