Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

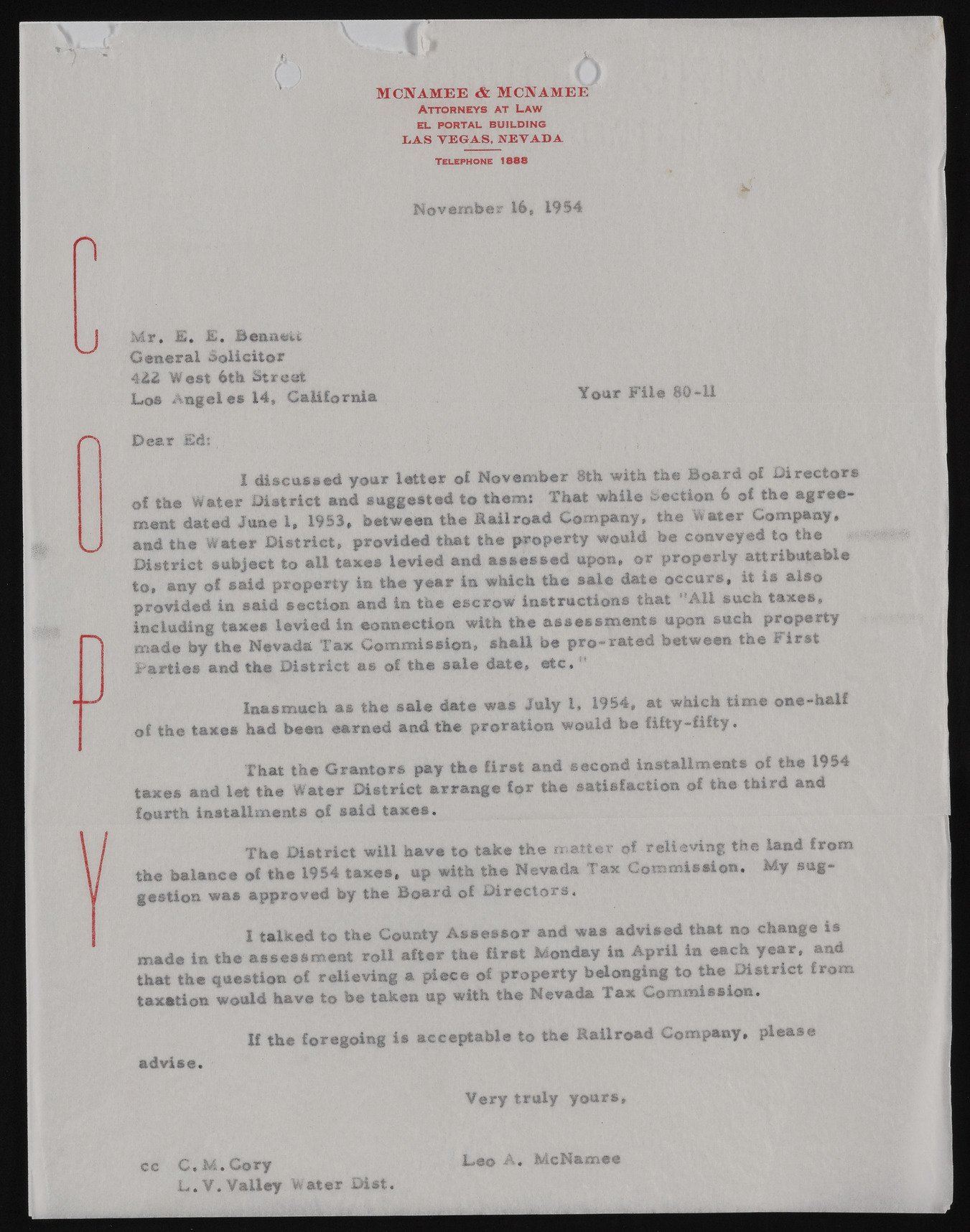

J '* M CN A M E E & M CN AM EE A t t o r n e y s a t L a w EL PORTAL BUILDING L A S V E G A S , N E V A D A TELEPHONE 1 8 8 8 November 16, 1954 n u Mr. E. E. BenaeU General solicitor 442 West 6th Street Los Angeles 14, California Dear Ed: Your File 80-U I discussed your letter of November 8th with the Board of Directors of the Water District and suggested to them: That while Section 8 of the agreement dated June 1, 1953, between the Railroad Company, the Water Company, and the Water District, provided that the property would be conveyed to the District subject to ail taxes levied and assessed upon, or properly attributable to, any of said property in the year in which the sale date occurs, it is also provided in said section and in the escrow instructions that "A ll such taxes, including taxes levied in connection with the assessments upon such property made by the Nevada Tax Commission, shall be pro-rated between the First Parties and the District as of the sale date, etc. " Inasmuch as the sale date was July 1. 1954, at which time one-half of the taxes had been earned and the proration would be fifty-fifty. That the Grantors pay the first and second installments of the 1954 taxes and let the Water District arrange for the satisfaction of the third and fourth installments of said taxes. The District will have to take the matter of relieving the land from the balance of the 1954 taxes, up with the Nevada Tax Commission. My suggestion was approved by the Board of Directors. I talked to the County Assessor and was advised that no change is made in the assessment roll after the first Monday in April in each year, and that the question of relieving a piece of property belonging to the District from taxation would have to be taken up with the Nevada Tax Commission. If the foregoing is acceptable to the Railroad Company, please advise. Very truly yours, cc C .M .C ory L . V . Valley water Dist. Leo A. McNamee