Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

More Info

Rights

Digital Provenance

Publisher

Transcription

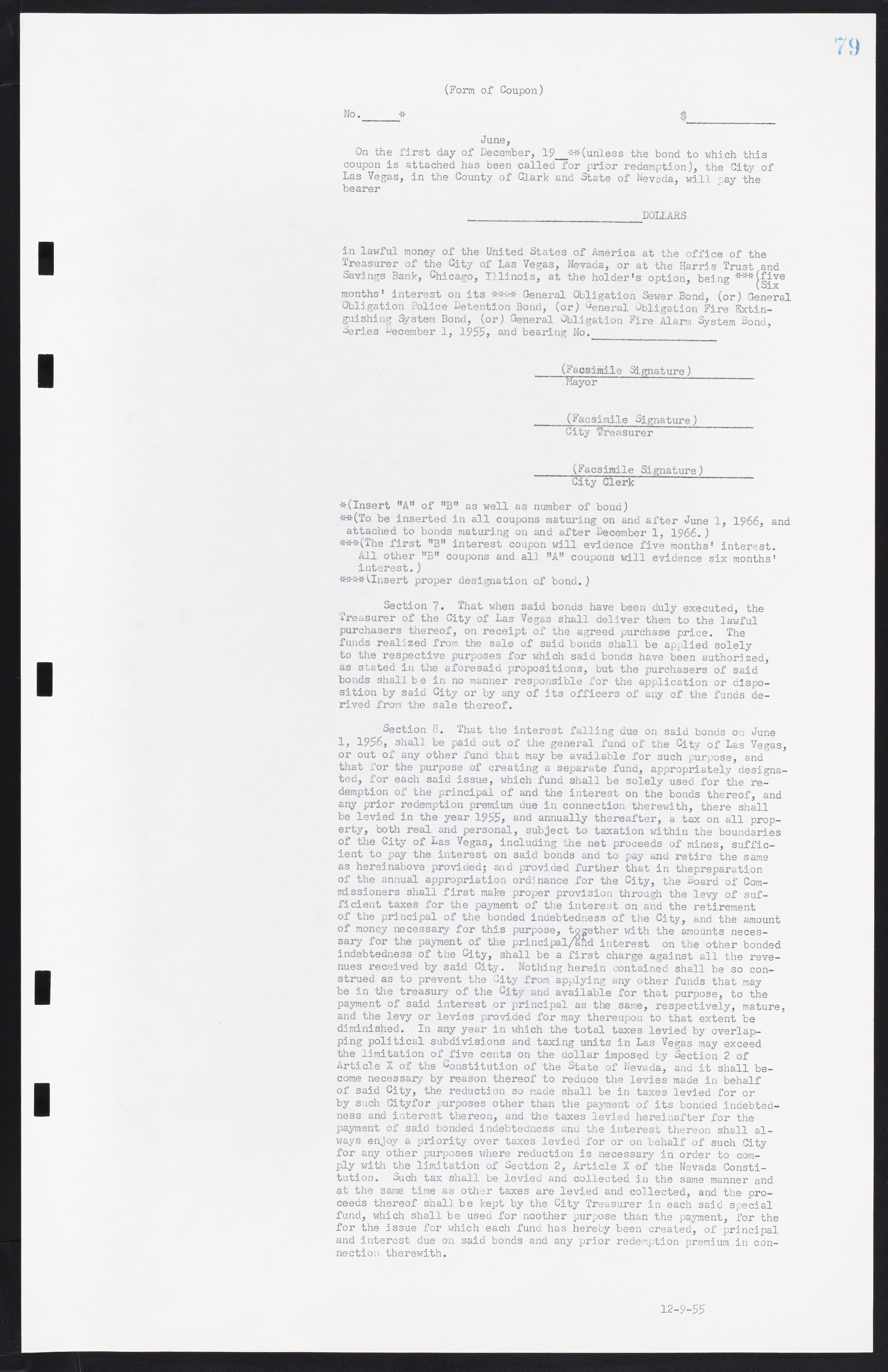

No._____* $______________ On the first day of June, 19 **(unless the bond to which this coupon is attached has been called for prior redemption), the City of Las Vegas, in the County of Clark and State of Nevada, will pay the bearer DOLLARS in lawful money of the United States of America at the office of the Treasurer of the City of Las Vegas, Nevada, or at the Harris Trust and Savings Bank, Chicago, Illinois, at the holder's option, being Six months' interest on its *** General Obligation Sewer Bond, (or) General Obligation Police Detention Bond, (or) General Obligation Fire Extinguishing System Bond, (or) General Obligation Fire Alarm System Bond, Series December 1, 1955, and bearing No.____ (Facsimile Signature) Mayor _____(Facsimile Signature)_________ City Treasurer ______(Facsimile Signature)________ City Clerk *(Insert "A" of "B" as well as number of bond) **(To be inserted in all coupons maturing on and after June 1, 1966, and attached to bonds maturing on and after December 1, 1966.) ***(The first "B" interest coupon will evidence five months' interest. All other "B" coupons and all "A" coupons will evidence six months' interest.) ****(Insert proper designation of bond. ) Section 7. That when said bonds have been duly executed, the Treasurer of the City of Las Vegas shall deliver them to the lawful purchasers thereof, on receipt of the agreed purchase price. The funds realized from the sale of said bonds shall be applied solely to the respective purposes for which said bonds have been authorized, as stated in the aforesaid propositions, but the purchasers of said bonds shall be in no manner responsible for the application or disposition by said City or by any of its officers of any of the funds derived from the sale thereof. Section 8. That the interest falling due on said bonds on June 1, 1956, shall be paid out of the general fund of the City of Las Vegas, or out of any other fund that may be available for such purpose, and that for the purpose of creating a separate fund, appropriately designated, for each said issue, which fund shall be solely used for the redemption of the principal of and the interest on the bonds thereof, and any prior redemption premium due in connection therewith, there shall be levied in the year 1955, and annually thereafter, a tax on all property, both real and personal, subject to taxation within the boundaries of the City of Las Vegas, including the net proceeds of mines, sufficient to pay the interest on said bonds and to pay and retire the same as hereinabove provided; and provided further that in the preparation of the annual appropriation ordinance for the City, the Board of Commissioners shall first make proper provision through the levy of sufficient taxes for the payment of the interest on and the retirement of the principal of the bonded indebtedness of the City, and the amount of money necessary for this purpose, together with the amounts necessary for the payment of the principal of interest on the other bonded indebtedness of the City, shall be a first charge against all the revenues received by said City. Nothing herein contained shall be so construed as to prevent the City from applying any other funds that may be in the treasury of the City and available for that purpose, to the payment of said interest or principal as the same, respectively, mature, and the levy or levies provided for may thereupon to that extent be diminished. In any year in which the total taxes levied by overlapping political subdivisions and taxing units in Las Vegas may exceed the limitation of five cents on the dollar imposed by Section 2 of Article X of the Constitution of the State of Nevada, and it shall become necessary by reason thereof to reduce the levies made in behalf of said City, the reduction so made shall be in taxes levied for or by such City for purposes other than the payment of its bonded indebtedness and interest thereon, and the taxes levied hereinafter for the payment of said bonded indebtedness and the interest thereon shall always enjoy a priority over taxes levied for or on behalf of such City for any other purposes where reduction is necessary in order to comply with the limitation of Section 2, Article X of the Nevada Constitution. Such tax shall be levied and collected in the same manner and at the same time as other taxes are levied and collected, and the proceeds thereof shall be kept by the City Treasurer in each said special fund, which shall be used for noother purpose than the payment, for the for the issue for which each fund has hereby been created, of principal and interest due on said bonds and any prior redemption premium in connection therewith. (Form of Coupon) 12-9-55