Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

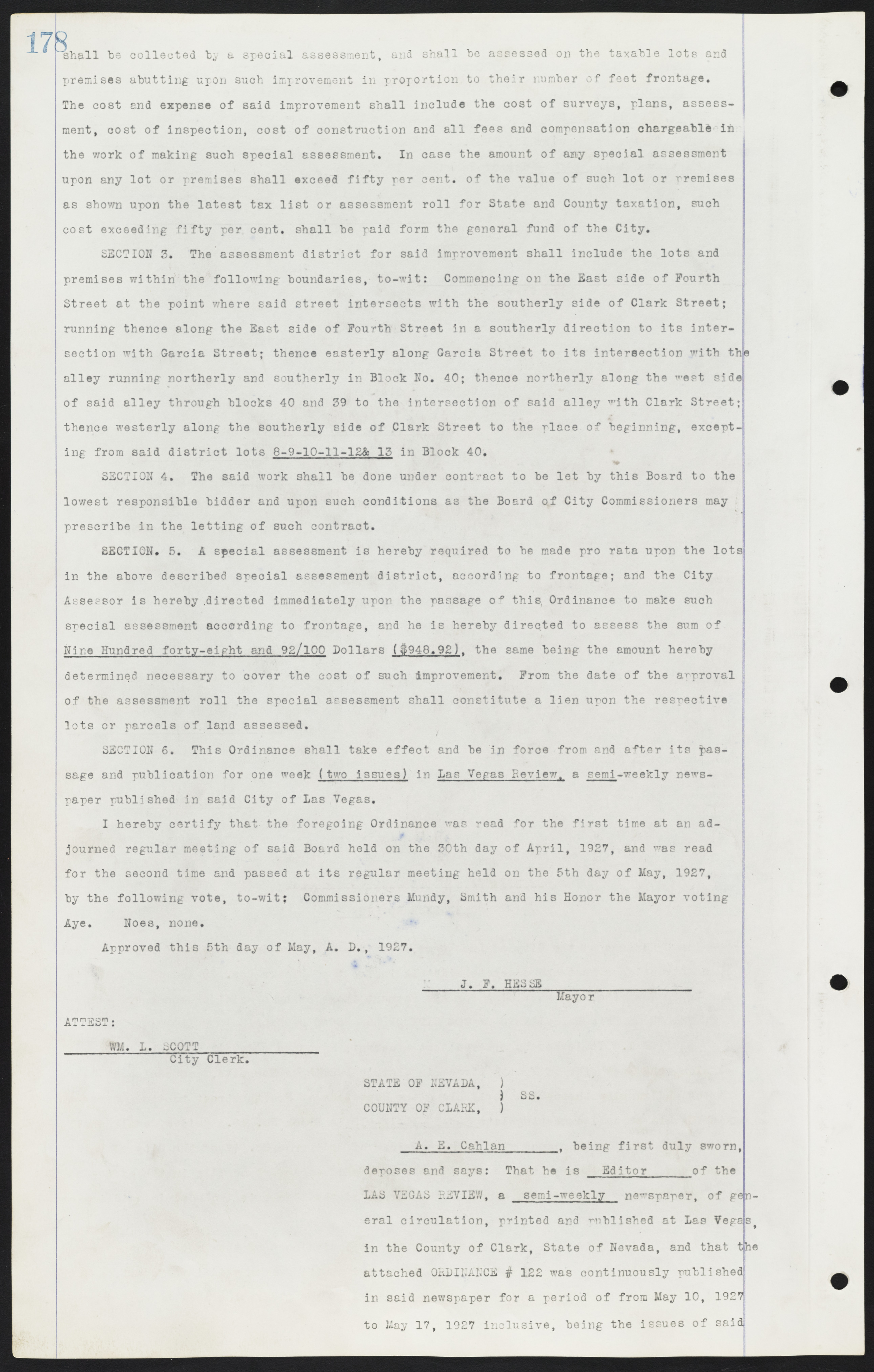

shall he collected be a special assessment, and shall be assessed on the taxable lots and premises abutting upon such improvement in proportion to their number of feet frontage. The cost and expense of said improvement shall include the cost of surveys, plans, assessment, cost of inspection, cost of construction and all fees and compensation chargeable in the work of making such special assessment. In case the amount of any special assessment upon any lot or premises shall exceed fifty per cent, of the value of such lot or premises as shown upon the latest tax list or assessment roll for State and County taxation, such cost exceeding fifty per cent, shall be paid form the general fund of the City. SECTION 3. The assessment district for said improvement shall include the lots and premises within the following boundaries, to-wit: Commencing on the East side of Fourth Street at the point where said street intersects with the southerly side of Clark Street; running thence along the East side of Fourth Street in a southerly direction to its intersection with Garcia Street; thence easterly along Garcia Street to its intersection with the alley running northerly and southerly in Block No. 40; thence northerly along the west side of said alley through blocks 40 and 39 to the intersection of said alley with Clark Street; thence westerly along the southerly side of Clark Street to the place of beginning, excepting from said district lots 8-9-10-11-12 & 13 in Block 40. SECTION 4. The said work shall be done under contract to be let by this Board to the lowest responsible bidder and upon such conditions as the Board of City Commissioners may prescribe in the letting of such contract. SECTION. 5. A special assessment is hereby required to be made pro rata upon the lots in the above described special assessment district, according to frontage; and the City Assessor is hereby directed immediately upon the passage of this Ordinance to make such special assessment according to frontage, and he is hereby directed to assess the sum of Nine Hundred forty-eight and 92/100 Dollars ($948.92), the same being the amount hereby determined necessary to cover the cost of such improvement. From the date of the approval of the assessment roll the special assessment shall constitute a lien upon the respective lots or parcels of land assessed. SECTION 6. This Ordinance shall take effect and be in force from and after its passage and publication for one week (two issues) in Las Vegas Review, a semi-weekly newspaper published in said City of Las Vegas. I hereby certify that the foregoing Ordinance was read for the first time at an adjourned regular meeting of said Board held on the 30th day of April, 1927, and was read for the second time and passed at its regular meeting held on the 5th day of May, 1927 by the following vote, to-wit; Commissioners Mundy, Smith and his Honor the Mayor voting Aye. Noes, none. Approved this 5th day of May, A. D., 1927. J. F. HESSE _____________________ Mayor ATTEST: _______WM. L. SCOTT__________________ City Clerk. STATE OF NEVADA, ) :SS. COUNTY OF CLARK, ) A. E. Cahlan________, being first duly sworn deposes arid says: That he is Editor_______of the LAS VEGAS REVIEW, a semi-weekly newspaper, of general circulation, printed and published at Las Vegas in the County of Clark, State of Nevada, and that the attached ORDINANCE # 122 was continuously published in said newspaper for a period of from May 10, 1927 to May 17, 1927 inclusive, being the issues of said