Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

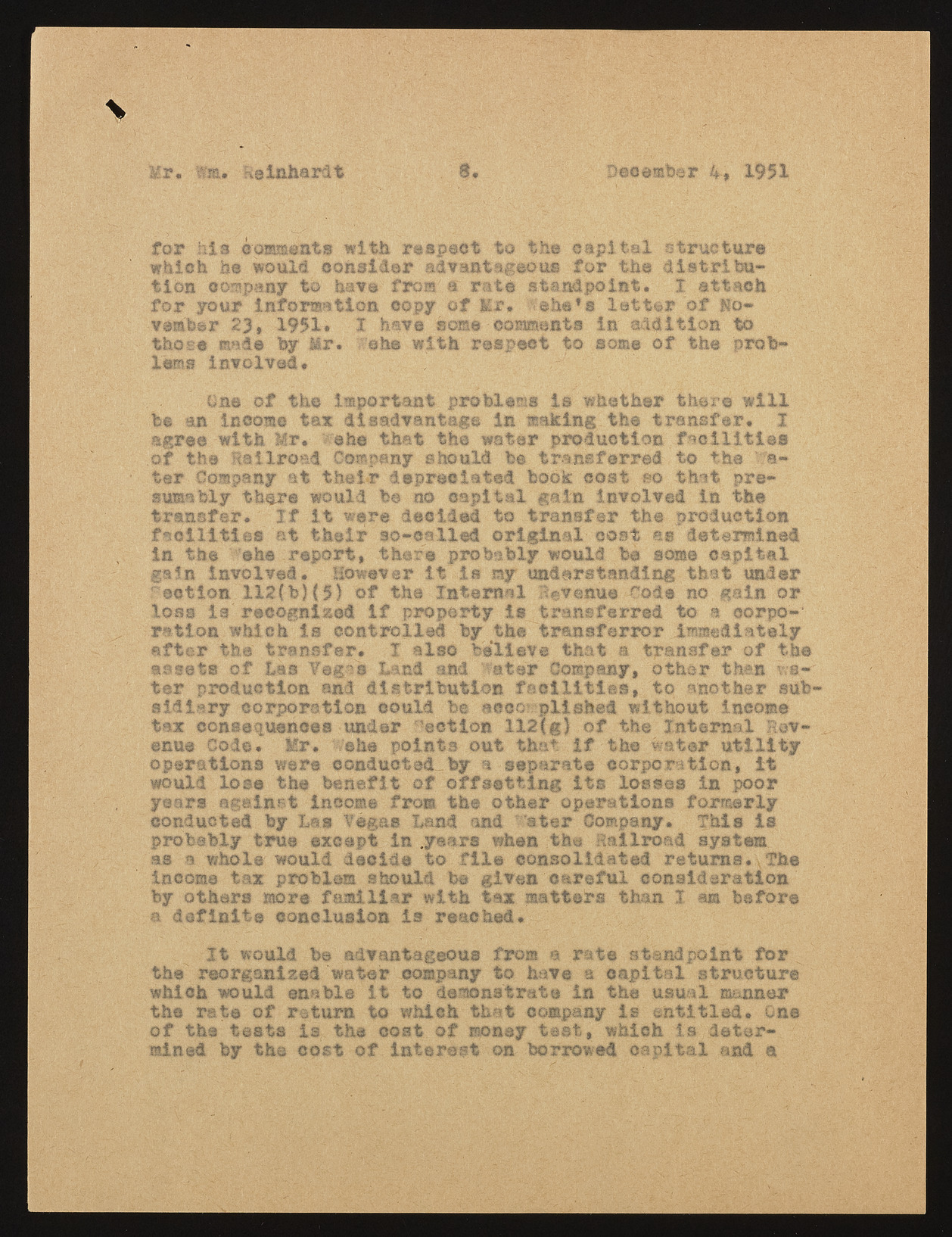

?'Mr. Witu Reinhardt 8. ? December 4* 1951 for his comments with respect to the capital structure which he would consider advantageous for the distribution company to have from a rate standpoint. 1 attach for your information copy of Mr. vehe’s letter of November 23, 1951* 1 have some-comments in addition to those made by Mr. “she with respect to some of the problems involved. One of the important problems is whether there will be an income tax disadvantage in making the transfer. I agree with Mr. wehe that the water production facilities of the Railroad Company should be transferred to the a-tar Company at their depreciated book cost so that presumably there would be no capital gain involved in the transfer. If it were decided to transfer the production facilities at their so-called original- cost as determined in the eh® report, there probably would be some capital gain involved. However it la my understanding that under faction 112(b)(5) of the Internal Revenue Code no gain or loss la recognized If property is transferred to a corporation which is controlled by the transferror immediately after the transfer. I also believe that a transfer of th© assets o f Las Vegas hand and y m tar Company, other than wa~" ter production and distribution facilities, to another sub sldlary corporation could be accomplished without income tax consequences under action 112(g) of the Internal Revenue Code. M r. she points out that if the water utility operations were conducted by a separate corporation, it would lose the benefit of offsetting its losses in poor years against income from the other operations formerly conducted by Las Vegas Land and I??’ster Company. This is probably true except in .years when the Railroad system as a whole would decide to file consolidated returns.\The income tax problem should be given careful consideration by others more familiar with tax matt sirs than I am before a definite conclusion is reached. It would be advantageous from a rate standpoint for the reorganized water company to have a capital structure which would enable it to demonstrate in the usual manner the rate of return to which that company is entitled. On© of the tests is the cost of money test, whieh is determined by the cost of Interest on borrowed capital and a