Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

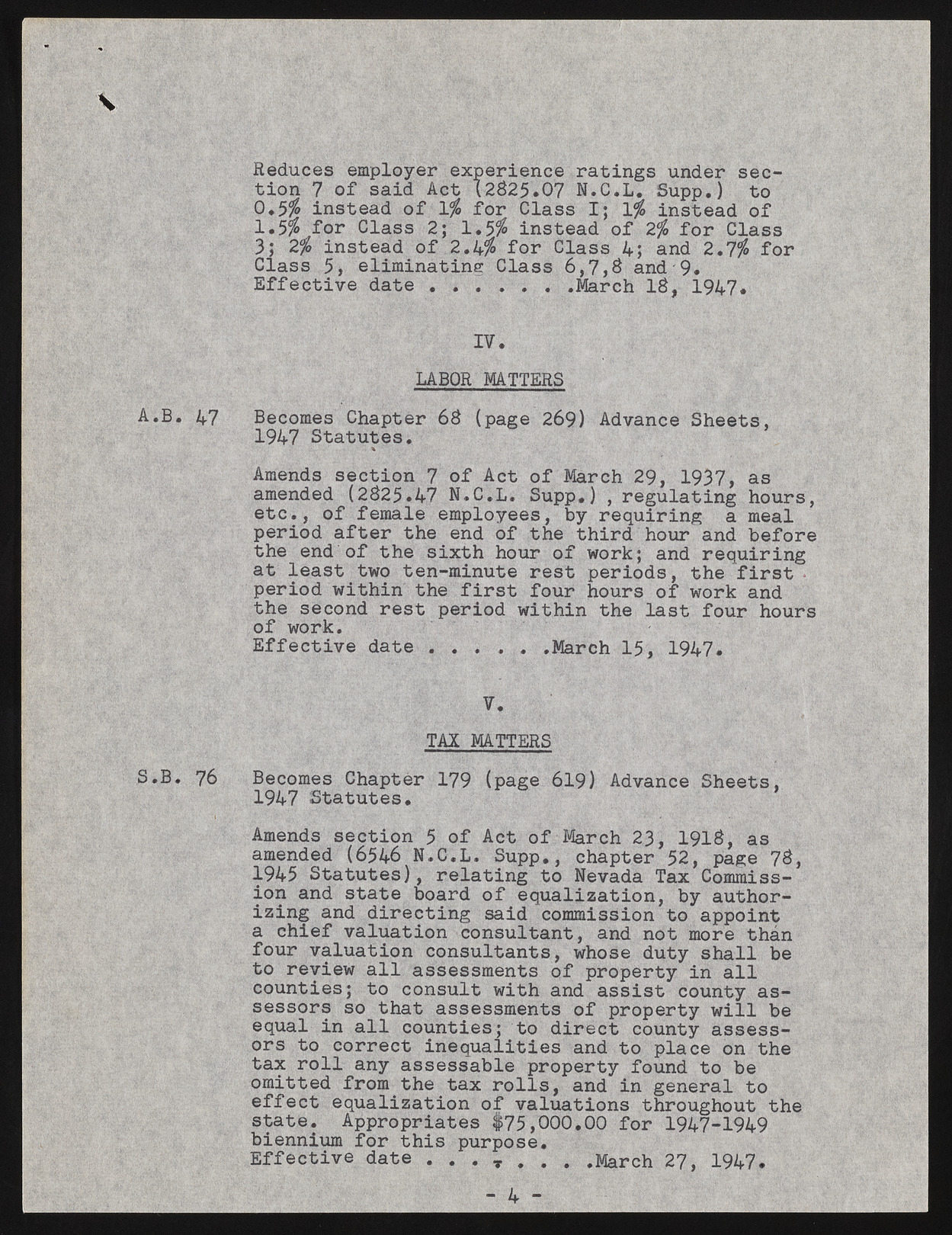

V Reduces employer experience ratings under section 7 of said Act (2825.07 N.C.L. Supp.) to 0.5% instead of 1% for Class I; 1% instead of 1.5$ for Class 2; 1*5$ instead of 2^ for Class 3; 2$ instead of 2./$ for Class 4; and 2.7$ for Class 5i eliminating Class 6,7,8 and'9. Effective date . . . > . . .March IS, 1947* IV. LABOR MATTERS A.B. 47 Becomes Chapter 68 (page 269) Advance Sheets, 1947 Statutes. Amends section 7 of Act of March 29, 1937, as amended (2825.47 N.C.L. Supp.) , regulating hours, etc., of female employees, by requiring a meal period after the end of the third hour and before the end of the sixth hour of work; and requiring at least two ten-minute rest periods, the first * period within the first four hours of work and the second rest period within the last four hours of work. Effective date . . . .. .March 15, 1947. V. TAX MATTERS S.B. 76 Becomes Chapter 179 (page 619) Advance Sheets, 1947 Statutes. Amends section 5 of Act of March 23, 1918, as amended (6546 N.C.L. Supp., chapter 52, page 78, 1945 Statutes), relating to Nevada Tax Commission and state board of equalization, by authorizing and directing said commission to appoint a chief valuation consultant, and not more than four valuation consultants, whose duty shall be to review all assessments of property in all counties; to consult with and assist county assessors so that assessments of property will be equal in all counties; to direct county assessors to correct inequalities and to place on the tax roll any assessable property found to be omitted from the tax rolls, and in general to effect equalization of valuations throughout the state. Appropriates #75,000,00 for 1947-1949 biennium for this purpose. Effective date . . . T . . . .March 27, 1947. - 4 -