Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

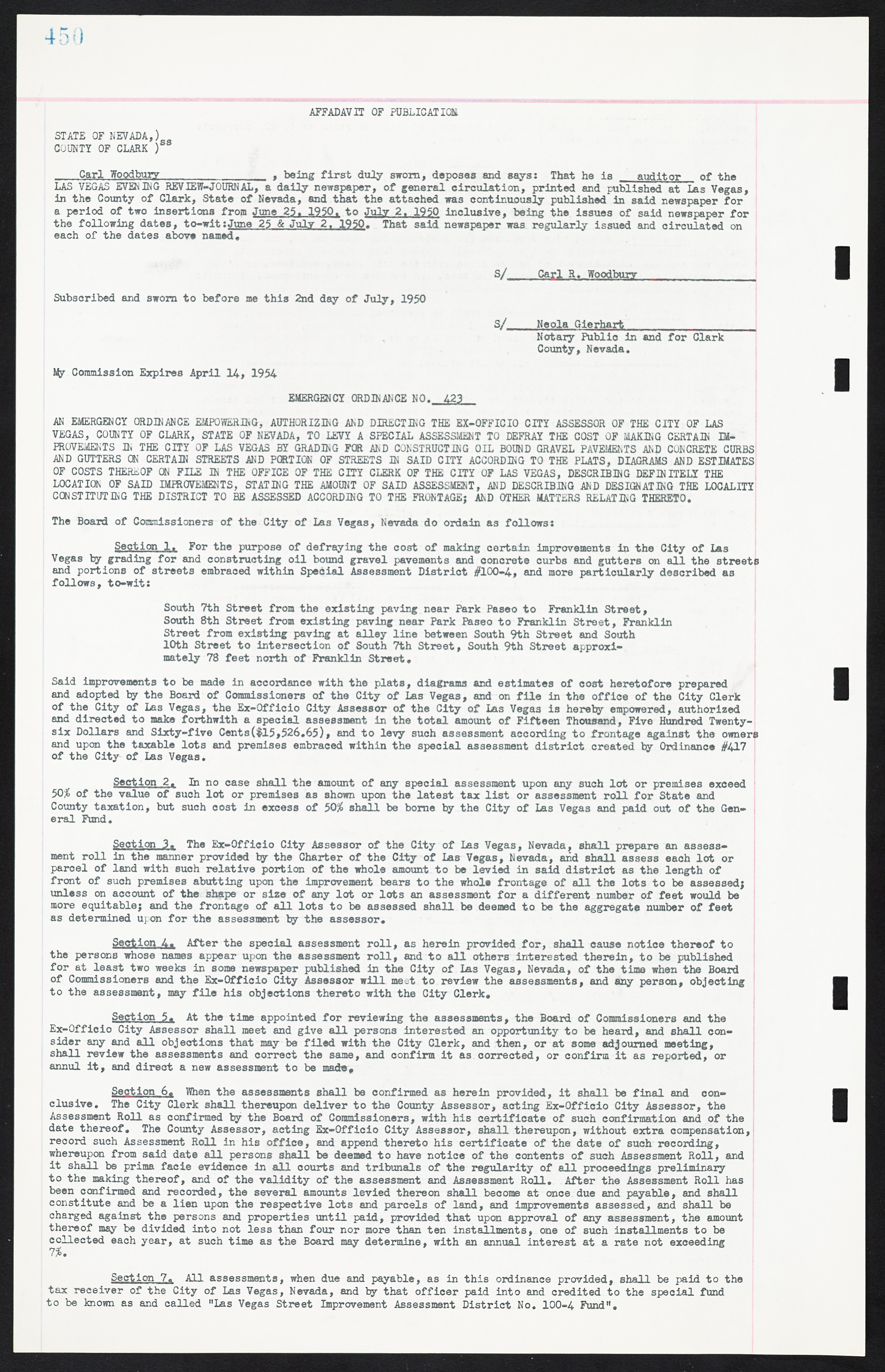

AFFIDAVIT OF PUBLICATION. STATE OF NEVADA,) COUNTY OF CLARK ) ss Carl Woodbury______________ , being first duly sworn, deposes and says: That he is auditor of the LAS VEGAS EVENING REVIEW-JOURNAL, a daily newspaper, of general circulation, printed and published at Las Vegas, in the County of Clark, State of Nevada, and that the attached was continuously published in said newspaper for a period of two insertions from June 25, 1950, to July 2, 1950 inclusive, being the issues of said newspaper for the following dates, to-wit: June 25 & July 2, 1950. That said newspaper was regularly issued and circulated on each of the dates above named. S/ Carl R. Woodbury Subscribed and sworn to before me this 2nd day of July, 1950 S/ Neola Gierhart Notary Public in and for Clark County, Nevada. My Commission Expires April 14, 1954 EMERGENCY ORDINANCE NO. 423 AN EMERGENCY ORDINANCE EMPOWERING, AUTHORIZING AND DIRECTING THE EX-OFFICIO CITY ASSESSOR OF THE CITY OF LAS VEGAS, COUNTY OF CLARK, STATE OF NEVADA, TO LEVY A SPECIAL ASSESSMENT TO DEFRAY THE COST OF MAKING CERTAIN IMPROVEMENTS IN THE CITY OF LAS VEGAS BY GRADING FOR AND CONSTRUCTING OIL BOUND GRAVEL PAVEMENTS AND CONCRETE CURBS AND GUTTERS ON CERTAIN STREETS AND PORTION OF STREETS IN SAID CITY ACCORDING TO THE PLATS, DIAGRAMS AND ESTIMATES OF COSTS THEREOF ON FILE IN THE OFFICE OF THE CITY CLERK OF THE CITY OF LAS VEGAS, DESCRIBING DEFINITELY THE LOCATION OF SAID IMPROVEMENTS, STATING THE AMOUNT OF SAID ASSESSMENT, AND DESCRIBING AND DESIGNATING THE LOCALITY CONSTITUTING THE DISTRICT TO BE ASSESSED ACCORDING TO THE FRONTAGE; AND OTHER MATTERS RELATING THERETO. The Board of Commissioners of the City of Las Vegas, Nevada do ordain as follows: Section 1. For the purpose of defraying the cost of making certain improvements in the City of Las Vegas by grading for and constructing oil bound gravel pavements and concrete curbs and gutters on all the streets and portions of streets embraced within Special Assessment District #100-4, and more particularly described as follows, to-wit: South 7th Street from the existing paving near Park Paseo to Franklin Street, South 8th Street from existing paving near Park Paseo to Franklin Street, Franklin Street from existing paving at alley line between South 9th Street and South 10th Street to intersection of South 7th Street, South 9th Street approximately 78 feet north of Franklin Street. Said improvements to be made in accordance with the plats, diagrams and estimates of cost heretofore prepared and adopted by the Board of Commissioners of the City of Las Vegas, and on file in the office of the City Clerk of the City of Las Vegas, the Ex-Officio City Assessor of the City of Las Vegas is hereby empowered, authorized and directed to make forthwith a special assessment in the total amount of Fifteen Thousand, Five Hundred Twenty- six Dollars and Sixty-five Cents ($15,526.65), and to levy such assessment according to frontage against the owners and upon the taxable lots and premises embraced within the special assessment district created by Ordinance #417 of the City of Las Vegas. Section 2. In no case shall the amount of any special assessment upon any such lot or premises exceed 50% of the value of such lot or premises as shown upon the latest tax list or assessment roll for State and County taxation, but such cost in excess of 50% shall be borne by the City of Las Vegas and paid out of the General Fund. Section 3. The Ex-Officio City Assessor of the City of Las Vegas, Nevada, shall prepare an assessment roll in the manner provided by the Charter of the City of Las Vegas, Nevada, and shall assess each lot or parcel of land with such relative portion of the whole amount to be levied in said district as the length of front of such premises abutting upon the improvement bears to the whole frontage of all the lots to be assessed; unless on account of the shape or size of any lot or lots an assessment for a different number of feet would be more equitable; and the frontage of all lots to be assessed shall be deemed to be the aggregate number of feet as determined upon for the assessment by the assessor. Section 4. After the special assessment roll, as herein provided for, shall cause notice thereof to the persons whose names appear upon the assessment roll, and to all others interested therein, to be published for at least two weeks in some newspaper published in the City of Las Vegas, Nevada, of the time when the Board of Commissioners and the Ex-Officio City Assessor will meet to review the assessments, and any person, objecting to the assessment, may file his objections thereto with the City Clerk. Section 5. At the time appointed for reviewing the assessments, the Board of Commissioners and the Ex-Officio City Assessor shall meet and give all persons interested an opportunity to be heard, and shall consider any and all objections that may be filed with the City Clerk, and then, or at some adjourned meeting, shall review the assessments and correct the same, and confirm it as corrected, or confirm it as reported, or annul it, and direct a new assessment to be made. Section 6. When the assessments shall be confirmed as herein provided, it shall be final and conclusive. The City Clerk shall thereupon deliver to the County Assessor, acting Ex-Officio City Assessor, the Assessment Roll as confirmed by the Board of Commissioners, with his certificate of such confirmation and of the date thereof. The County Assessor, acting Ex-Officio City Assessor, shall thereupon, without extra compensation, record such Assessment Roll in his office, and append thereto his certificate of the date of such recording, whereupon from said date all persons shall be deemed to have notice of the contents of such Assessment Roll, and it shall be prima facie evidence in all courts and tribunals of the regularity of all proceedings preliminary to the making thereof, and of the validity of the assessment and Assessment Roll. After the Assessment Roll has been confirmed and recorded, the several amounts levied thereon shall become at once due and payable, and shall constitute and be a lien upon the respective lots and parcels of land, and improvements assessed, and shall be charged against the persons and properties until paid, provided that upon approval of any assessment, the amount thereof may be divided into not less than four nor more than ten installments, one of such installments to be collected each year, at such time as the Board may determine, with an annual interest at a rate not exceeding 7%. Section 7. All assessments, when due and payable, as in this ordinance provided, shall be paid to the tax receiver of the City of Las Vegas, Nevada, and by that officer paid into and credited to the special fund to be known as and called "Las Vegas Street Improvement Assessment District No. 100-4 Fund".