Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

Member of

More Info

Rights

Digital Provenance

Publisher

Transcription

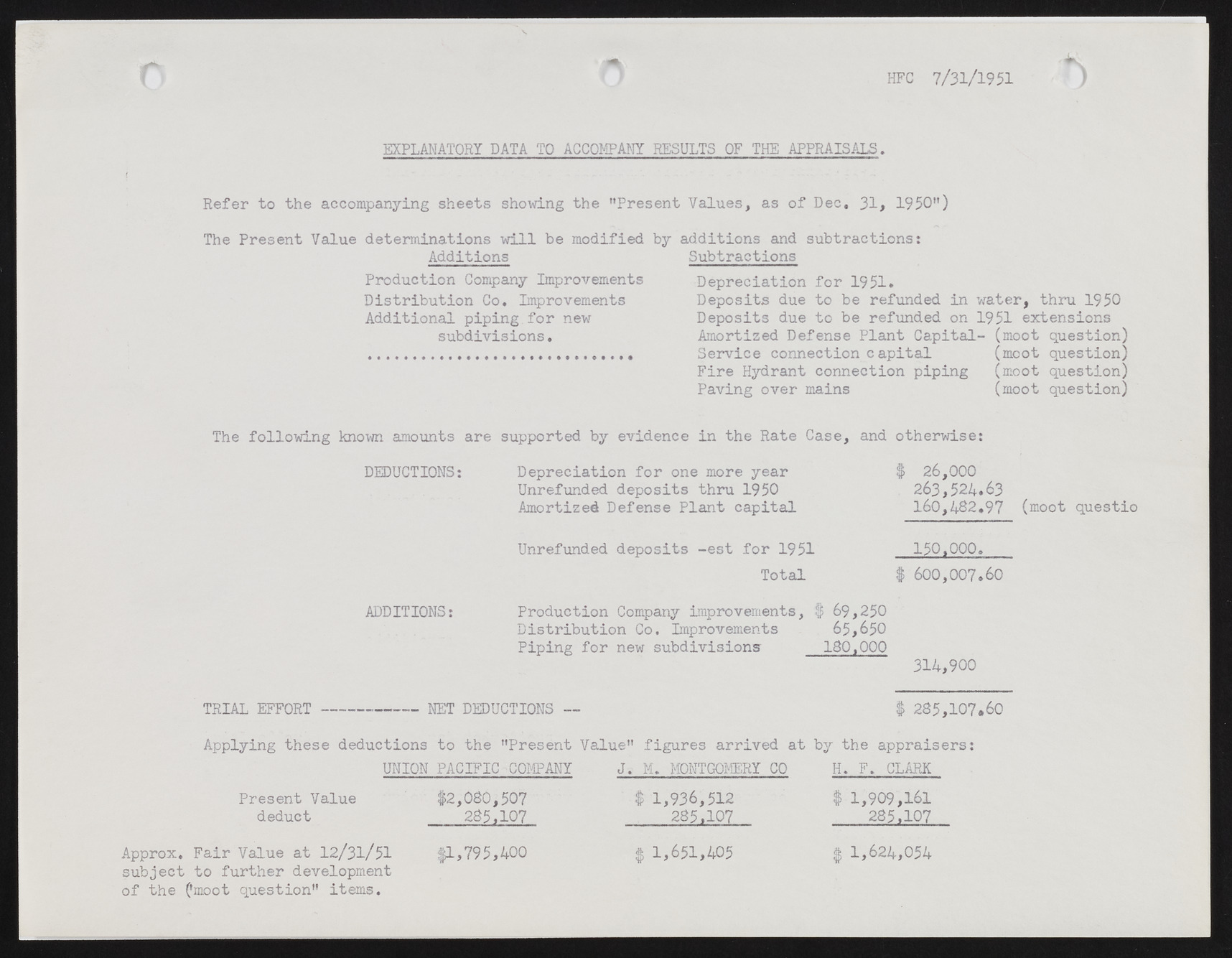

r HFC 7/31/1951 EXPLANATORY DATA TO ACCOMPANY RESULTS OF THE APPRAISALS. Refer to the accompanying sheets showing the "Present Values, as of Dec, 31# 1950") The Present Value determinations will be modified by additions and subtractions: Additions Subtractions Production Company Improvements Distribution Co. Improvements Additional piping for new subdivisions. Depreciation for 1951* Deposits due to be refunded in water, thru 1950 Deposits due to be refunded on 1951 extensions Amortized Defense Plant Capital- (moot question) Service connection capital (moot question) Fire Hydrant connection piping (moot question) Paving over mains (moot question) The following known amounts are supported by evidence in the Rate Case, and otherwise DEDUCTIONS: ADDITIONS! Depreciation for one more year Unrefunded deposits thru 1950 Amortized Defense Plant capital Unrefunded deposits -est for 1951 Total Production Company improvements, | 69,250 Distribution Co. Improvements 65,650 Piping for new subdivisions 180,00C 26,000 263,524.63 160,482*97 (moot questio 150.000. 600, 007.60 314,900 TRIAL EFFORT---------- NET DEDUCTIONS — 285,107.60 Applying these deductions to the "Present Value" figures arrived at by the appraisers: UNION PACIFIC COMPANY J. M. MONTGOMERY CO H. F. CLARK Present Value deduct Approx. Fair Value at 12/31/51 subject to further development of the ('moot question" items. $2,080,507 285.107 $1,795,400 $ 1,936,512 285.107 $ 1,651,405 $ 1, 909,161 285.107 $ 1,624,054