Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

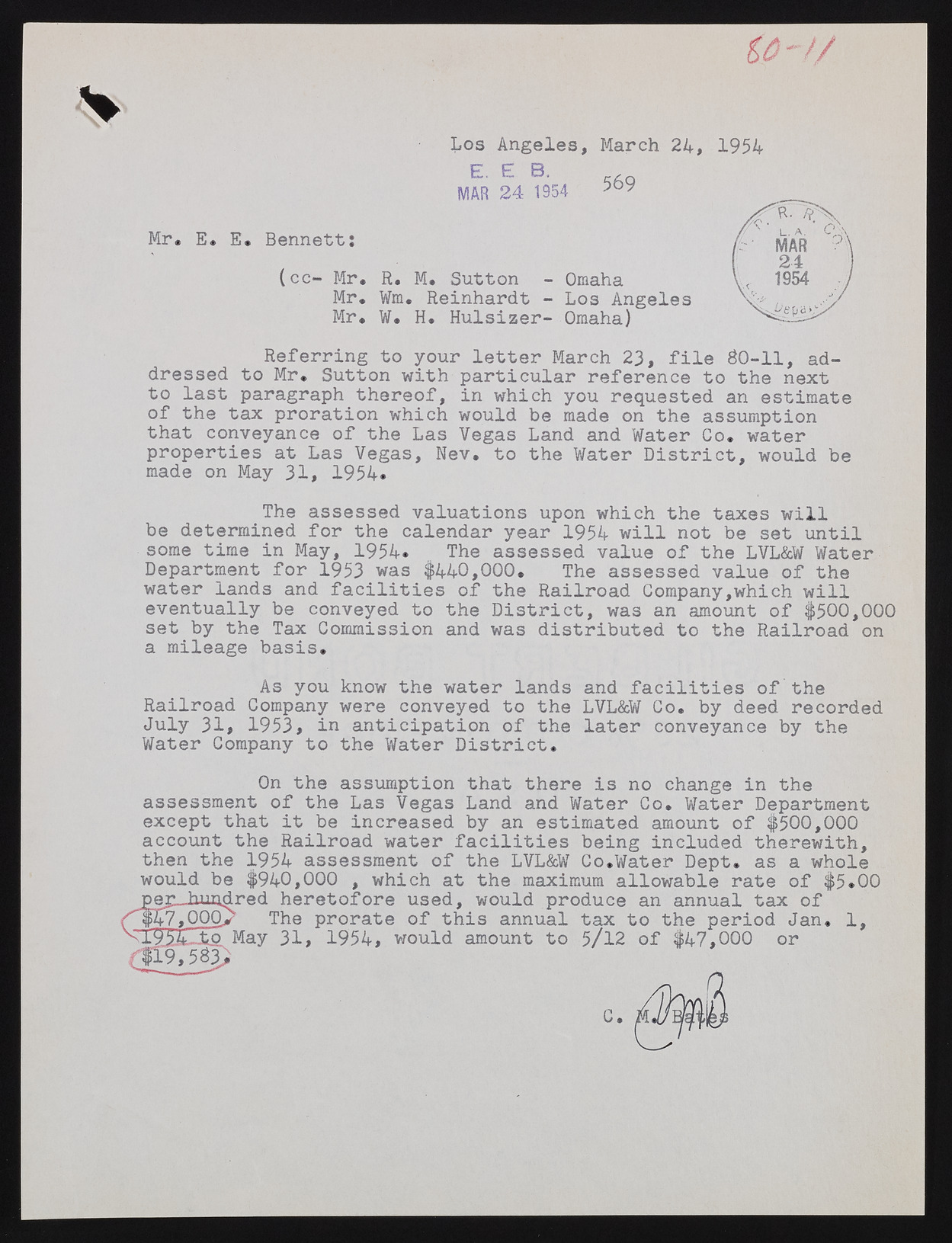

Los Angeles, E. E B. MAR 24 1954 Mr. E. E. Bennett: (cc- Mr. R. M. Sutton - Omaha Mr. Wm. Reinhardt - Los Angeles Mr. W. H. Hulsizer- Omaha) Referring to your letter March 23, file £0-11, addressed to Mr. Sutton with particular reference to the next to last paragraph thereof, in which you requested an estimate of the tax proration which would be made on the assumption that conveyance of the Las Vegas Land and Water Co. water properties at Las Vegas, Nev. to the Water District, would be made on May 31, 1954. The assessed valuations upon which the taxes will be determined for the calendar year 1954 will not be set until some time in May, 1954. The assessed value of the LVL&W Water Department for 1953 was $440,000. The assessed value of the water lands and facilities of the Railroad Company,which will eventually be conveyed to the District, was an amount of $500,000 set by the Tax Commission and was distributed to the Railroad on a mileage basis. March 24, 1954 569 As you know the water lands and facilities of the Railroad Company were conveyed to the LVL&W Co. by deed recorded July 31, 1953, in anticipation of the later conveyance by the Water Company to the Water District. On the assumption that there is no change in the assessment of the Las Vegas Land and Water Co. Water Department except that it be increased by an estimated amount of $$00,000 account the Railroad water facilities being included therewith, then the 1954 assessment of the LVL&W Co.Water Dept, as a whole would be $940,000 , which at the maximum allowable rate of $5.00 fejL..hundred heretofore used, would produce an annual tax of 47.OOOy The prorate of this annual tax to the period Jan. 1, May 31, 1954, would amount to 5/12 of $47,000 or ^0,563>