Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

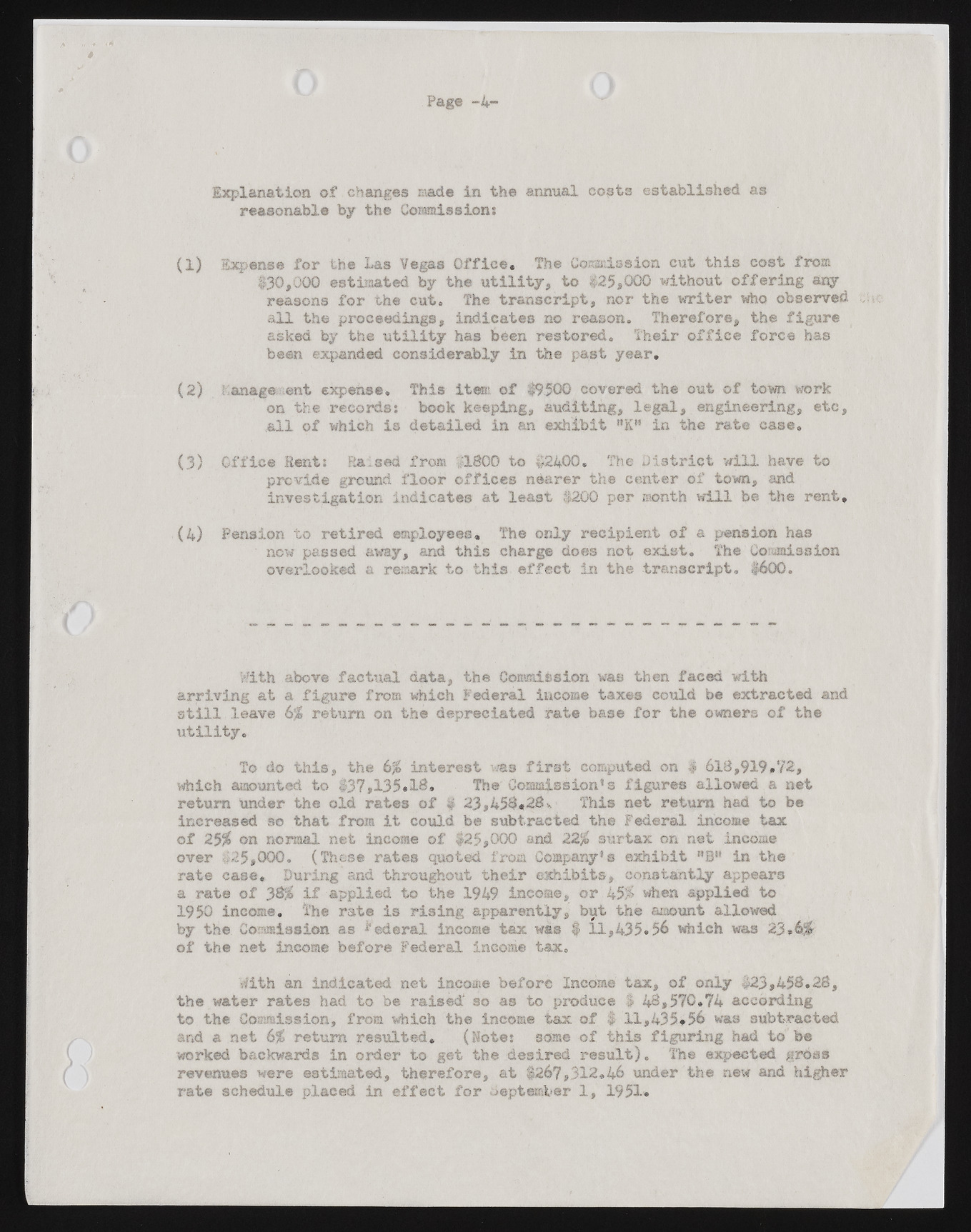

Page -4- Explanation of changes made in the annual costs established as reasonable by the Commissions (1) Expense for the Las Vegas Office, The Commission cut this cost from $30,000 estimated by the utility, to #25,000 without offering any reasons for the cut. The transcript, nor the writer who observed all the proceedings, indicates no reason. Therefore, the figure asked by the utility has been restored. Their office force has been expanded considerably in the past year. (2) rianagenent expense. This item of $9500 covered the out of town work on the records: book keeping, auditing, legal, engineering, etc, all of which is detailed in an exhibit nKH in the rate case. (3) Office Rent: Raised from >1800 to f2400„ The District will have to provide ground floor offices nearer the center of town, and investigation indicates at least $200 per month will be the rent, (4) Pension to retired employees. The only recipient of a pension has now passed away, and this charge does not exist. The Commission overlooked a remark to this effect in the transcript. $600. With above factual data., the Commission was then faced with arriving at a figure from which Federal income taxes could be extracted and still leave 6% return on the depreciated rate base for the owners of the utility. To do this, the 6% interest was first computed on # 618,919*72, which amounted to $37,135.18. The Cosuaission's figures allowed a net return Under the old rates of $ 23,458*28* This net return had to be increased so that from it could be subtracted the Federal income tax of 2 % on normal net income of $25,OCX) and 22% surtax on net income over 125,000. (These rates quoted from Company's exhibit "B" in the rate case. During and throughout their exhibits, constantly appears a rate of 3& % if applied to the 1949 income, or 45% when applied to 1950 income. The rate is rising apparently, but the amount allowed by the Commission as Federal income tax was $ 11,435.56 which was 23.6% of the net income before Federal income tax. With an indicated net income before Income tax, of only #23,458.28, the water rates had to be raised* so as to produce $ 48,570.74 according to the Commission, from which the income tax of $ 11,435*56 was subtracted and a net 6 % return resulted, (Kotos some of this figuring had to be worked backwards in order to get the desired result). The expected gross revenues were estimated, therefore, at $267,312,46 under the new and higher rat© schedule placed in effect for September 1, 1951.