Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

Member of

More Info

Rights

Digital Provenance

Publisher

Transcription

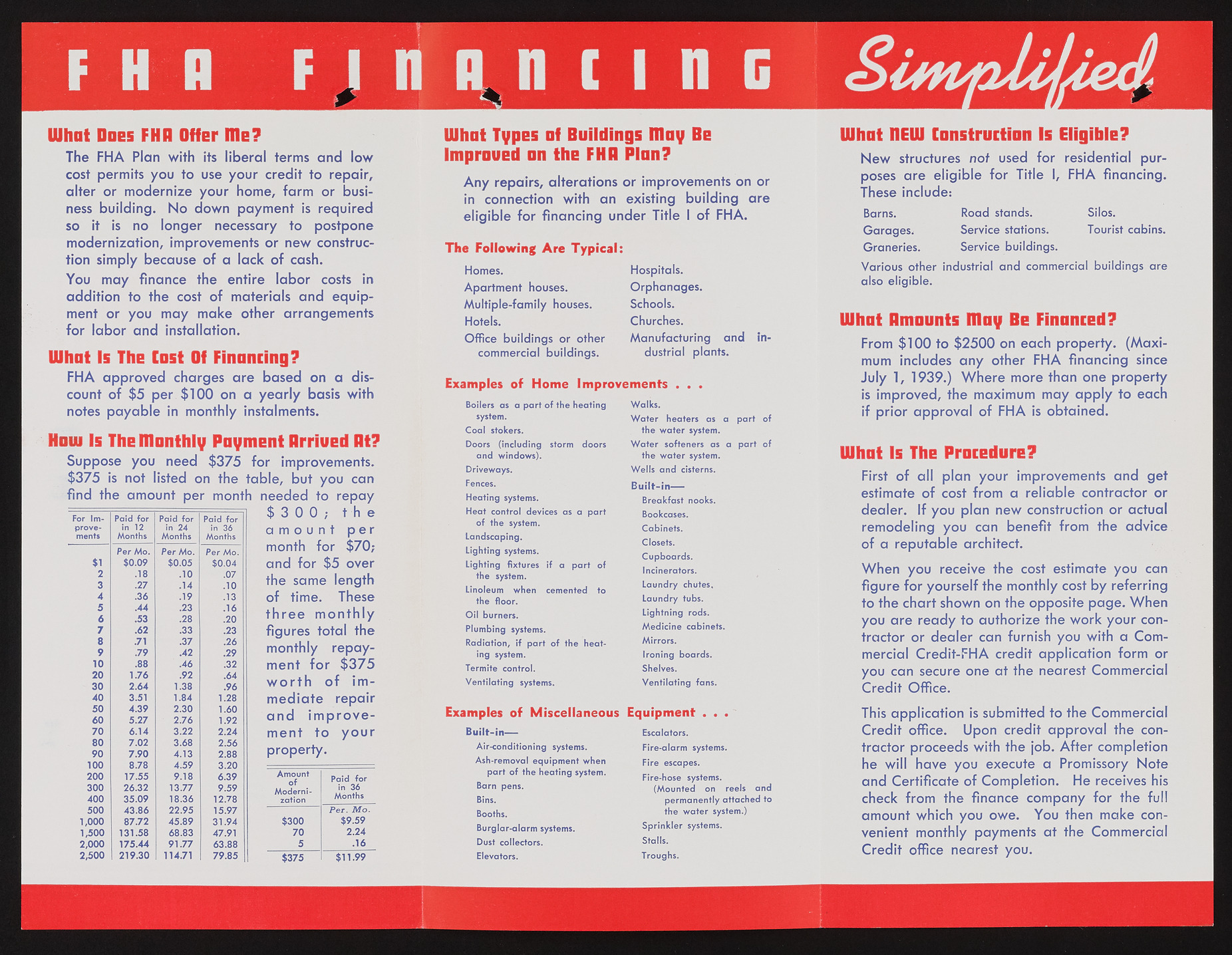

What Does FHR Offer m e? The FHA Plan with its liberal terms and low cost permits you to use your credit to repair, alter or modernize your home, farm or business building. N o down payment is required so it is no longer necessary to postpone modernization, improvements or new construction simply because of a lack of cash. You may finance the entire labor costs in addition to the cost of materials and equipment or you may make other arrangements for labor and installation. What Is The East Of Financing? FHA approved charges are based on a discount of $5 per $100 on a yearly basis with notes payable in monthly instalments. Haul Is The monthly Payment Rrriued Rt? Suppose you need $375 for improvements. $375 is not listed on the table, but you can find the amount per month needed to repay For Improvements Paid for in 12 Months Paid for in 24 M onths Paid for in 36 Months Per M o. Per M o . Per M o . $ i $0.09 $0.05 $0.04 2 .18 .10 .07 3 .27 .14 .10 4 .36 .19 .13 5 .44 .23 .16 6 .53 .28 .20 7 .62 .33 .23 8 .71 .37 .26 9 .79 .42 .29 10 .88 .46 .32 2 0 1.76 .92 .64 3 0 2 .64 1.38 .96 4 0 3.51 1.84 1.28 5 0 4.39 2.30 1.60 6 0 5.27 2.76 1.92 7 0 6.14 3.22 2.24 8 0 7.02 3.68 2.56 9 0 7 .9 0 4.13 2.88 1 0 0 8.78 4.59 3.20 2 0 0 17.55 9.18 6.39 3 0 0 26.32 13.77 9.59 4 0 0 35.0 9 18.36 12.78 5 0 0 43 .8 6 22.95 15.97 1,000 87.72 45.8 9 31.94 1,500 131.58 68.83 47.91 2,000 175.44 91.7 7 63.88 2,5 0 0 21 9 .3 0 114.71 79.8 5 $300; the a m o u n t p e r month for $70; and for $5 over the same length of time. These three monthly figures total the monthly repayment for $375 w o r t h of im mediate repair a n d im p r o v e ment to y ou r property. Amount of M odernization Paid for in 36 M onths P e r. M o . $ 3 0 0 $9.59 7 0 2 .24 5 .16 $ 3 7 5 $11.99 What Types of Buildings m ay Be Improued an the FHR Plan? Any repairs, alterations or improvements on or in connection with an existing building are eligible for financing under Title I of FHA. The Following Are Typical: Homes. Apartment houses. Multiple-family houses. Hotels. Office buildings or other commercial buildings. Hospitals. Orphanages. Schools. Churches. Manufacturing and industrial plants. Examples of Home Improvements Boilers as a part o f the h eating system. C o a l stokers. D oors (including storm d oo rs a n d window s). Drivew ays. Fences. H eating systems. H eat control devices as a part of the system. Landscaping. Lighting systems. Lighting fixtures if a part of the system. Linoleum w hen cemented to the floor. O il burners. Plum bing systems. Radiation, if part o f the heatin g system. Termite control. Ve n tilating systems. W a lks. W a t e r heaters a s a part of the w a te r system. W a t e r softeners as a part of the w ater system. W e lls a n d cisterns. Built-in- Breakfast nooks. Bookcases. Cabinets. Closets. C u p b o a rd s. Incinerators. L a u n d ry chutes. L a u n d ry tubs. Ligh tn in g rods. M e d icin e cabinets. M irrors. Iro n in g boards. Shelves. V e n tila tin g fans. What HEW Construction Is Eligible? New structures not used for residential purposes are eligible for Title I, FHA financing. These include: Barns. Road stands. Silos. Garages. Service stations. Tourist cabins. Graneries. Service buildings. Various other industrial and commercial buildings are also eligible. What Amounts Rlay Be Financed? From $100 to $2500 on each property. (Maximum includes any other FHA financing since July 1, 1939.) Where more than one property is improved, the maximum may apply to each if prior approval of FHA is obtained. What Is The Procedure? First of all plan your improvements and get estimate of cost from a reliable contractor or dealer. If you plan new construction or actual remodeling you can benefit from the advice of a reputable architect. When you receive the cost estimate you can figure for yourself the monthly cost by referring to the chart shown on the opposite page. When you are ready to authorize the work your contractor or dealer can furnish you with a Commercial Credit-FHA credit application form or you can secure one ai the nearest Commercial Credit Office. Examples of Miscellaneous Built-in— Escalators. A ir-co ndition in g systems. Fire-alarm systems. Ash-rem oval equipm ent w hen pjre escapes. part of the h eating system. _. , r 0 7 Fire-hose systems. Barn pens. (M o u n te d on reels a n d Bins. perm anently attached to Booths. the w ater system.) B urglar-a larm systems. S p rin k le r systems. Dust collectors. Stalls. Elevators. Troughs. This-Cfppli^oiion \% submitted to the CommercInL Credit office. Upon credit approval the contractor proceeds with the job. After completion he will have you execute a Promissory Note and Certificate of Completion. He receives his check from the finance company for the full amount which you owe. You then make convenient monthly payments at the Commercial Credit office nearest you.