Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

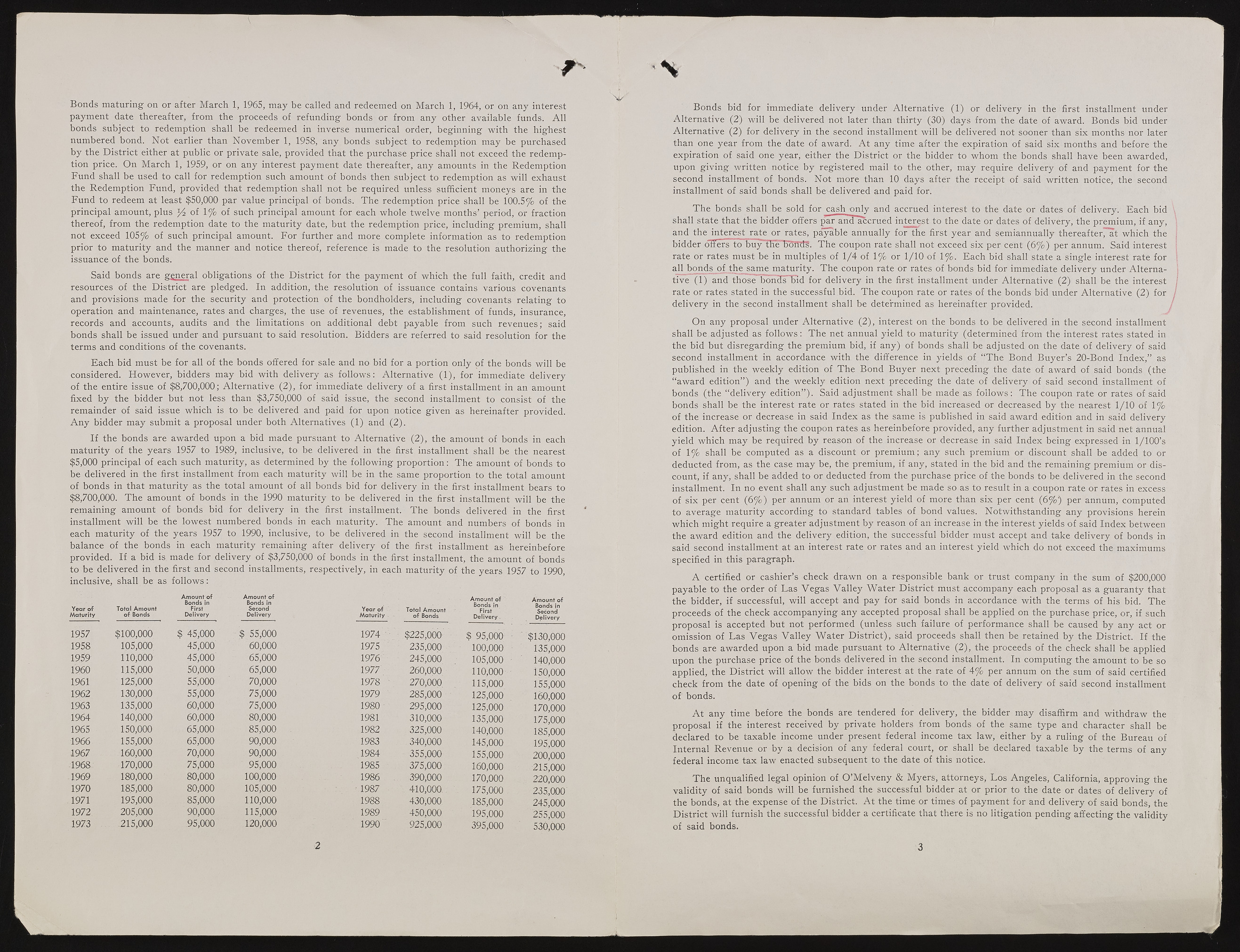

Bonds m aturing on or after March 1, 1965, may be called and redeemed on March 1, 1964, or on any interest paym ent date thereafter, from the proceeds of refunding bonds or from any other available funds. All bonds subject to redemption shall be redeemed in inverse numerical order, beginning w ith the highest numbered bond. Not earlier than November 1, 1958, any bonds subject to redemption may be purchased by the D istrict either at public or private sale, provided that the purchase price shall not exceed the redemption price. On March 1, 1959, or on any interest payment date thereafter, any amounts in the Redemption Fund shall be used to call for redemption such amount of bonds then subject to redemption as will exhaust the Redemption Fund, provided th at redemption shall not be required unless sufficient moneys are in the Fund to redeem at least $50,000 par value principal of bonds. The redem ption price shall be 100.5 % of the principal amount, plus y2 of 1% of such principal amount for each whole twelve m onths’ period, or fraction thereof, from the redemption date to the m aturity date, but the redemption price, including premium, shall not exceed 105% of such principal amount. For further and more complete information as to redemption prior to m aturity and the manner and notice thereof, reference is made to the resolution authorizing the issuance of the bonds. Said bonds are general obligations of the D istrict for the payment of which the full faith, credit and resources of the D istrict are pledged. In addition, the resolution of issuance contains various covenants and provisions made for the security and protection of the bondholders, including covenants relating to operation and maintenance, rates and charges, the use of revenues, the establishment of funds, insurance, records and accounts, audits and the limitations on additional debt payable from such revenues; said bonds shall be issued under and pursuant to said resolution. Bidders are referred to said resolution for the term s and conditions of the covenants. Each bid m ust be for all of the bonds offered for sale and no bid for a portion only of the bonds will be considered. However, bidders may bid with delivery as follows: Alternative (1), for immediate delivery of the entire issue of $8,700,000; A lternative (2), for immediate delivery of a first installm ent in an amount fixed by the bidder but not less than $3,750,000 of said issue, the second installment to consist of the rem ainder of said issue which is to be delivered and paid for upon notice given as hereinafter provided. Any bidder may subm it a proposal under both Alternatives (1) and (2), If the bonds are awarded upon a bid made pursuant to Alternative (2), the amount of bonds in each m aturity of the years 1957 to 1989, inclusive, to be delivered in the first installment shall be the nearest $5,000 principal of each such m aturity, as determined by the following proportion: The amount of bonds to be delivered in the first installm ent from each m aturity will be in the same proportion to the total amount of bonds in th at m aturity as the total am ount of all bonds bid for delivery in the first installment bears to $8,700,000. The am ount of bonds in the 1990 m aturity to be delivered in the first installm ent will be the rem aining am ount of bonds bid for delivery in the first installment. The bonds delivered in the first installm ent will be the lowest numbered bonds in each m aturity. The amount and numbers of bonds in ea.ch m aturity of the years 1957 to 1990, inclusive, to be delivered in the second installment will be the balance of the bonds in each m aturity remaining after delivery of the first installment as hereinbefore provided. If a bid is, made for delivery of $3,750,000 of bonds in the first installment, the am ount of bonds to be delivered in the first and second installments, respectively, in each m aturity of the years 1957 to 1990, inclusive, shall be as follow s: Year of Total Am ount Am ount of Bonds in First Am ount of Bonds in Second Year of Am ount of Bonds in Am ount of Bonds in M aturity of Bonds Delivery Delivery M aturity - - of Bonds D e live ry. Delivery 1957 $100,000 $ 45,000 1 55,000 1974 $225,000 $ 95,000 ; ' $130,000 1958 105,000. 45,000 60,000 1975 " 235,000 100,000 ? 135,000 1959' 110,000 45,000 65,000 1976' 245,000 105,000 • i40,000 1960 1.15,000 50,000 65,000 1977 260,000 110,000 150,000 1961 125,000 55,000 70,000 1978 ' 270,000. 115,000 155,000 1962 130,000 55,000 75,000 1979 285,000 125,000 160,000 1963 135,000 60,000 75,000 1980 - 295,000 125,000 170,000 1964 140,000 60,000 80,000 1981 310,000 135,000 175,000 1965 150,000 65,000 85,000 1982 325,000 140,000 185,000 1966 155,000 65,000 90,000 1983 340,000 145,000 195,000 1967 160,000 70,000 90,000 1984 355,000 155,000 200,000 1968.: 170,000 75,000 ! 95,000 1985 ? 375,000 160,000 215,000 1969 180,000 80,000 100,000 1986. 390,000 170,000 220,000 1970 18.5,000 80,000 105,000 •1987 410,000. 175,000 235,000 1971 195,000 85,000 110,000 1988 430y000 185,000 245,000 1972 205,000 90,000 115,000 1989 450,000 195,000 255,000 1973 .215,000 95,000 120,000 1990 " 925,000 395,000 530,000 2 \ Bonds bid for immediate delivery under Alternative (1) or delivery in the first installm ent under A lternative (2) will be delivered not later than thirty (30) days from the date of award. Bonds bid under A lternative (2) for delivery in the second installm ent will be delivered not sooner than six months nor later than one year from the date of award. At any time after the expiration of said six months and before the expiration of said one year, either the D istrict or the bidder to whom the bonds shall have been awarded, upon giving w ritten notice by registered mail to the other, may require delivery of and payment for the second installm ent of bonds. Not more than 10 days after the receipt of said w ritten notice, the second installment of said bonds shall be delivered and paid for. The bonds shall be sold for cash only and accrued interest to the date or dates of delivery. Each bid shall state th at the bidder offers par and accrued interest to the date or dates of delivery, the premium, if any, and the interest rate or rates, payable annually for the first year and semiannually thereafter^at which the bidder offers to buyTfieTlb'itdg. The coupon rate shall not exceed six per cent (6%) per annum. Said interest rate or rates m ust be in multiples of 1/4 of 1% or 1/10 of 1%. Each bid shall State a single interest rate for all bonds of the same maturity. The coupon rate or rates of bonds bid for immediate delivery under A lternative (1) and those bonds bid for delivery in the first installment under Alternative (2) shall be the interest rate or rates stated in the successful bid. The coupon rate or rates of the bonds bid under Alternative (2) for delivery in the second installm ent shall be determined as hereinafter provided. On any proposal under A lternative (2), interest on the bonds to be delivered in the second installment shall be adjusted as follows : The net annual yield to m aturity (determined from the interest rates stated in the bid but disregarding the premium bid, if any) of bonds shall be adjusted on the date of delivery of said second installm ent in accordance with the difference in yields of “The Bond Buyer’s 20-Bond Index,” as published in the weekly edition of The Bond Buyer next preceding the date of award of said bonds (the “award edition”) and the weekly edition next preceding the date of delivery of said second installment of bonds (the “delivery edition”). Said adjustm ent shall be made as follows:: The coupon rate or rates of said bonds shall be the interest rate or rates stated in the bid increased or decreased by the nearest 1/10 of 1%. of the increase or decrease in said Index as the same is published in said award edition and in said delivery edition. A fter adjusting the coupon rates as hereinbefore provided, any further adjustm ent in said net annual yield which may be required by reason of the increase or decrease in said Index being expressed in 1/100’s of \°/o shall be computed as a discount or prem ium ; any such premium or discount shall be added to or deducted from, as the case may be, the premium, if any, stated in the bid and the remaining premium or discount, if any, shall be added to or deducted from the purchase price of the bonds to be delivered in the second installment. In no event shall any such adjustm ent be made so as to result in a coupon rate or rates in excess of six per cent (6%). per annum or an interest yield of more than six per cent (6%) per annum, computed to average m aturity according to standard tables of bond values. N otw ithstanding any provisions herein which might require a greater adjustm ent by reason of an increase in the interest yields of said Index between the award edition and the delivery edition, the successful bidder m ust accept and take delivery of bonds in said second installm ent at an interest rate or rates and an interest yield which do not exceed the maximums specified in this paragraph. A certified or cashier’s check drawn on a responsible bank or tru st company in the sum of $200,000 payable to the order of Las Vegas Valley W ater D istrict m ust accompany each proposal as a guaranty that the bidder, if successful, will accept and pay for said bonds in accordance with the terms of his bid. The proceeds of the check accompanying any accepted proposal shall be applied on the purchase price, or, if such proposal is accepted but not performed (unless such failure of performance shall be caused by any act or omission of Las Vegas Valley W ater D istrict), said proceeds shall then be retained by the D istrict. If the bonds are awarded upon a bid made pursuant to Alternative (2),, the proceeds of the check shall be applied upon the purchase price of the bonds delivered in the second installment. In computing the am ount to be so applied, the D istrict will allow the bidder interest at the rate of 4% per annum on the sum of said certified check from the date of opening of the bids on the bonds to the date of delivery of said second installment of bonds. A t any time before the bonds are tendered for delivery, the bidder may disaffirm and w ithdraw the proposal if the interest received by private holders from bonds of the same type and character shall be declared to be taxable income under present federal income tax law, either by a ruling of the Bureau of Internal Revenue or by a decision of any federal court, or shall be declared taxable by the term s of any federal income tax law enacted subsequent to the date of this notice. The unqualified legal opinion of O ’Melveny & Myers, attorneys, Los Angeles, California, approving the validity of said bonds will be furnished the successful bidder at or prior to the date or dates of delivery of the bonds, at the expense of the District. A t the time or times of paym ent for and delivery of said bonds, the D istrict will furnish the successful bidder a certificate that there is no litigation pending affecting the validity of said bonds. 3