Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

Member of

More Info

Rights

Digital Provenance

Publisher

Transcription

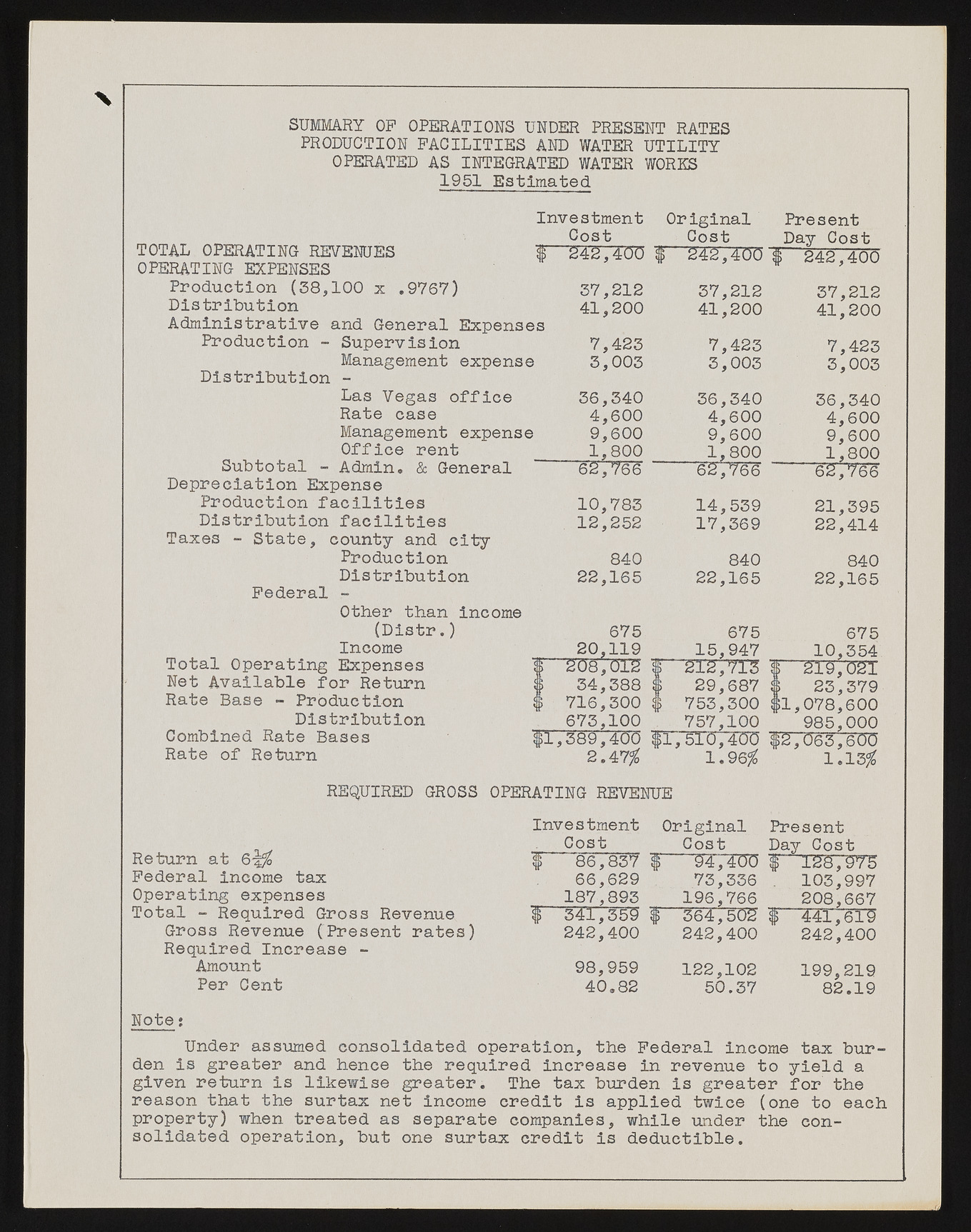

X SUMMARY OP OPERATIONS UNDER PRESENT RATES PRODUCTION FACILITIES AND WATER UTILITY OPERATED AS INTEGRATED WATER WORES 1951 Estimated Investment Original Present Cost Cost Day Cost TOTAL OPERATING REVENUES | 242,400 1 S427400 1“ 242,400 OPERATING EXPENSES Production (38,100 x .9767) 37,212 37,212 37,212 Distribution 41,200 41,200 41^200 Administrative and General Expenses Production - Supervision 7,423 7,423 7,423 Management expense 3,003 3,003 3,003 Distribution - Las Vegas office 36,340 36,340 36,340 Rate case 4,600 4,600 4,600 Management expense 9,600 9,600 9,600 Office rent 1,800 1,800 1,800 Subtotal - Admin. & General 627766 ' 62,766 ' 62,766 Depreciation Expense Production facilities 10,783 14,539 21,395 Distribution facilities 12,252 17,369 22,414 Taxes - State, county and city Production 840 840 840 Distribution 22,165 22,165 22,165 Federal - Other than income (Distr.) 675 675 675 Income 20,119 15,947 10,354 Total Operating Expenses 208,012 i I' 2l2,7l3 $ ~2l9,021 Net Available for Return 34,388 } 29,687 $ 23', 379 Rate Base - Production HP 716,300 ^ | 753,300 fl, 078,600 Distribution 673,100 757,100 985,000 Combined Rate Bases $1,389,400 fl,'510,400 IS". “063,600 Rate of Return 2.47$ 1.96$ 1.13$ REQUIRED GROSS OPERATING REVENUE Investment Original Present Cost Cost Day Cost Return at 6-|$ $ 86,837 4 i 94, 400 $i 128,9*75 Federal income tax 66,629 73,336 . 103,997 Operating expenses 187,893 196,766 208,667 Total - Required Gross Revenue r 341,359 f 364,502 f” 441,619 Gross Revenue (Present rates) 242,400 242,400 242,400 Required Increase - Amount 98,959 122,102 199,219 Per Cent 40.82 50.37 82.19 Note: Under assumed consolidated operation, the Federal income tax bur- den is greater and hence the required increase in revenue to yield a given return is likewise greater. The tax burden is greater for the reason that the surtax net income credit is applied twice (one to each property) when treated as separate companies, while under the con- solidated operation, but one surtax credit is deductible.