Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

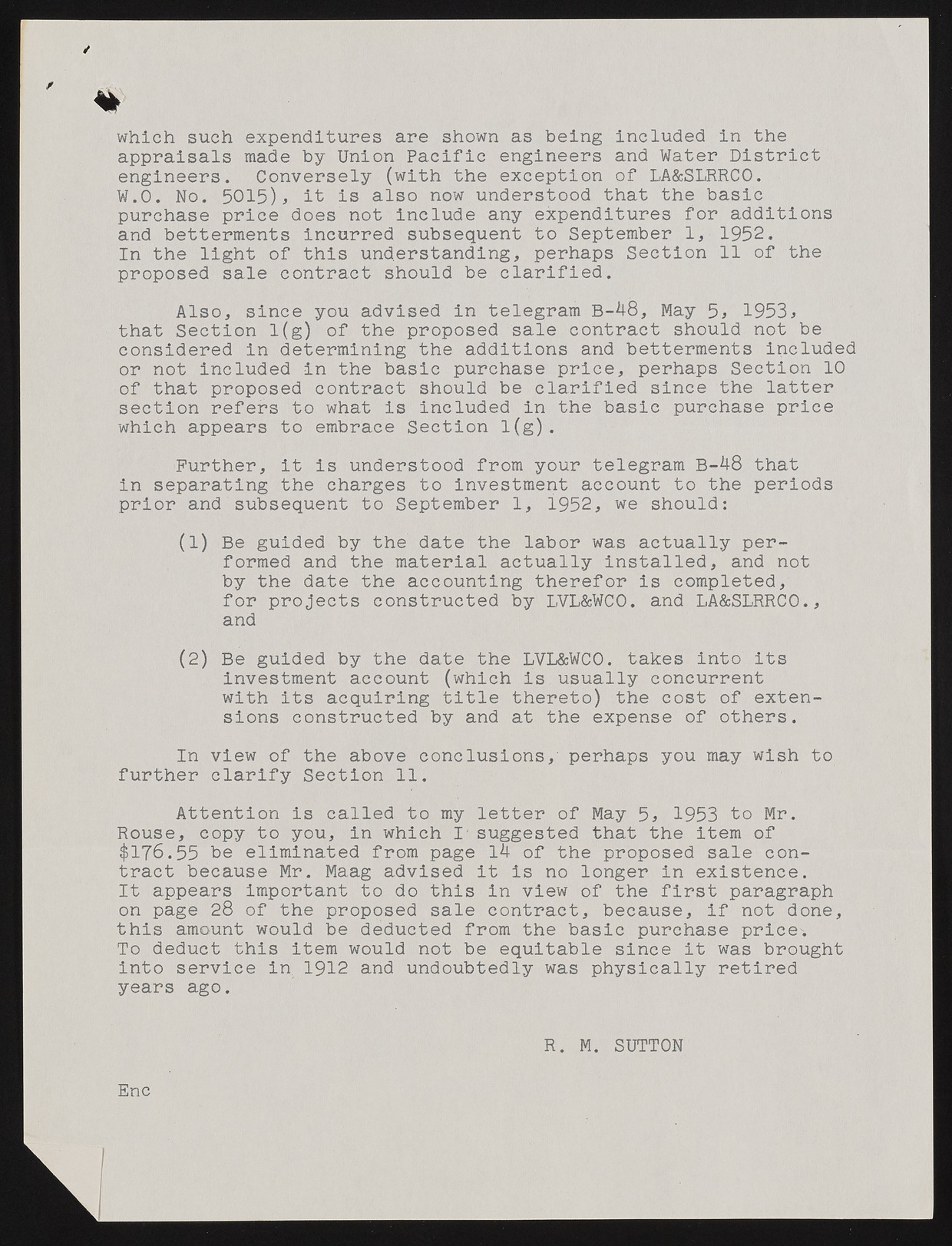

? % w h i c h such expenditures are shown as being included in the appraisals made by Union Pacific engineers and W a t e r District engineers. Conversely (with the exception of LA&SLRRCO. W.O. No. 5015), it is also now understood that the basic purchase price does not include any expenditures for additions and betterments incurred subsequent to September 1, 1952. In the light of this understanding, perhaps Section 11 of the proposed sale contract should be clarified. Also, since you advised in telegram B-48, May 5* 1953* that Section 1(g) of the proposed sale contract should not be considered in determining the additions and betterments included or not included in the basic purchase price, perhaps Section 10 of that proposed contract should be clarified since the latter section refers to what is included in the basic purchase price wh i c h appears to embrace Section 1(g). Further, it is understood from your telegram B-48 that in separating the charges to investment account to the periods prior and subsequent to September 1, 1952, we should: (1) Be guided b y the date the labor was actually p e r formed and the material actually installed, and not by the date the accounting therefor is completed, for projects constructed by LVL&WCO. and LA&SLRRCO., and (2) Be guided by the date the LVL&WCO. takes into its investment account (which is usually concurrent with its acquiring title thereto) the cost of e x t e n sions constructed by and at the expense of others. In view of the above conclusions, perhaps you m a y wish to further clarify Section 11. Attention is called to m y letter of May 5* 1953 to Mr. Rouse, copy to you, in w h i c h I' suggested that the item of $176.55 be eliminated from page 14 of the proposed sale c o n tract because Mr. Maag advised it is no longer in existence. It appears Important to do this in view of the first paragraph on page 2 8 of the proposed sale contract, because, if not done, this amount would be deducted from the basic purchase price'. To deduct this item would not be equitable since it was brought into service in. 1912 and undoubtedly was physically retired years ago. / R. M. SUTTON Enc