Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

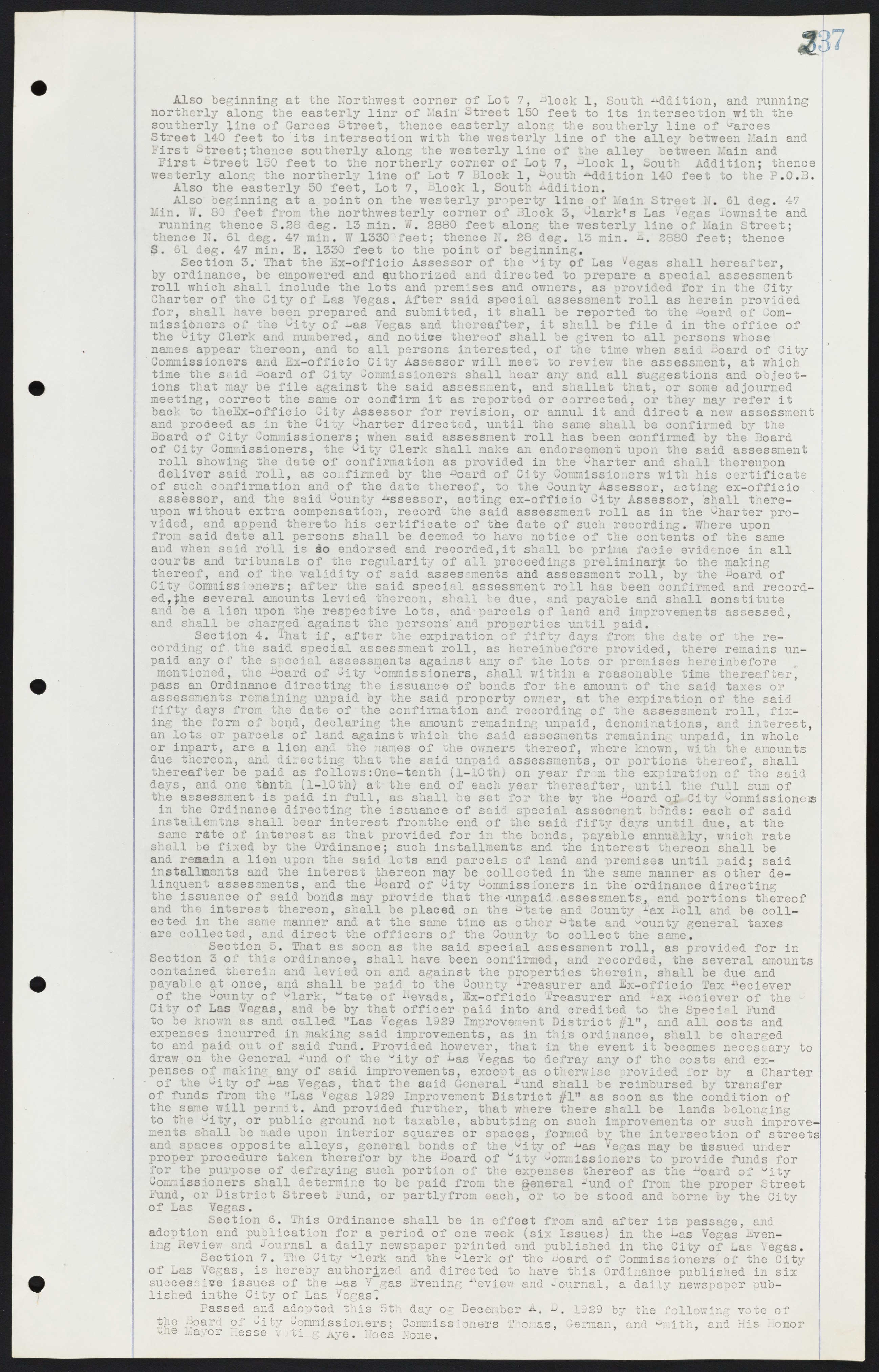

Also beginning at the Northwest corner of Lot 7, Block 1, South Addition, and running northerly along the easterly line of Main Street 150 feet to its intersection with the southerly line of Garces Street, thence easterly along the southerly line of Garces Street 140 feet to its intersection with the westerly line of the alley between Main and First Street; thence southerly along the westerly line of the alley between Main and First Street 150 feet to the northerly corner of Lot 7, Block 1, South Addition; thence westerly along the northerly line of Lot 7 Block 1, South Addition 140 feet to the P. O. B. Also the easterly 50 feet, Lot 7, Block 1, South Addition. Also beginning at a point on the westerly property line of Main Street N. 61 deg. 47 Min. W. 80 feet from the northwesterly corner of Block 3, Clark's Las Vegas Townsite and running thence S. 28 deg. 13 min. N. 2880 feet along the westerly line of Main Street; thence N. 61 deg. 47 min. W 1330 feet; thence N. 28 deg. 13 min. 2880 feet; thence S. 61 deg. 47 min. E. 1330 feet to the point of beginning. Section 3. That the Ex-officio Assessor of the City of Las Vegas shall hereafter, by ordinance, be empowered and authorized and directed to prepare a special assessment roll which shall include the lots and premises and owners, as provided for in the City Charter of the City of Las Vegas. After said special assessment roil as herein provided for, shall have been prepared and submitted, it shall be reported to the Board of Commissioners of the City of Las Vegas and thereafter, it shall be filed in the office of the City Clerk and numbered, and notice thereof shall be given to all persons whose names appear thereon, and to all persons interested, of the time when said Board of City Commissioners and Ex-officio City Assessor will meet to review the assessment, at which time the said Board of City Commissioners shall hear any and all suggestions and objections that may be filed against the said assessment, and shall at that, or some adjourned meeting, correct the same or confirm it as reported or corrected, or they may refer it back to the Ex-officio City Assessor for revision, or annul it and direct a new assessment and proceed as in the City Charter directed, until the same shall be confirmed by the Board of City Commissioners; when said assessment roll has been confirmed by the Board of City Commissioners, the City Clerk shall make an endorsement upon the said assessment roll showing the date of confirmation as provided in the Charter and shall thereupon deliver said roll, as confirmed by the Board of City Commissioners with his certificate of such confirmation and of the date thereof, to the County Assessor, acting ex-officio assessor, and the said County Assessor, acting ex-officio City Assessor, shall thereupon without extra compensation, record the said assessment roll as in the Charter provided, and append thereto his certificate of the date of such recording. Where upon from said date all persons shall be deemed to have notice of the contents of the same and when said roll is do endorsed and recorded, it shall be prima facie evidence in all courts and tribunals of the regularity of all proceedings preliminary to the making thereof, and of the validity of said assessments and assessment roll, by the Board of City Commissioners; after the said special assessment roll has been confirmed and recorded, the several amounts levied thereon, shall be due, and payable and shall constitute and be a lien upon the respective lots, and parcels of land and improvements assessed, and shall be charged against the persons' and properties until paid. Section 4. That if, after the expiration of fifty days from the date of the recording of the said special assessment roll, as hereinbefore provided, there remains unpaid any of the special assessments against any of the lots or premises hereinbefore mentioned, the Board of City Commissioners, shall within a reasonable time thereafter, pass an Ordinance directing the issuance of bonds for the amount of the said taxes or assessments remaining unpaid by the said property owner, at the expiration of the said fifty days from the date of the confirmation and recording of the assessment roll, fixing the form of bond, declaring the amount remaining unpaid, denominations, and interest, an lots or parcels of land against which the said assessments remaining unpaid, in whole or inpart, are a lien and the names of the owners thereof, where known, with the amounts due thereon, and directing that the said unpaid assessments, or portions thereof, shall thereafter be paid as follows: One-tenth (1-10th) on year from the expiration of the said days, and one tenth (1-10th) at the end of each year thereafter, until the full sum of the assessment is paid in full, as shall be set for the by the Board of City Commissioners in the Ordinance directing the issuance of said special assessment bonds: each of said installments shall bear interest from the end of the said fifty days until due, at the same rate of interest as that provided for in the bonds, payable annually, which rate shall be fixed by the Ordinance; such installments and the interest thereon shall be and remain a lien upon the said lots and parcels of land and premises until paid; said installments and the interest thereon may be collected in the same manner as other delinquent assessments, and the Board of City Commissioners in the ordinance directing the issuance of said bonds may provide that the unpaid assessments, and portions thereof and the interest thereon, shall be placed on the State and County Tax Roll and be collected in the same manner and at the same time as other State and County general taxes are collected, and direct the officers of the County to collect the same. Section 5. That as soon as the said special assessment roll, as provided for in Section 3 of this ordinance, shall have been confirmed, and recorded, the several amounts contained therein and levied on and against the properties therein, shall be due and payable at once, and shall be paid to the County Treasurer and Ex-officio Tax Receiver of the County of Clark, State of Nevada, Ex-officio Treasurer and Tax Receiver of the City of Las Vegas, and be by that officer paid into and credited to the Special Fund to be known as and called "Las Vegas 1929 Improvement District #1", and all costs and expenses incurred in making said improvements, as in this ordinance, shall be charged to and paid out of said fund. Provided however, that in the event it becomes necessary to draw on the General Fund of the City of Las Vegas to defray any of the costs and expenses of making any of said improvements, except as otherwise provided for by a Charter of the City of Las Vegas, that the said General Fund shall be reimbursed by transfer of funds from the "Las Vegas 1929 Improvement District #1" as soon as the condition of the same will permit. And provided further, that where there shall be lands belonging to the City, or public ground not taxable, abutting on such improvements or such improvements shall be made upon interior squares or spaces, formed by the intersection of streets and spaces opposite alleys, general bonds of the City of Las Vegas may be issued under proper procedure taken therefor by the Board of City Commissioners to provide funds for for the purpose of defraying such portion of the expenses thereof as the Board of City Commissioners shall determine to be paid from the general Fund of from the proper Street Fund, or District Street Fund, or partly from each, or to be stood and borne by the City of Las Vegas. Section 6. This Ordinance shall be in effect from and after its passage, and adoption and publication for a period of one week (six Issues) in the Las Vegas Evening Review and Journal a daily newspaper printed and published in the City of Las Vegas. Section 7. The City Clerk and the Clerk of the Board of Commissioners of the City of Las Vegas, is hereby authorized and directed to have this Ordinance published in six successive issues of the Las Vegas Evening Review and Journal, a daily newspaper published in the City of Las Vegas. Passed and adopted this 5th day of December A. D. 1929 by the following vote of the Board of City Commissioners; Commissioners Thomas, German, and Smith, and His Honor the Mayor Hesse voting Aye. Noes None.