Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

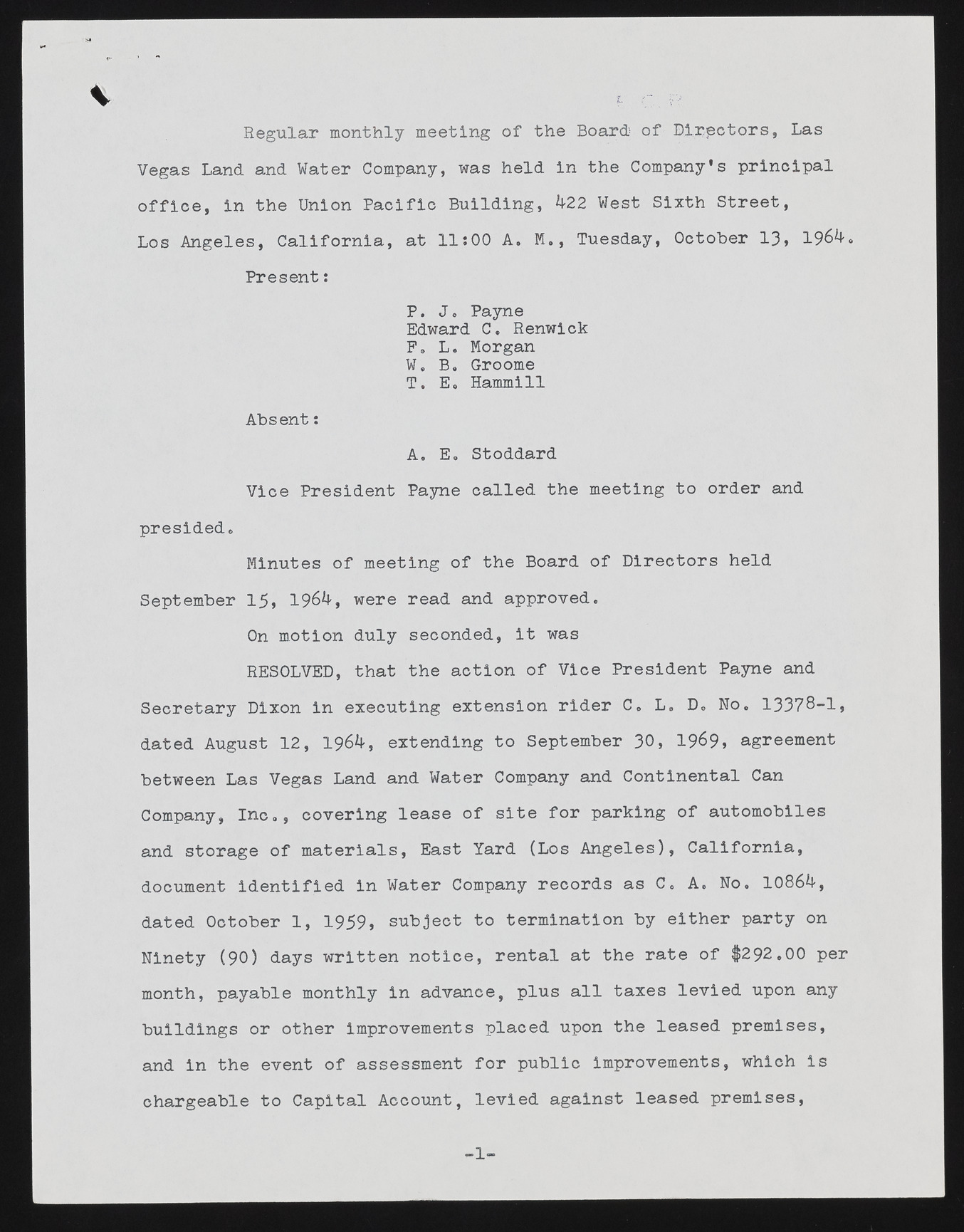

% Regular monthly meeting of the Board’ of Directors, Las Vegas Land and Water Company, was held In the Company's principal office, in the Union Pacific Building, 422 West Sixth Street, Los Angeles, California, at 11:00 A. M., Tuesday, October 13, 1964. Present: P . J . Payne Edward C. Renwlck F. L. Morgan W. B. Groome T. E. Hammill Absent: A. E. Stoddard Vice President Payne called the meeting to order and presided. Minutes of meeting of the Board of Directors held September 15, 1964, were read and approved. On motion duly seconded, it was RESOLVED, that the action of Vice President Payne and Secretary Dixon in executing extension rider C. L. D. No. 13378-1, dated August 12, 1964, extending to September 30, 1969, agreement between Las Vegas Land and Water Company and Continental Can Company, Ino., covering lease of site for parking of automobiles and storage of materials, East Yard (Los Angeles), California, document identified in Water Company records as C. A. No. 10864, dated October 1, 1959, subject to termination by either party on Ninety (90) days written notice, rental at the rate of $292.00 per month, payable monthly in advance, plus all taxes levied upon any buildings or other improvements placed upon the leased premises, and in the event of assessment for public improvements, which is chargeable to Capital Account, levied against leased premises, -1-