Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

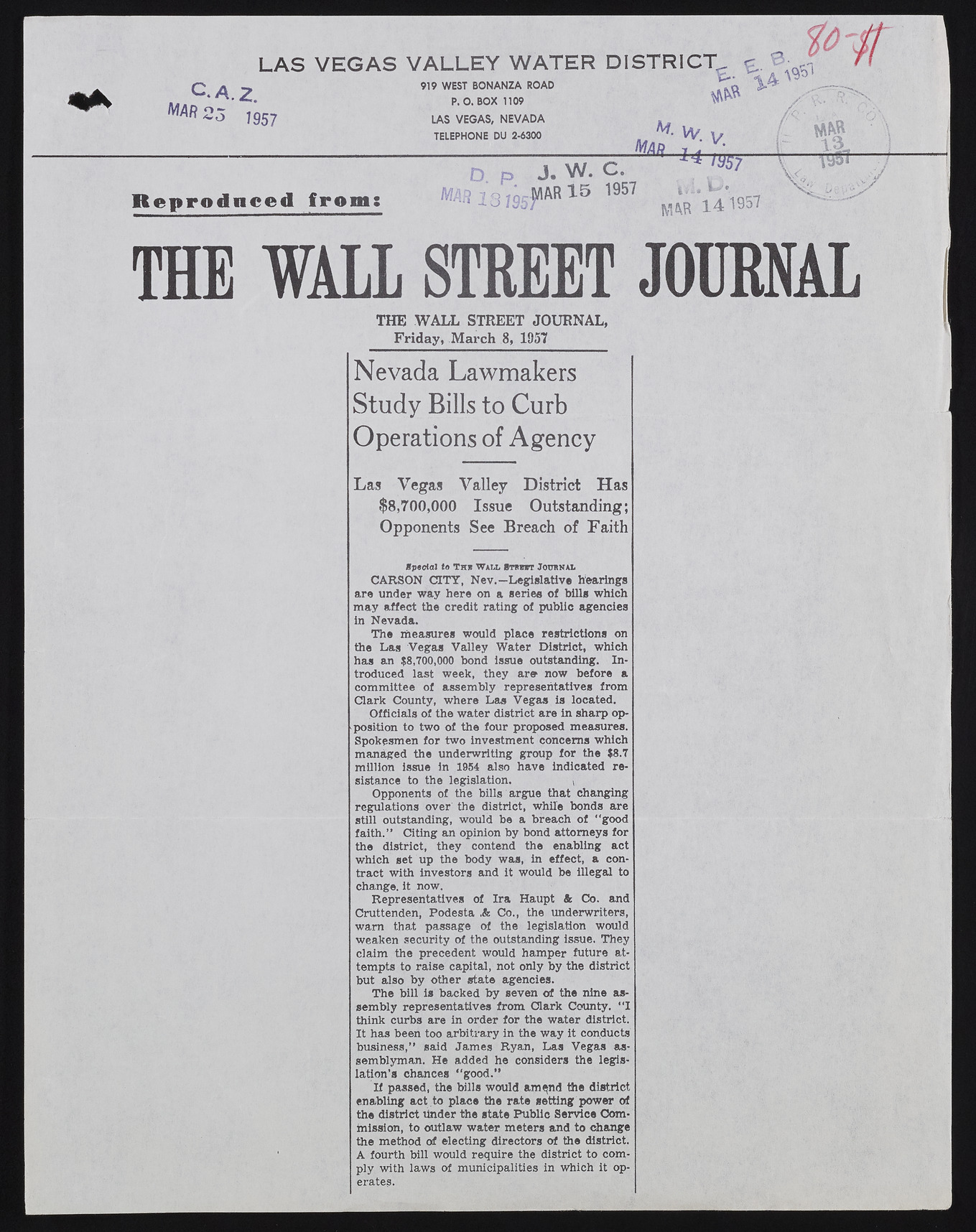

THE WALL STREET JOURNAL I THE WALL STREET JOURNAL, Friday, March 8, 1957________ Nevada Lawmakers Study Bills to Curb Operations of Agency Las Vegas Valley District Has $8,700,000 Issue Outstanding; Opponents See Breach of Faith 8p«cta) to T h v Wall Str o tt Journal CARSON CITY, Nev.—Legislative hearings are under way here on a series of bills which may affect the credit rating of public agencies in Nevada. The measures would place restrictions on the Las Vegas Valley Water District, which has an $8,700,000 bond issue outstanding. Introduced last week, they are now before a committee of assembly representatives from Clark County, where Las Vegas is located. Officials of the water district are in sharp opposition to two of the four proposed measures. Spokesmen for two investment concerns which managed the underwriting group for the $8.7 million issue in 1954 also have indicated resistance to the legislation. Opponents of the bills argue that changing regulations over the district, while bonds are still outstanding, would be a breach of “good faith.’’ Citing an opinion by bond attorneys for the district, they contend the enabling act which set up the body was, in effect, a contract with investors and it would be illegal to change, it now. Representatives of Ira Haupt & Co. and Cruttenden, Podesta ,& Co., the underwriters, warn that passage of the legislation would weaken security of the outstanding issue. They claim the precedent would hamper future attempts to raise capital, not only by the district but also by other state agencies. The bill is backed by seven of the nine assembly representatives from Clark County. “I think curbs are in order for the water district. It has been too arbitrary in the way it conducts business,’’ said James Ryan, Las Vegas assemblyman. He added he considers the legislation’s chances “ good.” If passed, the bills would am^nd the district enabling act to place the rate setting power of the district tinder the state Public Service Commission, to outlaw water meters and to change the method of electing directors of the district. A fourth bill would require the district to comply with laws of municipalities in which it operates.