Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

More Info

Rights

Digital Provenance

Publisher

Transcription

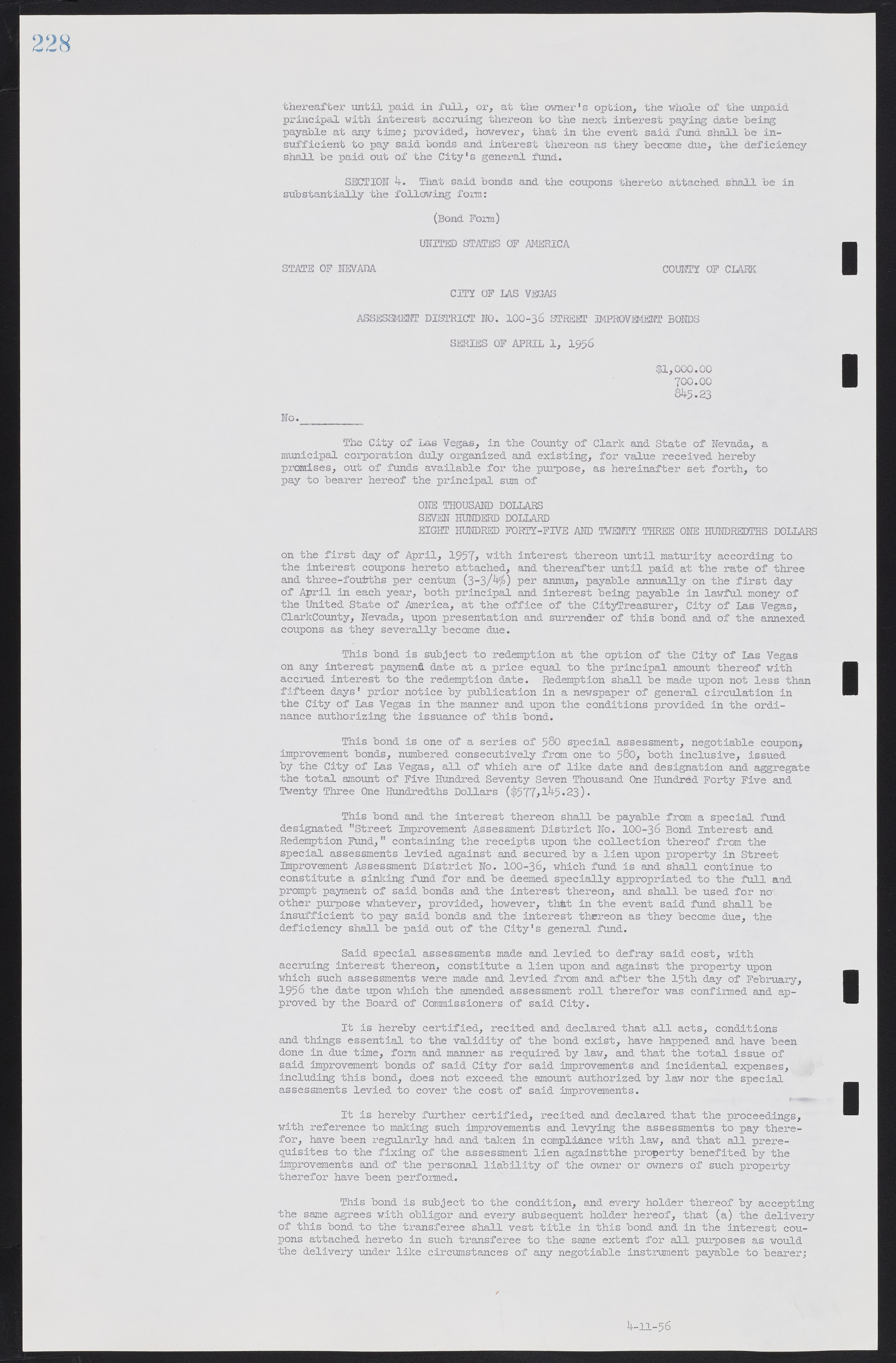

thereafter until paid in full; or; at the owner's option; the whole of the unpaid principal with interest accruing thereon to the next interest paying date being payable at any time; provided; however; that in the event said fund shall be insufficient to pay said bonds and interest thereon as they become due; the deficiency shall be paid out of the City's general fund. SECTION 4. That said bonds and the coupons thereto attached shall be in substantially the following form: (Bond Form) UNITED STATES OF AMERICA STATE OF NEVADA COUNTY OF CLARK CITY OF IAS VEGAS ASSESSMENT DISTRICT NO. 100-36 STREET IMPROVEMENT BONDS SERIES OF APRIL 1; 1956 $1,000.00 700.00 845.23 No.__________ The City of Las Vegas; in the County of Clark and State of Nevada, a municipal corporation duly organized and existing, for value received hereby promises, out of funds available for the purpose, as hereinafter set forth, to pay to bearer hereof the principal sum of ONE THOUSAND DOLLARS SEVEN HUNDRED DOLLARD EIGHT HUNDRED FORTY-FIVE AND TWENTY THREE ONE HUNDREDTHS DOLLARS on the first day of April, 1957; with interest thereon until maturity according to the interest coupons hereto attached, and thereafter until paid at the rate of three and three-fourths per centum (3-3/4%) per annum, payable annually on the first day of April in each year, both principal and interest being payable in lawful money of the United State of America, at the office of the City Treasurer, City of Las Vegas, Clark County, Nevada, upon presentation and surrender of this bond and of the annexed coupons as they severally become due. This bond is subject to redemption at the option of the City of Las Vegas on any interest payment date at a price equal to the principal amount thereof with accrued interest to the redemption date. Redemption shall be made upon not less than fifteen days' prior notice by publication in a newspaper of general circulation in the City of Las Vegas in the manner and upon the conditions provided in the ordinance authorizing the issuance of this bond. This bond is one of a series of 580 special assessment, negotiable coupon, improvement bonds, numbered consecutively from one to 580, both inclusive, issued by the City of Las Vegas, all of which are of like date and designation and aggregate the total amount of Five Hundred Seventy Seven Thousand One Hundred Forty Five and Twenty Three One Hundredths Dollars ($577,145.23). This bond and the interest thereon shall be payable from a special fund designated "Street Improvement Assessment District No. 100-36 Bond Interest and Redemption Fund," containing the receipts upon the collection thereof from the special assessments levied against and secured by a lien upon property in Street Improvement Assessment District No. 100-36, which fund is and shall continue to constitute a sinking fund for and be deemed specially appropriated to the full and prompt payment of said bonds and the interest thereon, and shall be used for no other purpose whatever, provided, however, that in the event said fund shall be insufficient to pay said bonds and the interest thereon as they became due, the deficiency shall be paid out of the City's general fund. Said special assessments made and levied to defray said cost, with accruing interest thereon, constitute a lien upon and against the property upon which such assessments were made and levied from and after the 15th day of February, 1956 the date upon which the amended assessment roll therefor was confirmed and approved by the Board of Commissioners of said City. It is hereby certified, recited and declared that all acts, conditions and things essential to the validity of the bond exist, have happened and have been done in due time, form and manner as required by law, and that the total issue of said improvement bonds of said City for said improvements and incidental expenses, including this bond, does not exceed the amount authorized by law nor the special assessments levied to cover the cost of said improvements. It is hereby further certified, recited and declared that the proceedings, with reference to making such improvements and levying the assessments to pay therefor, have been regularly had and taken in compliance with law, and that all prerequisites to the fixing of the assessment lien against the property benefited by the improvements and of the personal liability of the owner or owners of such property therefor have been performed. This bond is subject to the condition, and every holder thereof by accepting the same agrees with obligor and every subsequent holder hereof, that (a) the delivery of this bond to the transferee shall vest title in this bond and in the interest coupons attached hereto in such transferee to the same extent for all purposes as would the delivery under like circumstances of any negotiable instrument payable to bearer;