Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

Member of

More Info

Rights

Digital Provenance

Publisher

Transcription

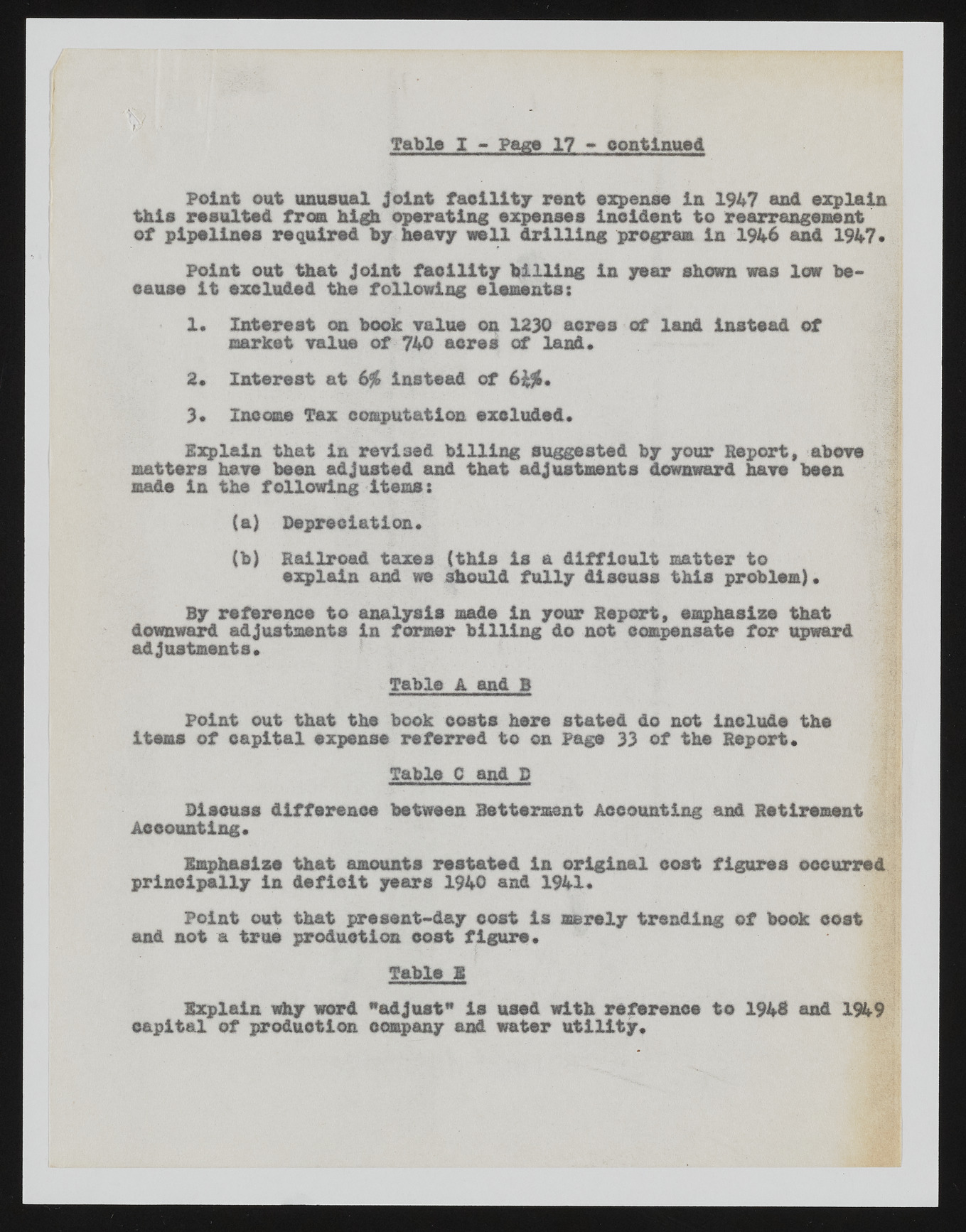

Table I - Page 17 - continued Point out unusual joint facility rent expense in 1947 and explain this resulted from high operating expenses incident to rearrangement of pipelines required by heavy well drilling program in 1946 and 1947* Point out that joint facility billing in year shown was low because it excluded the following elements: 1. Interest on book value on 1230 acres of land Instead of market value of 740 acres of land. 2. Interest at 6$ Instead of 6£$6. 3* Income Tax computation excluded. Explain that in revised billing suggested by your Report, above matters have been adjusted and that adjustments downward have been made In the following items: (a) Depreciation. (b) Railroad taxes (this la a difficult matter to explain and we should fully discuss this problem). By reference to analysis made in your Report, emphasize that downward adjustments in former billing do not compensate for upward adjustments* r Table A and B Point out that the book costs here stated do not include the items of capital expense referred to on Page 33 of the Report. Table 0 and D Bleeuss difference between Betterment Accounting and Retirement Accounting. Emphasize that amounts restated la original cost figures occurred principally in deficit years 1940 and 1941« Point out that present-day cost is merely trending of book cost and not a true production cost figure. Table g Explain why word "adjust* is used with reference to 1946 and 1949 capital of production company and water utility.