Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

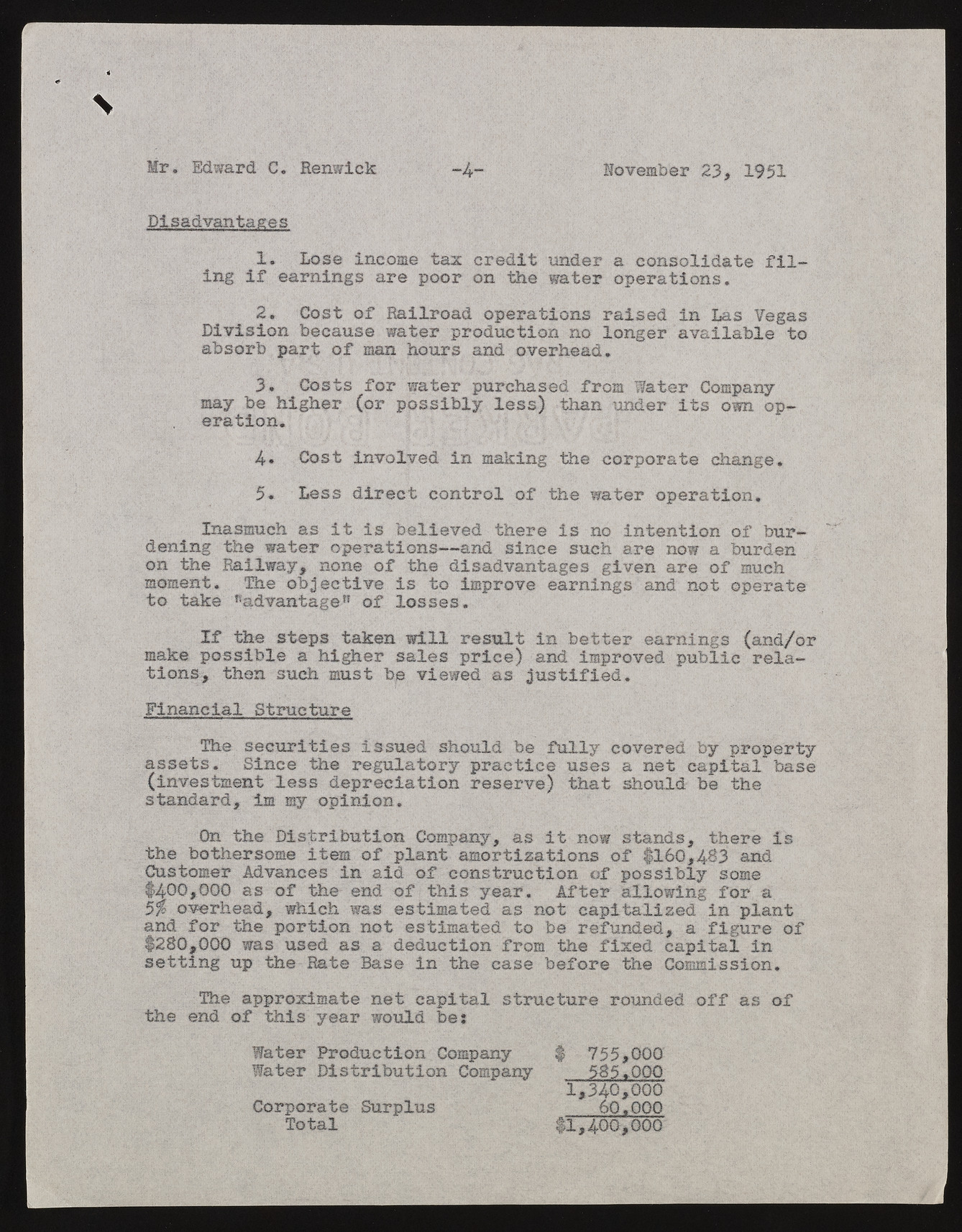

\ Mr, Edward C. Renwick -4- November 23, 1951 Disadvantages 1. Lose income tax credit under ing if earnings are poor on the water ao pecroantsioolnisd*ate filDivisi2. o n Cbeocsatu soef wRaatielrr opard odoupcetriaotino nnso lroainsgeerd aivna iLlaas blVee gatso absorb part of man hours and overhead. may be3. higChoestrs (foro r powsastierb lyp urlecshsa)s edt hafnr oumn dWeart eri tsC oomwpann oy peration. 4 . Cost involved in making the corporate change. 5* Less direct control of the water operation. deningI ntahsem uwcaht ears oipte rias tiboenlsi—evaendd tshienrcee iss uncoh airnet ennotwi oan bouf rdbeunron the Railway, none of the disadvantages given are of much mtoom etnatk.e ^Tahdvea notbajgeec't1 ivofe liso ssteos .improve earnings and not operate make pIofs stihbel es tae phs igthaekre n swaillesl prreiscuel)t ainnd biemtptreorv eeda rnpiunbglsi c (raenlda/-or tions, then such must be viewed as justified. Financial Structure assetsT.h e Ssienccuer ittihee s riesgsuuleadt orsyho purlad ctbiec ef uulsleys coav nereetd cbayp iptraolp*bearstey (investment less depreciation reserve) that should be the standard, im my opinion. On the Distribution Company, as it now stands, there is Ctuhes tobmoetrh erAsdovmaen ceist eim no fa idp laonft caomnosrttriuscattiioonn so f opfo s$s16i0bl,4y8 3s omaend f-400,000 as of the end of this year. After allowing for a a5n%d ofveorrh etahde, pwohritciho nw naso t esetsitmiamtaetde d ast o nobte rceafpuintdaeldi,s eda fiing uprlea nto f $280,000 was used as a deduction from the fixed capital in setting up the Rate Rase in the case before the Commission, the enTdh e ofa pptrhiosx iymeaatre nwoeutl dc abpei:tal structure rounded off as of WWaatteerr PDirsotdruicbtuitoino nC omCpoamnpya ny $ 755855,,000000 1,340,000 60,000 1 1 ,400,000 CorpToortaalte Surplus