Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

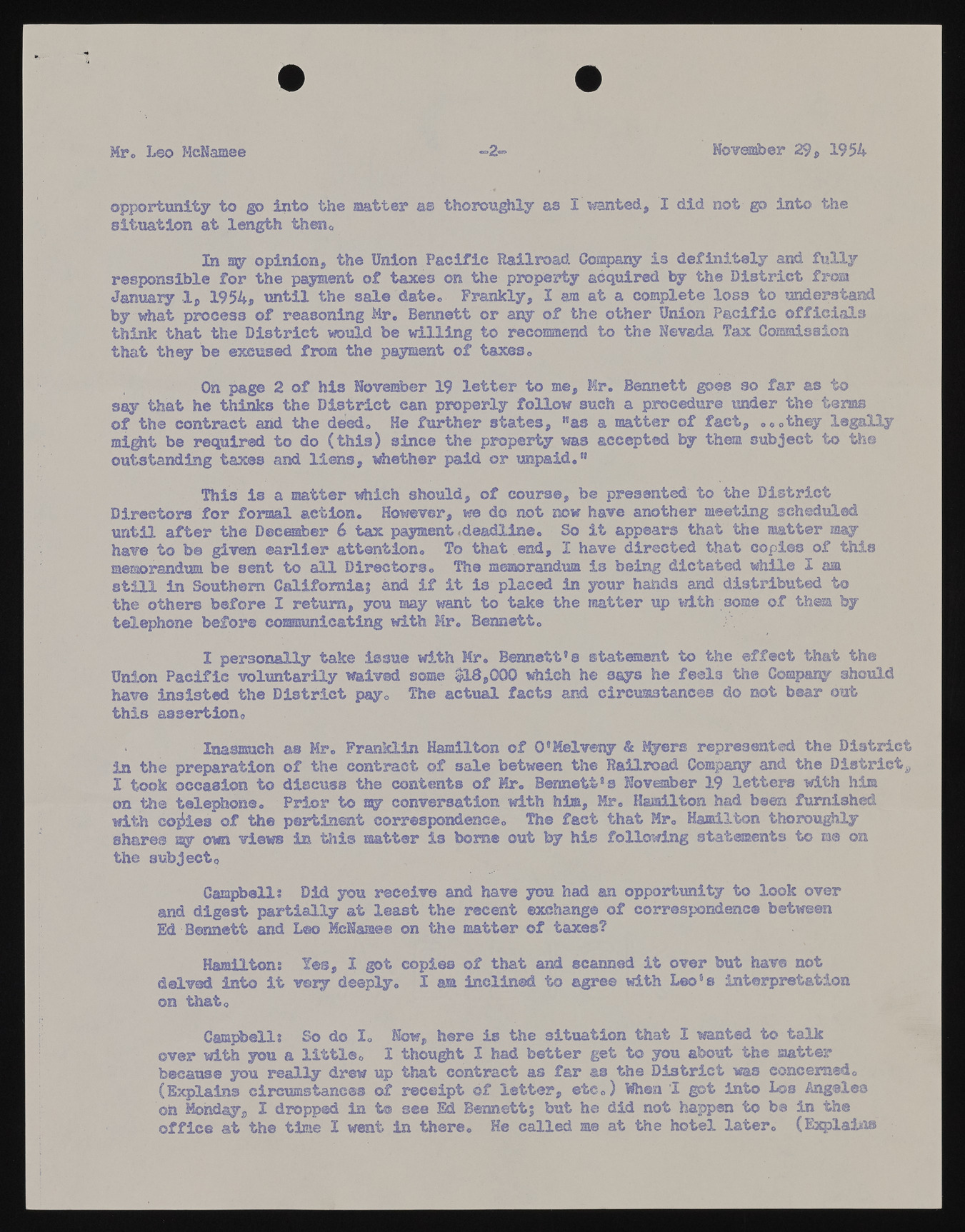

MFo Leo McNamee 2- November 29® 1954 opportunity to go into the matter as thoroughly as I wanted® I did not go into the situation at length then. In say opinion® the Union Pacific Railroad Company is definitely and fully responsible for the payment of taxes on the property acquired by the District from January 1® 1954* until the sale date. Frankly* I am at a complete loss to understand by what process of reasoning Mr. Bennett or any of the other Union Pacific officials think that the District would be willing to recommend to the Nevada Tax Commission that they be excused from the payment of taxes. On page 2 of his November 19 letter to me* Mr. Bennett goes so far as to say that he thinks the District can properly follow such a procedure under the terms of the contract and the deed. He further states, "as a matter of fact® ...they legally might be required to do (this) since the property was accepted by them subject to th© outstanding taxes and liens* whether paid or unpaid." This is a matter which should® of course, be presented to the District Directors for formal action. However, we do not now have another meeting scheduled until after the December 6 tax payment.deadline. So it appears that the matter may have to be given earlier attention. To that end, I have directed that copies of this memorandum be sent to all Directors. The memorandum is being dictated while I am still in Southern California! and if It is placed in your hands and distributed to the others before I return, you may want to take the matter up with some of them by telephone before communicating with Mr. Bennett. I personally take issue with Mr. Bennett’s statement to the effect that the Union Pacific voluntarily waived some $18,000 which he 3ays he feels the Company should have insisted the District pay. The actual facts and circumstances do not bear out this assertion. Inasmuch as Mr. Franklin Hamilton of O ’Melveny & M y e r s represented the District in the preparation of the contract of sale between the Railroad Company and the District^ I took occasion to discuss the contents of Mr. Bennett’s November 19 letters with him on the telephone. Prior to my conversation with him, Mr. Hamilton had been furnished with copies of th© pertinent correspondence. The fact that Mr. Hamilton thoroughly shares my own views in this matter is borne out by his following statements to m® on the subject. Campbell: Did you receive and have you had an opportunity to look over and digest partially at least the recent exchange of correspondence between Ed Bennett and Leo McNamee on the matter of taxes? Hamilton: Yes, I got copies of that and scanned it over but have not delved into it very deeply. I am inclined to agree with Leo’s interpretation on that0 Campbell: So do I. Now, here is the situation that I wanted to talk over with you a little. I thought I had better get to you about the matter because you really drew up that contract as far as the District was concerned. (Explains circumstances of receipt of letter, etc.) When I got into Los Angeles on Monday® I dropped in to see Ed Bennett; but he did not happen to be in the office at the time I went in there. He called me at the hotel later. (Explains