Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

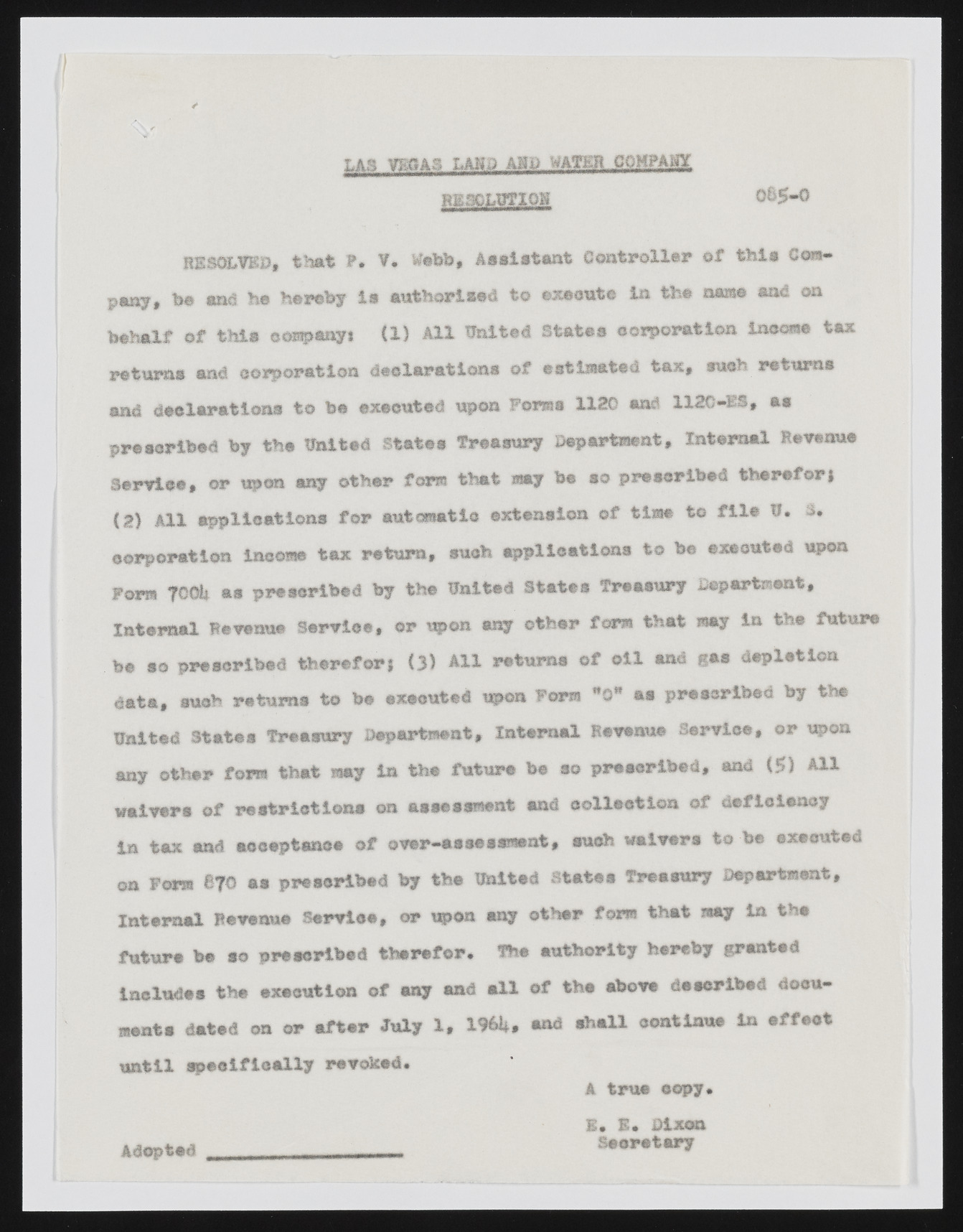

o&$«o LAS VBQA3 LAND JkWti WATER CQM.PAjfl£ RESOLUTION RESOLVED, that P. V* Webb, Assistant Controller of this Company, be and he hereby is authorised to execute in the name and on behalf of this company* (15 All United States corporation income tax returns and corporation declarations of estimated ta x , such returns gyn*i declarations to be executed upon Forms 1120 and 112C-ES, as prescribed by the United States Treasury Department, Internal Revenue Service, or upon any other form that may be so prescribed therefor* (2) All applications for automatic extension of time to f ile U, 3. corporation income tax return, such applications to be executed upon Form TOOL* as prescribed by the United States Treasury Department, Internal Revenue Service, or upon any other form that way in the future be so prescribed therefor* (3) All returns of o il and gas depletion data, such returns to be executed upon Form "0W as prescribed by the United States Treasury Department, Internal Revenue Service, or upon any other form that may in the future be so prescribed, and (5) All waivers of restrictio n s on assessment and collection of deficiency in tax and acceptance of over-asses sweat, such waivers to be executed on Form 070 as prescribed by the united states Treasury Department, Internal Revenue Service, or upon any other form that way in the future be so prescribed therefor. The authority hereby granted includes the execution of any and a ll of the above described documents dated on or after July 1 , 1961*. and shall continue in effect until specifically revoked. Adopted A true copy. £ . 1 . Dixon Secretary