Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

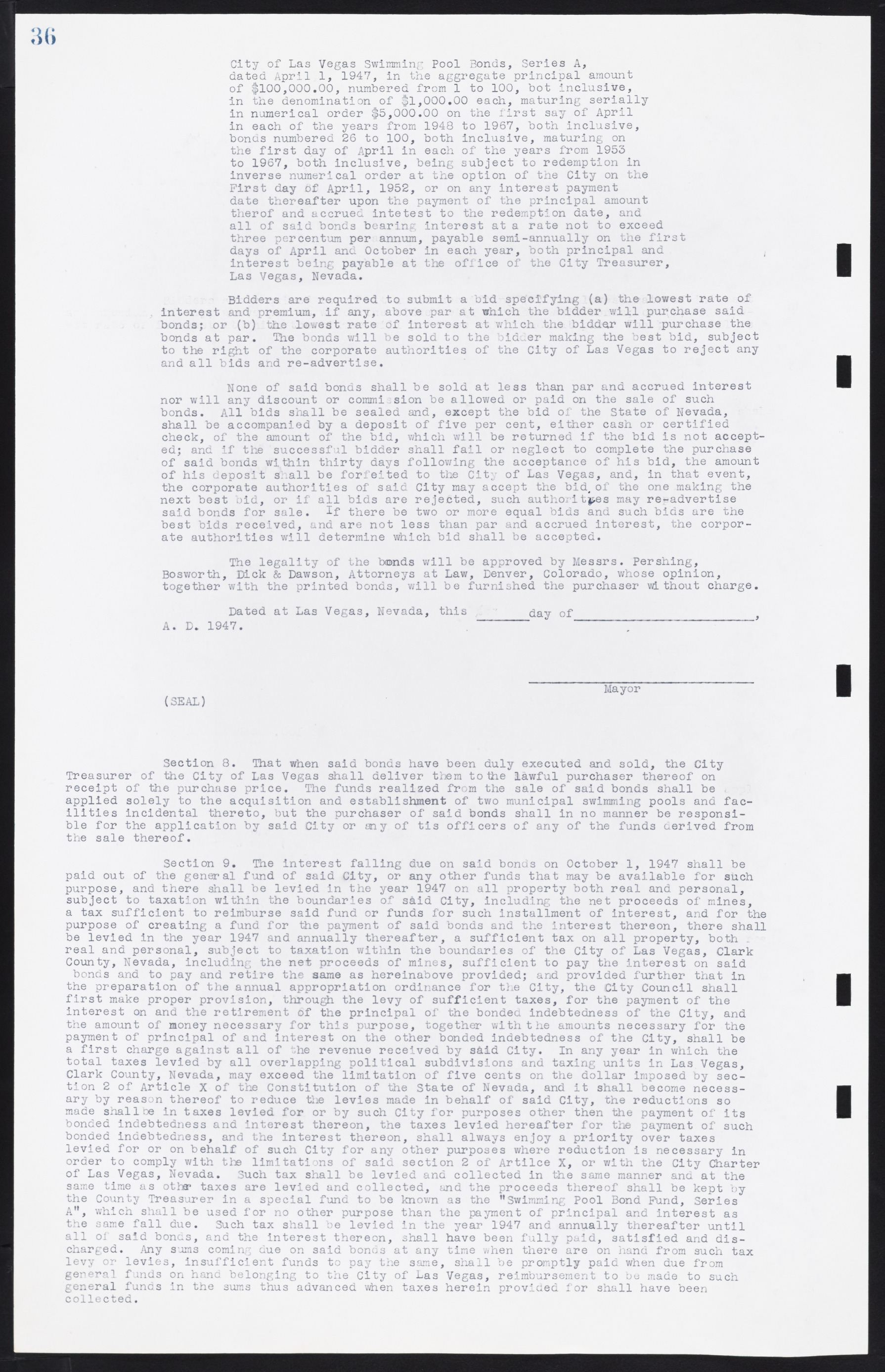

36 City of Las Vegas Swimming Pool Bonds, Series A, dated April 1, 1947, in the aggregate principal amount of $100,000.00, numbered from 1 to 100, bot inclusive, in the denomination of $1,000.00 each, maturing serially in numerical order $5,000.00 on the first say of April in each of the years from 1948 to 1967, both inclusive, bonds numbered 26 to 100, both inclusive, maturing on the first day of April in each of the years from 1953 to 1967, both inclusive, being subject to redemption in inverse numerical order at the option of the City on the First day of April, 1952, or on any interest payment date thereafter upon the payment of the principal amount thereof and accrued interest to the redemption date, and all of said bonds bearing interest at a rate not to exceed three per centum per annum, payable semi-annually on the first days of April and October in each year, both principal and interest being payable at the office of the City Treasurer, Las Vegas, Nevada. Bidders are required to submit a bid specifying (a) the lowest rate of interest and premium, if any, above par at which the bidder will purchase said bonds; or (b) the lowest rate of interest at which the bidder will purchase the bonds at par. The bonds will be sold to the bidder making the best bid, subject to the right of the corporate authorities of the City of Las Vegas to reject any and all bids and re-advertise. None of said bonds shall be sold at less than par and accrued interest nor will any discount or commission be allowed or paid on the sale of such bonds. All bids shall be sealed and, except the bid of the State of Nevada, shall be accompanied by a deposit of five per cent, either cash or certified check, of the amount of the bid, which will be returned if the bid is not accepted; and if the successful bidder shall fail or neglect to complete the purchase of said bonds within thirty days following the acceptance of his bid, the amount of his deposit shall be forfeited to the City of Las Vegas, and, in that event, the corporate authorities of said City may accept the bid, of the one making the next best bid, or if all bids are rejected, such authorities may re-advertise said bonds for sale. If there be two or more equal bids and such bids are the best bids received, and are not less than par and accrued interest, the corporate authorities will determine which bid shall be accepted. The legality of the bonds will be approved by Messrs. Pershing, Bosworth, Dick & Dawson, Attorneys at Law, Denver, Colorado, whose opinion, together with the printed bonds, will be furnished the purchaser without charge. Dated at Las Vegas, Nevada, this day of A. D. 1947. Mayor (SEAL) Section 8. That when said bonds have been duly executed and sold, the City Treasurer of the City of Las Vegas shall deliver them to the lawful purchaser thereof on receipt of the purchase price. The funds realized from the sale of said bonds shall be applied solely to the acquisition and establishment of two municipal swimming pools and facilities incidental thereto, but the purchaser of said bonds shall in no manner be responsible for the application by said City or any of tis officers of any of the funds derived from the sale thereof. Section 9. The interest falling due on said bonds on October 1, 1947 shall be paid out of the general fund of said City, or any other funds that may be available for such purpose, and there shall be levied in the year 1947 on all property both real and personal, subject to taxation within the boundaries of sad City, including the net proceeds of mines, a tax sufficient to reimburse said fund or funds for such installment of interest, and for the purpose of creating a fund for the payment of said bonds and the interest thereon, there shall be levied in the year 1947 and annually thereafter, a sufficient tax on all property, both real and personal, subject to taxation within the boundaries of the City of Las Vegas, Clark County, Nevada, including the net proceeds of mines, sufficient to pay the interest on said bonds and to pay and retire the same as hereinabove provided; and provided further that in the preparation of the annual appropriation ordinance for the City, the City Council shall first make proper provision, through the levy of sufficient taxes, for the payment of the interest on and the retirement of the principal of the bonded indebtedness of the City, and the amount of money necessary for this purpose, together with the amounts necessary for the payment of principal of and interest on the other bonded indebtedness of the City, shall be a first charge against all of the revenue received by said City. In any year in which the total taxes levied by all overlapping political subdivisions and taxing units in Las Vegas, Clark County, Nevada, may exceed the limitation of five cents on the dollar imposed by section 2 of Article X of the Constitution of the State of Nevada, and it shall become necessary by reason thereof to reduce the levies made in behalf of said City, the reductions so made shall be in taxes levied for or by such City for purposes other then the payment of its bonded indebtedness and interest thereon, the taxes levied hereafter for the payment of such bonded indebtedness, and the interest thereon, shall always enjoy a priority over taxes levied for or on behalf of such City for any other purposes where reduction is necessary in order to comply with the limitations of said section 2 of Article X, or with the City Charter of Las Vegas, Nevada. Such tax shall be levied and collected in the same manner and at the same time as other taxes are levied and collected, and the proceeds thereof shall be kept by the County Treasurer in a special fund to be known as the "Swimming Pool Bond Fund, Series A", which shall be used for no other purpose than the payment of principal and interest as the same fall due. Such tax shall be levied in the year 1947 and annually thereafter until all of said bonds, and the interest thereon, shall have been fully paid, satisfied and discharged. Any sums coming due on said bonds at any time when there are on hand from such tax levy or levies, insufficient funds to pay the same, shall be promptly paid when due from general funds on hand belonging to the City of Las Vegas, reimbursement to be made to such general funds in the sums thus advanced when taxes herein provided for shall have been collected.