Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

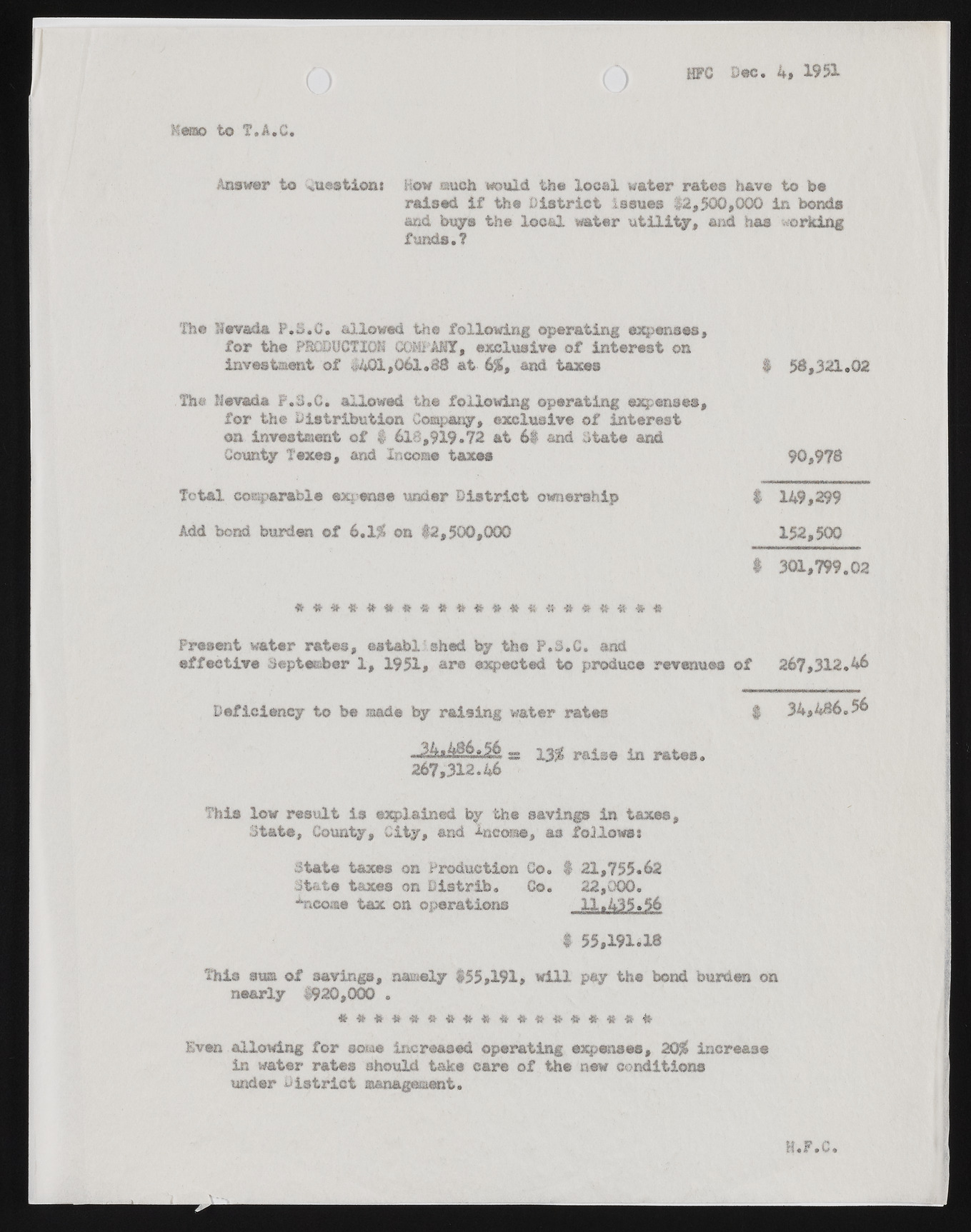

( ) HFC Dec. 4, 1953- Kero to T.A.G. Answer to -question t How such would the local water rates have to be raised if the District Issues 12,500,000 in bonds and buys the local water utility, and has working funds.? The Hevada P.S.C. allowed- the following operating expenses, for the PIGBUCTIOH COMFAMf, exclusive of interest on Investment of 4401,061.38 at 6%, and. taxes $ $8,321.02 The flevada P.S.C. allowed the following operating expenses, for the Distribution Company, exclusive of interest on investment of I 618,919*72 at 6t and State and County Texes, and Income taxes 90,973 Total comparable expense under District ownership | 149,299 Add bond burden of 6.1$ on |2,$00,000 152,500 I 301,799.02 # ? # * * * * # * * # # * # * # # ? # * # Present water rates, established by the P.S.C. and effective September 1, 1951, are expected to produce revenues of 267,312.46 Deficiency to fee made by raising water rates ® 34,436.56 s 13$ raise in rates. 267,312.46 This low result is explained fey the savings in taxes, State, County, City, and income, as follows: State taxes on Production Co. $ 21,755.62 State taxes on Kiatrib. Co. 22,000. income tax on operations 11.435.56 I 55,191.18 This asm of savings, namely $55,191, will pay the bond burden on nearly 1920,000 . # • * « * * * # * * ? * # # * » ? » # Even allowing for some increased operating expenses, 20$ increase in water rate® should take care of the new conditions under District management. H .F .C .