Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

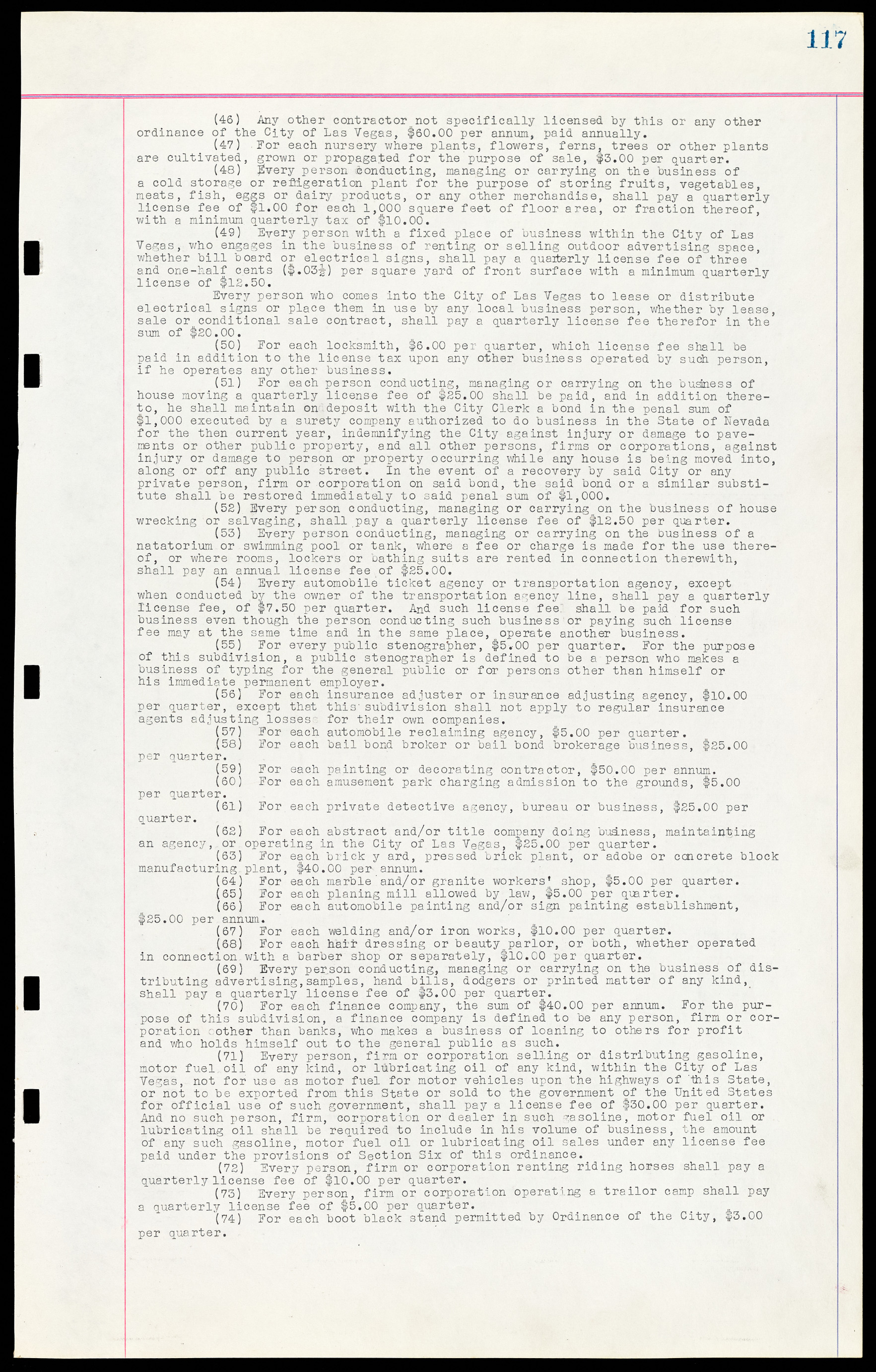

(46) Any other contractor not specifically licensed by this or any other ordinance of the City of Las Vegas, $60.00 per annum, paid annually. (47) For each nursery where plants, flowers, ferns, trees or other plants are cultivated, grown or propagated for the purpose of sale, $3.00 per quarter. (48) Every person conducting, managing or carrying on the business of a cold storage or refrigeration plant for the purpose of storing fruits, vegetables, meats, fish, eggs or dairy products, or any other merchandise, shall pay a quarterly license fee of $1.00 for each 1,000 square feet of floor area, or fraction thereof, with a minimum quarterly tax of $10.00. (49) Every person with a fixed place of business within the City of Las Vegas, who engages in the business of renting or selling outdoor advertising space, whether bill board or electrical signs, shall pay a quarterly license fee of three and one-half cents ($.03½) per square yard of front surface with a minimum quarterly license of $12.50. Every person who comes into the City of Las Vegas to lease or distribute electrical signs or place them in use by any local business person, whether by lease, sale or conditional sale contract, shall pay a quarterly license fee therefor in the sum of $20.00. (50) For each locksmith, $6.00 per quarter, which license fee shall be paid in addition to the license tax upon any other business operated by such person, if he operates any other business. (51) For each person conducting, managing or carrying on the business of house moving a quarterly license fee of $25.00 shall be paid, and in addition thereto, he shall maintain on deposit with the City Clerk a bond in the penal sum of $1,000 executed by a surety company authorized to do business in the State of Nevada for the then current year, indemnifying the City against injury or damage to pavements or other public property, and all other persons, firms or corporations, against injury or damage to person or property occurring while any house is being moved into, along or off any public street. In the event of a recovery by said City or any private person, firm or corporation on said bond, the said bond or a similar substitute shall be restored immediately to said penal sum of $1,000. (52) Every person conducting, managing or carrying on the business of house wrecking or salvaging, shall pay a quarterly license fee of $12.50 per quarter. (53) Every person conducting, managing or carrying on the business of a natatorium or swimming pool or tank, where a fee or charge is made for the use thereof, or where rooms, lockers or bathing suits are rented in connection therewith, shall pay an annual license fee of $25.00. (54) Every automobile ticket agency or transportation agency, except when conducted by the owner of the transportation agency line, shall pay a quarterly license fee, of $7.50 per quarter. And such license fee shall be paid for such business even though the person conducting such business or paying such license fee may at the same time and in the same place, operate another business. (55) For every public stenographer, $5.00 per quarter. For the purpose of this subdivision, a public stenographer is defined to be a person who makes a business of typing for the general public or for persons other than himself or his immediate permanent employer. (56) For each insurance adjuster or insurance adjusting agency, $10.00 per quarter, except that this subdivision shall not apply to regular insurance agents adjusting losses for their own companies. (57) For each automobile reclaiming agency, $5.00 per quarter. (58) For each bail bond broker or bail bond brokerage business, $25.00 per quarter. (59) For each painting or decorating contractor, $50.00 per annum. (60) For each amusement park charging admission to the grounds, $5.00 per quarter. (61) For each private detective agency, bureau or business, $25.00 per quarter. (62) For each abstract and/or title company doing business, maintaining an agency, or operating in the City of Las Vegas, $25.00 per quarter. (63) For each brick yard, pressed brick plant, or adobe or concrete block manufacturing plant, $40.00 per annum. (64) For each marble and/or granite workers' shop, $5.00 per quarter. (65) For each planing mill allowed by law, $5.00 per quarter. (66) For each automobile painting and/or sign painting establishment, $25.00 per annum. (67) For each welding and/or iron works, $10.00 per quarter. (68) For each hair dressing or beauty parlor, or both, whether operated in connection with a barber shop or separately, $10.00 per quarter. (69) Every person conducting, managing or carrying on the business of distributing advertising, samples, hand bills, dodgers or printed matter of any kind, shall pay a quarterly license fee of $3.00 per quarter. (70) For each finance company, the sum of $40.00 per annum. For the purpose of this subdivision, a finance company is defined to be any person, firm or corporation other than banks, who makes a business of loaning to others for profit and who holds himself out to the general public as such. (71) Every person, firm or corporation selling or distributing gasoline, motor fuel oil of any kind, or lubricating oil of any kind, within the City of Las Vegas, not for use as motor fuel for motor vehicles upon the highways of this State, or not to be exported from this State or sold to the government of the United States for official use of such government, shall pay a license fee of $30.00 per quarter. And no such person, firm, corporation or dealer in such gasoline, motor fuel oil or lubricating oil shall be required to include in his volume of business, the amount of any such gasoline, motor fuel oil or lubricating oil sales under any license fee paid under the provisions of Section Six of this ordinance. (72) Every person, firm or corporation renting riding horses shall pay a quarterly license fee of $10.00 per quarter. (73) Every person, firm or corporation operating a trailer camp shall pay a quarterly license fee of $5.00 per quarter. (74) For each boot black stand permitted by Ordinance of the City, $3.00 per quarter.