Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

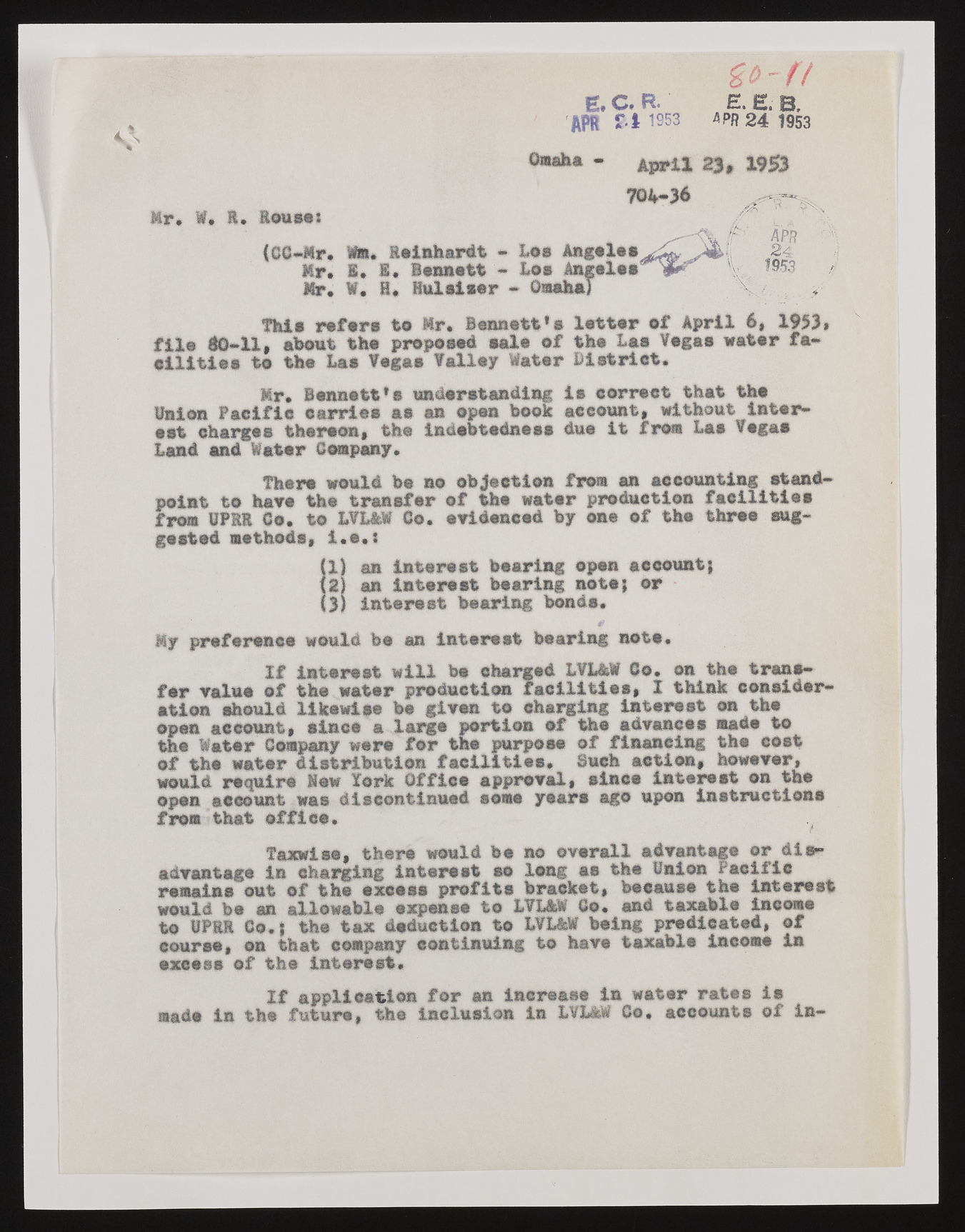

ii ? 1 ft E. C. a E. E, B, APR r4 1953 APR 24 1953 ©»aha - ;,prii 2$$ 1953 704-36 Mr. W. R. Rouse: (CC-Mr. feu Reinhardt - Los Angeles Mr. B. S. Bennett - Los Angeles Mr. V. H. Kulslser - Omaha) pH W ?' APR 2 4 i; 1953 mi IM This refers to Mr. Bennett's letter of April 6, 1953» file 40-11, about the proposed sale of the Lao Vegas water facilities to the Las Vegas Valley Water District. Mr. Bennett's understanding is correct that the Union Pacific carries as an open book account, without interest charges thereon, the indebtedness due it from Las Vegas Land and Water Company. There would be no objection from an accounting standpoint to have the transfer of the water production facilities from UPRR Co. to LVL&W Co. evidenced by one of the throe suggested methods, i.e.t ill an interest bearing open account; 2} an interest bearing note; or 3) Interest bearing bonds. My preference would be an interest bearing note. If Interest will be charged LVLfcW Co. on the transfer value of the water production facilities, I think consideration should likewise be given to charging interest on the open account, since a large portion of the advances made to the Water Company were for the purpose of financing the cost of tho water distribution facilities* Such action, however, would require Hew fork Office approval, since interest on the open account was discontinued some years ago upon Instructions from that office. ill ' Taxwisa, there would be no overall advantage or disadvantage in charging interact so long as the Union Pacific remains out of the excess profits bracket, because the interest would be an allowable expense to LVL&W Co. and taxable income to UPRR Co.| the tax deduction to LVL&W being predicated, of course, on that company continuing to have taxable income in excess of the interest. If application for an increase in water rates is made in the future, the inclusion in LVL&W Co, accounts of in-