Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

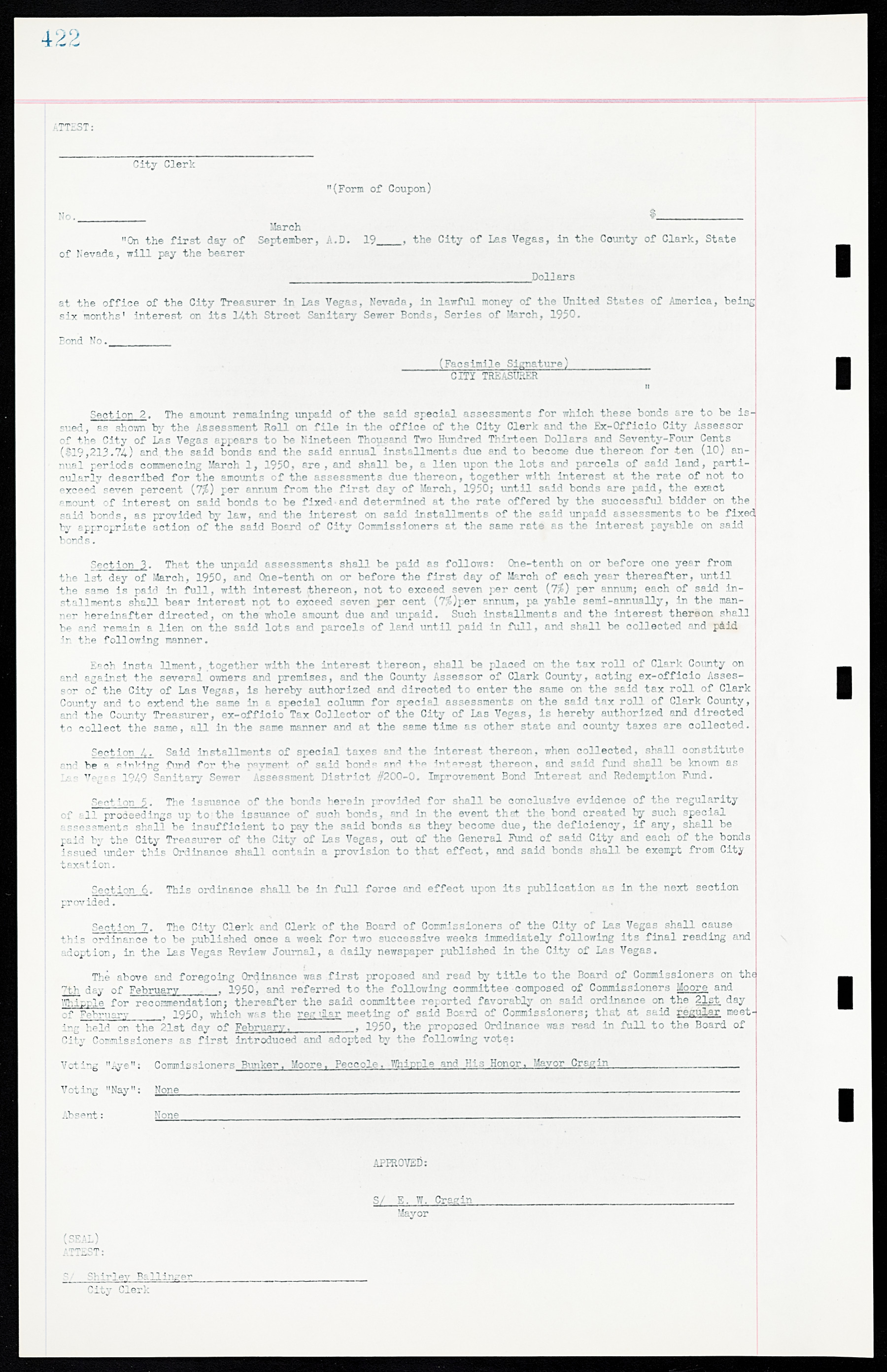

City Clerk "(Form of Coupon) No._________ $___________ March "On the first day of September, A.D. 19___, the City of Las Vegas, in the County of Clark, State of Nevada, will pay the bearer ________________________________Dollars at the office of the City Treasurer in Las Vegas, Nevada, in lawful money of the United States of America, being six months' interest on its 14th Street Sanitary Sewer Bonds, Series of March, 1950. Bond No. _____(Facsimile Signature)___________ CITY TREASURER " Section 2. The amount remaining unpaid of the said special assessments for which these bonds are to be issued, as shown by the Assessment Roll on file in the office of the City Clerk and the Ex-Officio City Assessor of the City of Las Vegas appears to be Nineteen Thousand Two Hundred Thirteen Dollars and Seventy-Four Cents ($19,213.74) and the said bonds and the said annual installments due and to become due thereon for ten (10) annual periods commencing March 1, 1950, are, and shall be, a lien upon the lots and parcels of said land, particularly described for the amounts of the assessments due thereon, together with interest at the rate of not to exceed seven percent (7%) per annum from the first day of March, 1950; until said bonds are paid, the exact amount of interest on said bonds to be fixed and determined at the rate offered by the successful bidder on the j said bonds, as provided by law, and the interest on said installments of the said unpaid assessments to be fixed by appropriate action of the said Board of City Commissioners at the same rate as the interest payable on said Section 3. That the unpaid assessments shall be paid as follows: One-tenth on or before one year from the 1st day of March, 1950, and One-tenth on or before the first day of March of each year thereafter, until the same is paid in full, with interest thereon, not to exceed seven per cent (7%) per annum; each of said installments shall bear interest not to exceed seven per cent (7%) per annum, payable semi-annually, in the manner hereinafter directed, on the whole amount due and unpaid. Such installments and the interest thereon shall be and remain a lien on the said lots and parcels of land until paid in full, and shall be collected and paid in the following manner. Each installment, together with the interest thereon, shall be placed on the tax roll of Clark County on and against the several owners and premises, and the County Assessor of Clark County, acting ex-officio Assessor of the City of Las Vegas, is hereby authorized and directed to enter the same on the said tax roll of Clark County and to extend the same in a special column for special assessments on the said tax roll of Clark County, and the County Treasurer, ex-officio Tax Collector of the City of Las Vegas, is hereby authorized and directed to collect the same, all in the same manner and at the same time as other state and county taxes are collected. Section 4. Said installments of special taxes and the interest thereon, when collected, shall constitute and be a sinking fund for the payment of said bonds and the interest thereon, and said fund shall be known as Las Vegas 1949 Sanitary Sewer Assessment District #200-0. Improvement Bond Interest and Redemption Fund. Section 5. The issuance of the bonds herein provided for shall be conclusive evidence of the regularity of all proceedings up to the issuance of such bonds, and in the event that the bond created by such special assessments shall be insufficient to pay the said bonds as they become due, the deficiency, if any, shall be paid by the City Treasurer of the City of Las Vegas, out of the General Fund of said City and each of the bonds issued under this Ordinance shall contain a provision to that effect, and said bonds shall be exempt from City taxation. Section 6. This ordinance shall be in full force and effect upon its publication as in the next section Section 7. The City Clerk and Clerk of the Board of Commissioners of the City of Las Vegas shall cause this ordinance to be published once a week for two successive weeks immediately following its final reading and adoption, in the Las Vegas Review Journal, a daily newspaper published in the City of Las Vegas. The above and foregoing Ordinance was first proposed and read by title to the Board of Commissioners on the 7th day of February 1950, and referred to the following committee composed of Commissioners Moore and Whipple for recommendation; thereafter the said committee reported favorably on said ordinance on the 21st day of February____, 1950, which was the regular meeting of said Board of Commissioners; that at said regular meeting held on the 21st day of February,________, 1950, the proposed Ordinance was read in full to the Board of City Commissioners as first introduced and adopted by the following vote: Voting "Aye": Commissioners Bunker, Moore, Peccole, Whipple and His Honor, Mayor Cragin_________________ Voting "Nay": None ______________————________________________________________ Absent: None___________________________________________________________________________ APPROVED: S/ E. W. Cragin___________________________________ Mayor (SEAL) Shirley Ballinger City Clerk