Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

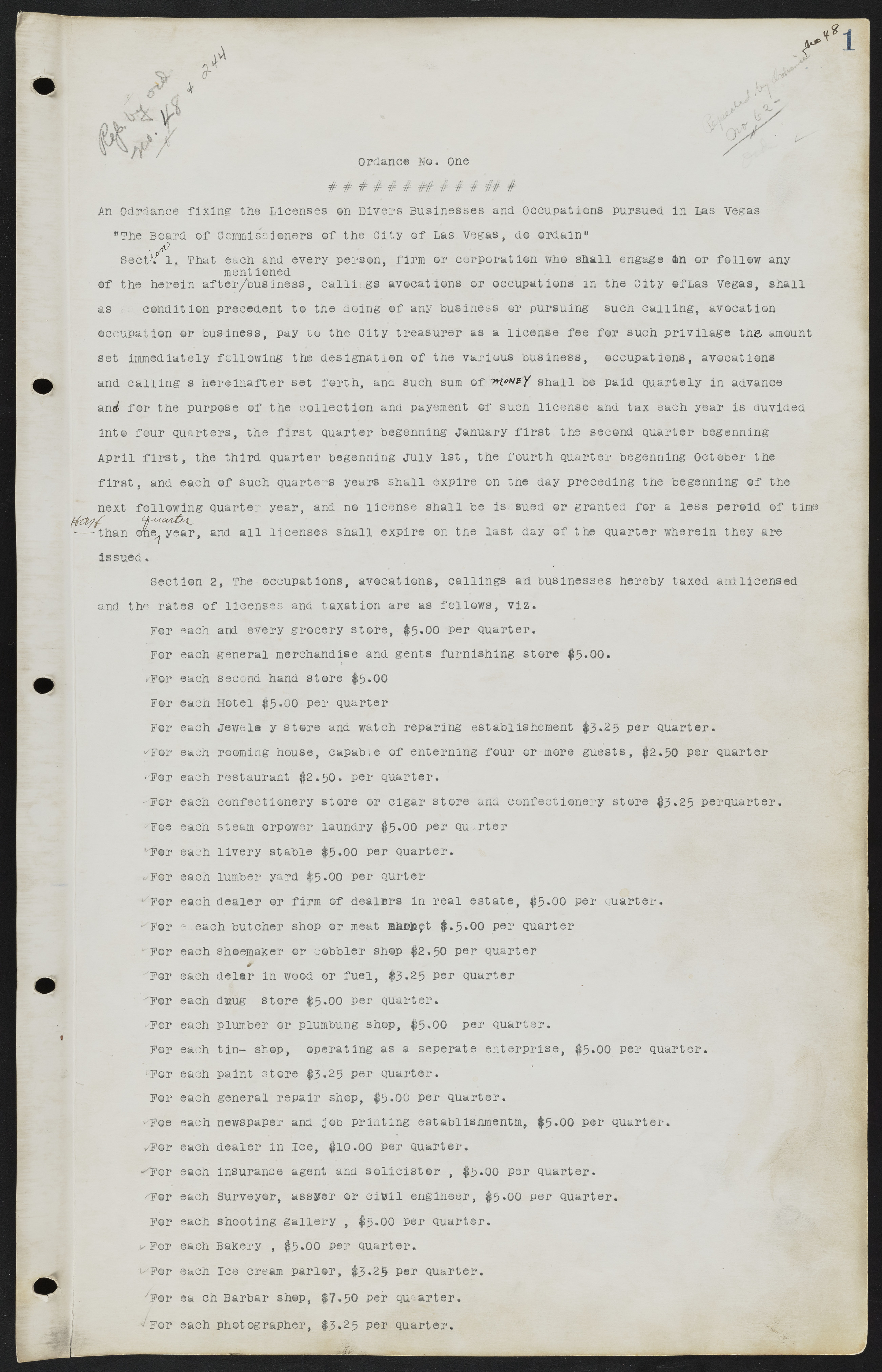

Ordinance No. One An Ordinance fixing the Licenses on Divers Businesses and Occupations pursued in Las Vegas "The Board of Commissioners of the City of Las Vegas, do ordain" Section 1. That each and every person, firm or corporation who shall engage on or follow any of the herein after mentioned business, callings avocations or occupations in the City of Las Vegas, shall as condition precedent to the doing of any business or pursuing such calling, avocation occupation or business, pay to the City treasurer as a license fee for such privilege the amount set immediately following the designation of the various business, occupations avocations and calling s hereinafter set forth, and such sum of shall be paid quarterly in advance and for the purpose of the collection and payment of such license and tax each year is divided into four quarters, the first quarter beginning January first the second quarter beginning April first, the third quarter beginning July 1st, the fourth quarter beginning October the first, and each of such quarters years shall expire on the day preceding the beginning of the next following quarter year, and no license shall be issued or granted for a less period of time than one, year, and all licenses shall expire on the last day of the quarter wherein they are issued. Section 2, The occupations, avocations, callings ad businesses hereby taxed and licensed and the rates of licenses and taxation are as follows, viz. For each and every grocery store, $5.00 per quarter. For each general merchandise and gents furnishing store $5.00. For each second hand store $5.00 For each Hotel $5.00 per quarter For each Jewelary store and watch reparing establishment $3.25 per quarter. For each rooming house, capable of entering four or more guests, $2.50 per quarter For each restaurant $2.50. per quarter. For each confectionery store or cigar store and confectionery store $3.25 per quarter. For each steam or power laundry $5.00 per quarter For each livery stable $5.00 per quarter. For each lumber yard $5.00 per quarter For each dealer or firm of dealers in real estate, $5.00 per quarter. For each butcher shop or meat market $.5.00 per quarter For each shoemaker or cobbler shop $2.50 per quarter For each delar in wood or fuel, $3.25 per quarter For each drug store $5.00 per quarter. For each plumber or plumbing shop, $5.00 per quarter. For each tin- shop, operating as a separate enterprise, $5.00 per quarter. For each paint store $3.25 per quarter. For each general repair shop, $5.00 per quarter. For each newspaper and job printing establishment, $5.00 per quarter. For each dealer in Ice, $10.00 per quarter. For each insurance agent and solicitor , $5.00 per quarter. For each Surveyor, assyer or civil engineer, $5.00 per quarter. For each shooting gallery , $5.00 per quarter. For each Bakery , $5.00 per quarter. For each Ice cream parlor, $3.25 per quarter. For each Barber shop, $7.50 per quarter. For each photographer, $3-25 Per quarter.