Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

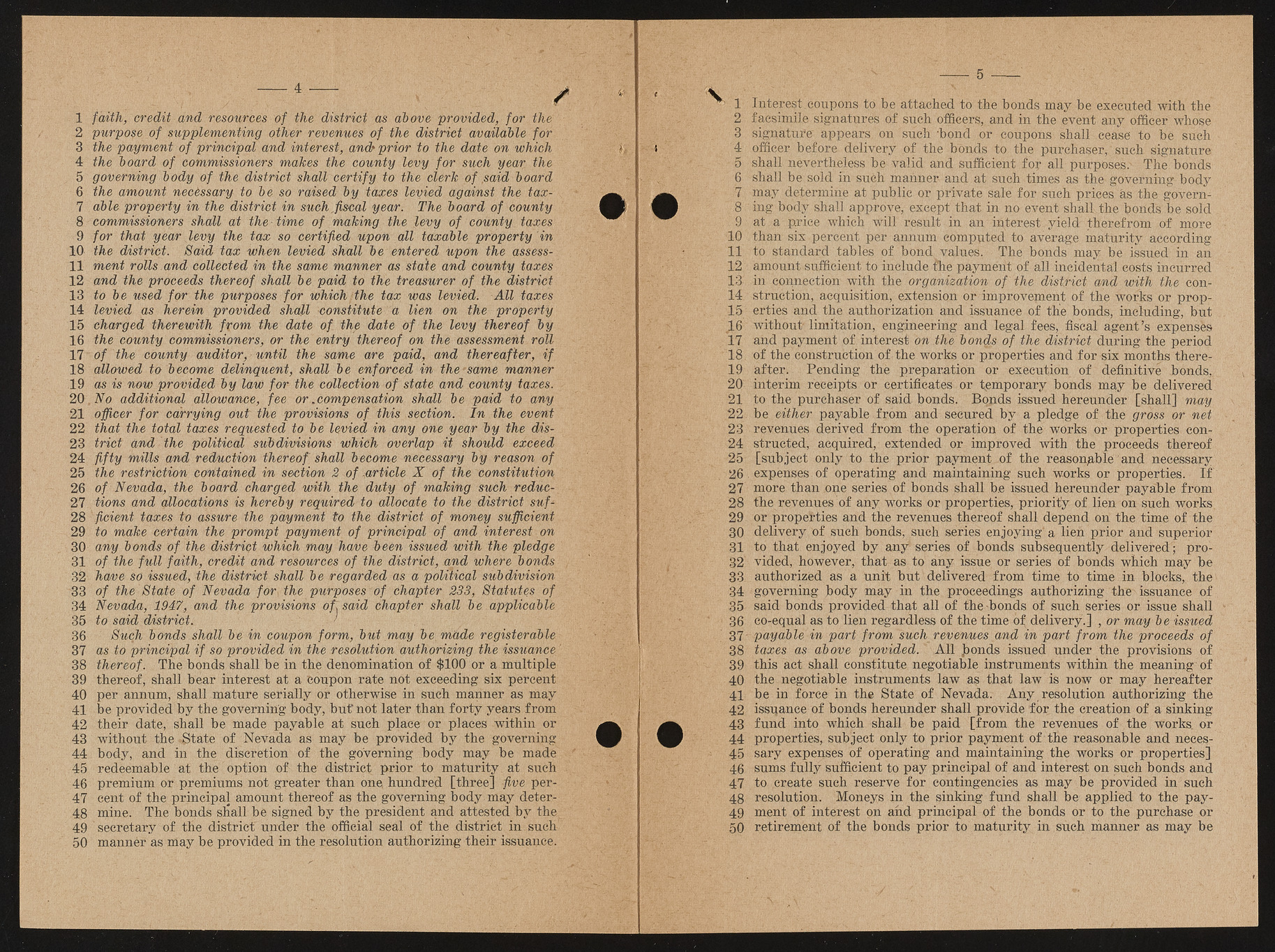

4 if 1 faith, credit and resources of the district as above provided, for the ' 2 purpose of supplementing other revenues of the district available for 3 the payment of principal and interest, and? prior to the date on which 4 the board of commissioners makes the county levy for such year the 5 governing body of the district shall certify to the clerk of .said board 6 the amount necessary to be so raised by taxes levied against the tax- 1 7 able property in the district in such,fiscal year. The board of county 8 commissioners shall at the time of making the levy of county taxes 9 for that year levy the tax so certified upon all taxable property in 10' the district. Said tax when levied shall be entered upon the assess- 11 ment rolls .and collected in the same manner as state and county taxes 12 and the proceeds thereof shall be paid to the treasurer of the district 13 to be used for the purposes for which‘the tax was levied. All taxes 14 levied as herein provided shall constitute a lien on the property 15 charged therewith from the date of the date of the levy thereof by 16 the county commissioners, or the entry thereof on the assessment roll 17 of the county auditor, until the same are paid, and thereafter, if 18 allowed to become delinquent, shall be enforced in the’same manner 19 as is now provided by law for the collection of state and county taxes. 20, No additional allowance, fee or .compensation shall be paid to any 21 officer for carrying out the provisions of this section. In the event 22 that the total taxes requested to be levied in any one year by the dis- 23 trict and'the political subdivisions which overlap it Should exceed 24 fifty mills and reduction thereof shall become necessary by reason of 25 the restriction contained in section 2 of .article X of the Constitution. 26 of Nevada, the board charged with the duty of making such reduc- 27 lions and allocations is hereby required to allocate to the district suffi 28 ficient taxes to assure the payment to the district of money sufficient 29 to make certain the prompt payment of principal of and interest on 30 any bonds of the district which may have been issued with the pledge 31 of the full faith, Credit and resources of the district, and where bonds ; 32 have so issued, the district shall be regarded as a political subdivision 33 of the State of Nevada for, the purposes of chapter 233, Statutes of 34 Nevada, 1947, and the provisions of said chapter shall be applicable 35 to said district. . ' 36 Such bonds shall be in coupon form, but may be. made registerable 37 as to principal if so provided in the resolution authorizing the issuance ' 38 thereof. The bonds shall be in the denomination of $100 or a multiple 39 thereof, shall bear interest at a Coupon rate not exceeding six percent 40 per annum, shall mature serially or otherwise in such manner as may 41 be provided by the governing body, but not later than forty years from 42 their date, shall be made payable at such place or places within or 43 without the .State of Nevada as may be provided by the governing 44 body,' and in the discretion of the governing body may be made 45 redeemable at the option of: the district prior to maturity at such 46 premium or premiums not greater than one hundred [three] five per- 47 cent of the principal amount thereof as the governing body, may deter- 48 mine. The bonds shall be signed by the president and attested by the 49 ' secretary of the district under the official seal of the district in such 50 manner as may be provided in the resolution authorizing their issuance. 1 Interest , coupons to be attached to the bonds may be executed with the 2 facsimile signatures of such officers, and in the event any officer whose 3 signature appears on such bond or coupons shall cease' to be such 4 officer before delivery of the‘bonds to the purchaser, such signature 5 shall nevertheless be valid and sufficient for all purpose’s The. bonds 6 shall be sold in such manner and at such times as the governing body 7 may determine at public or private sale for such prices as the govern'd ing body shall approve, except that in no event: shall the bonds be sold .. 9 at a price which Will result in an interest yield therefrom of more TO than six percent per annum computed to average maturity according 11 to standard tables of bond values, The bonds may be issued in an 12 amount sufficient to include file payment of all incidental costs incurred 13 in connection with the organization of the district and with the c.on- 14 struction, acquisition, extension or improvement of the works or prop- 15 erties and the authorization and issuance of the bonds, including, but JL6 without- limitation, engineering and legal fees, fiscal agent’s expenses 17 and payment of. interest on the bonds of the district during the period 18. of the construction of the works or properties and for six months there- 19 after. Pending the preparation or execution of definitive bonds, 20 interim receipts or certificates or temporary bonds may be delivered 21 to the purchaser of said bonds. Bqnds issued hereunder [shall] may 22. be either payable from and secured by a pledge of the gross or net 23 revenues derived from the operation of the works or properties con- 24 structed, acquired, extended or improved with the proceeds thereof 25 [subject only to the prior payment of the reasonable and necessary 26. expenses of operating and maintaining such works or properties. If 27 more than one series ,of bonds shall b.e issued hereunder payable from 28 the revenues of any works or properties, priority of lien on such works, 29 or properties and the revenues thereof shall depend on the time of the 30 delivery of such bonds, such series enjoying' a lien prior and superior 31 to that enjoyed hy any series of bonds subsequently delivered] pro- 32 vided, however, that as to any issue or series of bonds which may be 33 authorized as a unit but delivered from time to time in blocks, the 34 governing body may in the proceedings authorizing the issuance of 35 said bonds provided that all of the-bonds of such series or issue shall 36 co-equal as to lien regardless of the time of delivery.] , or may b e issued 37’ payable in part from such revenues and in part from the proceeds of 38 taxes as above provided. ' All b°nds issued under the provisions of 39 thjs act shall constitute negotiable instruments within the meaning' of 40 the negotiable instruments law as that law is now or may hereafter 41 be in force in the State of Nevada. Any resolution authorizing the 42 issuance of bonds hereunder shall provide for the creation of a sinking 43 fund into which shall be paid [from the revenues of the works, or 44 properties, subject only to prior payment of the reasonable and neces- 45 sary expenses of operating and maintaining the works or properties] 46 sums fully sufficient to pay principal of and interest on such bonds and 47 to create sueh reserve for contingencies as may be provided in such 48 resolution. Moneys in the sinking fund shall be applied to the pay- 49 ment of interest on and principal of the bonds or to the purchase or 50 retirement of the bonds prior to maturity in such manner as may be