Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

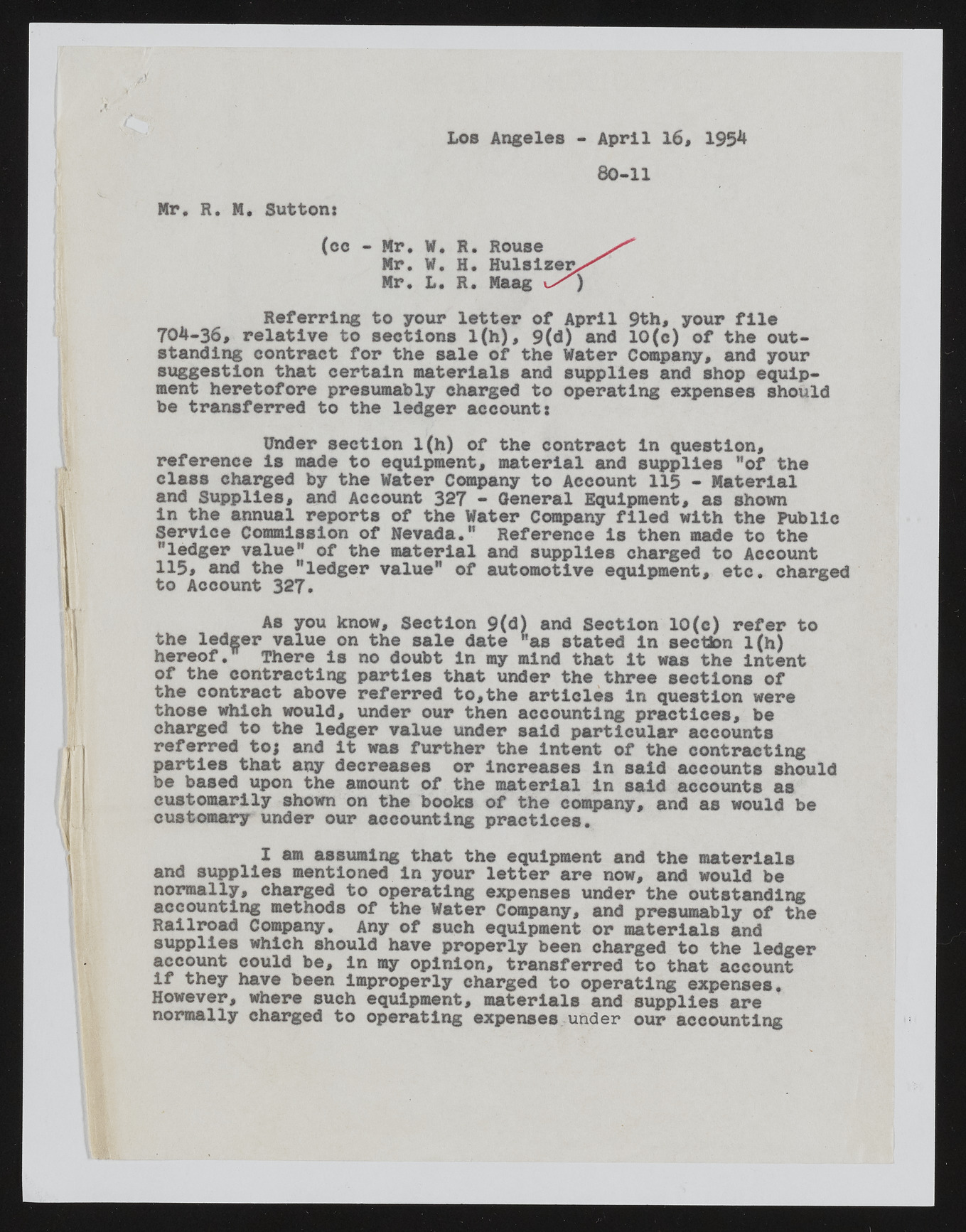

Lo b Angeles - April 16* 195*1 80-11 Nr. R. M. Sutton: (co - Mr. W. R. Rouse Mr. W. H. Hulslzer^ Mr, L. R. Maag i / j Referring to your letter of April 9th, your file 704-36, relative to sections 1(h), 9(d) and 10(c) of the outstanding contract for the sale of the Water Company, and your suggestion that certain materials and supplies and shop equipment heretofore presumably charged to operating expenses should be transferred to the ledger accounts reference is made to equipment, material and supplies "of the class charged by the Water Company to Account 115 - Material and Supplies, and Account 327 - General Equipment, as shown in the annual reports of the Water Company filed with the Public Service Commission of Nevada." Reference is then made to the "ledger value" of the material and supplies charged to Account 115, and the "ledger value" of automotive equipment, etc. charged to Account 327. the ledger value on the sale date "as stated in section 1(h) hereof. There is no doubt in my mind that it was the Intent of the contracting parties that under the three sections of the contract above referred to,the articles in question were those which would, under our then accounting practices, be charged to the ledger value under said particular accounts referred toi and it was further the intent of the contracting parties that any decreases or Increases in said accounts should be based upon the amount of the material in said accounts as customarily shown on the books of the company, and as would be customary under our accounting practices. I I am assuming that the equipment and the materials and supplies mentioned in your letter are now, and would be normally, charged to operating expenses under the outstanding accounting methods of the Water Company, and presumably of the Railroad Company. Any of such equipment or materials and supplies which should have properly been charged to the ledger account could be, in my opinion, transferred to that account if they have been improperly charged to operating expenses. However, where such equipment, materials and supplies are normally charged to operating expenses under our accounting Under section 1(h) of the contract in question, As you know, Section 9(d) and Section 10(c) refer to