Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

Member of

More Info

Rights

Digital Provenance

Publisher

Transcription

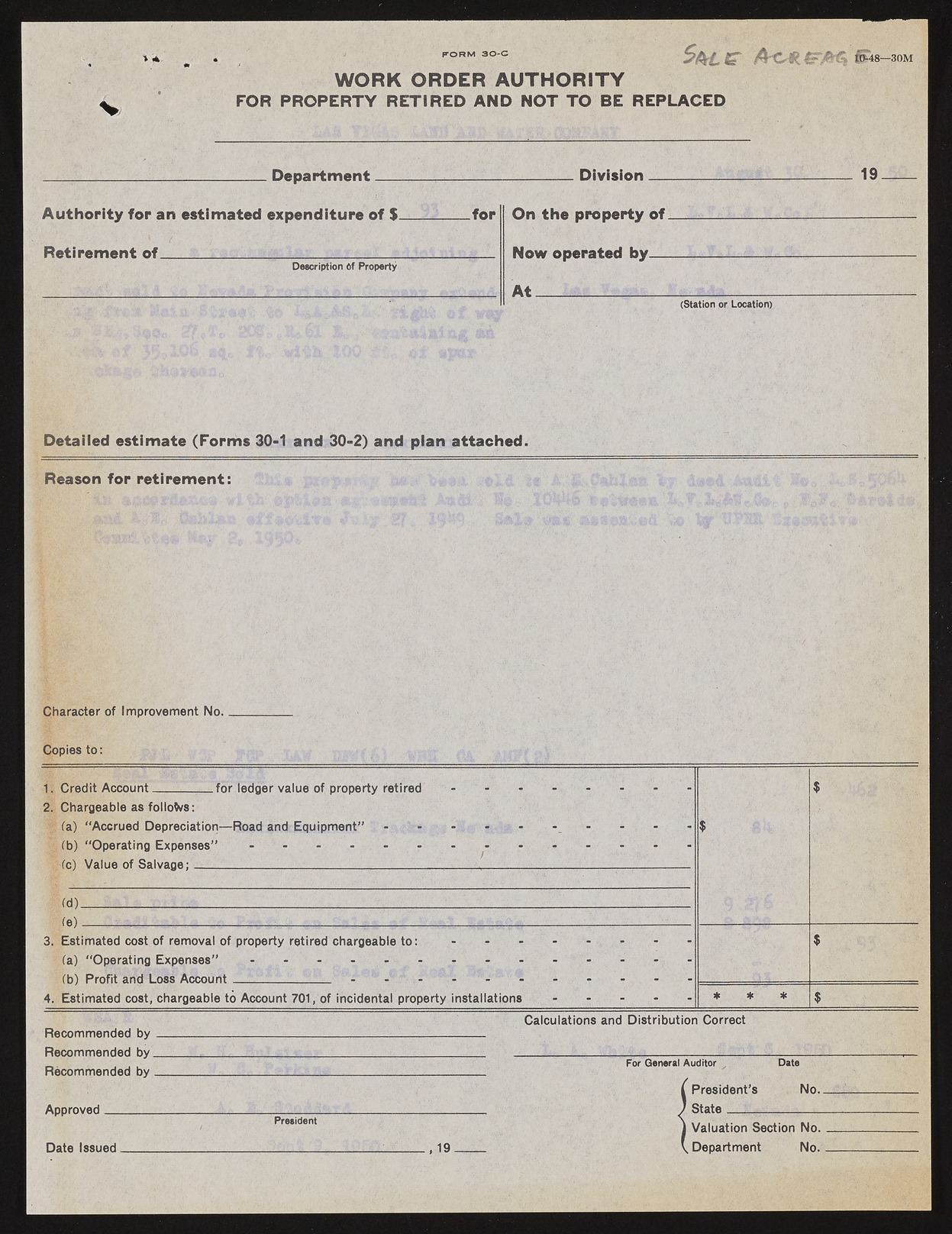

V«4. F O R M 3 0 - C V WORK ORDER AUTHORITY FOR PROPERTY RETIRED AND NOT TO BE REPLACED Z= A C-SR. |F#'& 1*48—30M ___________;_______________Department--------------,------------- Authority for an estimated expenditure of $________for Retirement of________________________________________ Description Of Property _______Division___ On the property of Now operated by— At_________________________ (Station or Location) 19 Detailed estimate (Forms 30-1 and 30-2) and plan attached. Reason for retirement: Character of Improvement No. Copies to: 1. Credit Account_________for ledger value of property retired 2. Chargeable as follows: H (a) “Accrued Depreciation—Road and Equipment" ' - ; (b) “Operating Expenses” ... - - fc) Value of Salvage;______________________________________ $ $ 3. 4. <d)_________________________________________________I_______________________ (0)----......................I------------£---$--- . . Estimated cost of removal of property retired chargeable to: (a) “Operating Expenses" - - - - (b) Profit and Loss Account________________ - - - ' - - - Estimated cost, chargeable to Account 701, of incidental property installations * $ * * $ Recommended by Recommended by Recommended by Approved________ President Date Issued ,19 Calculations and Distribution Correct For General Auditor Date t President’s / State ______ No. i Valuation Section No. V Department No.