Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

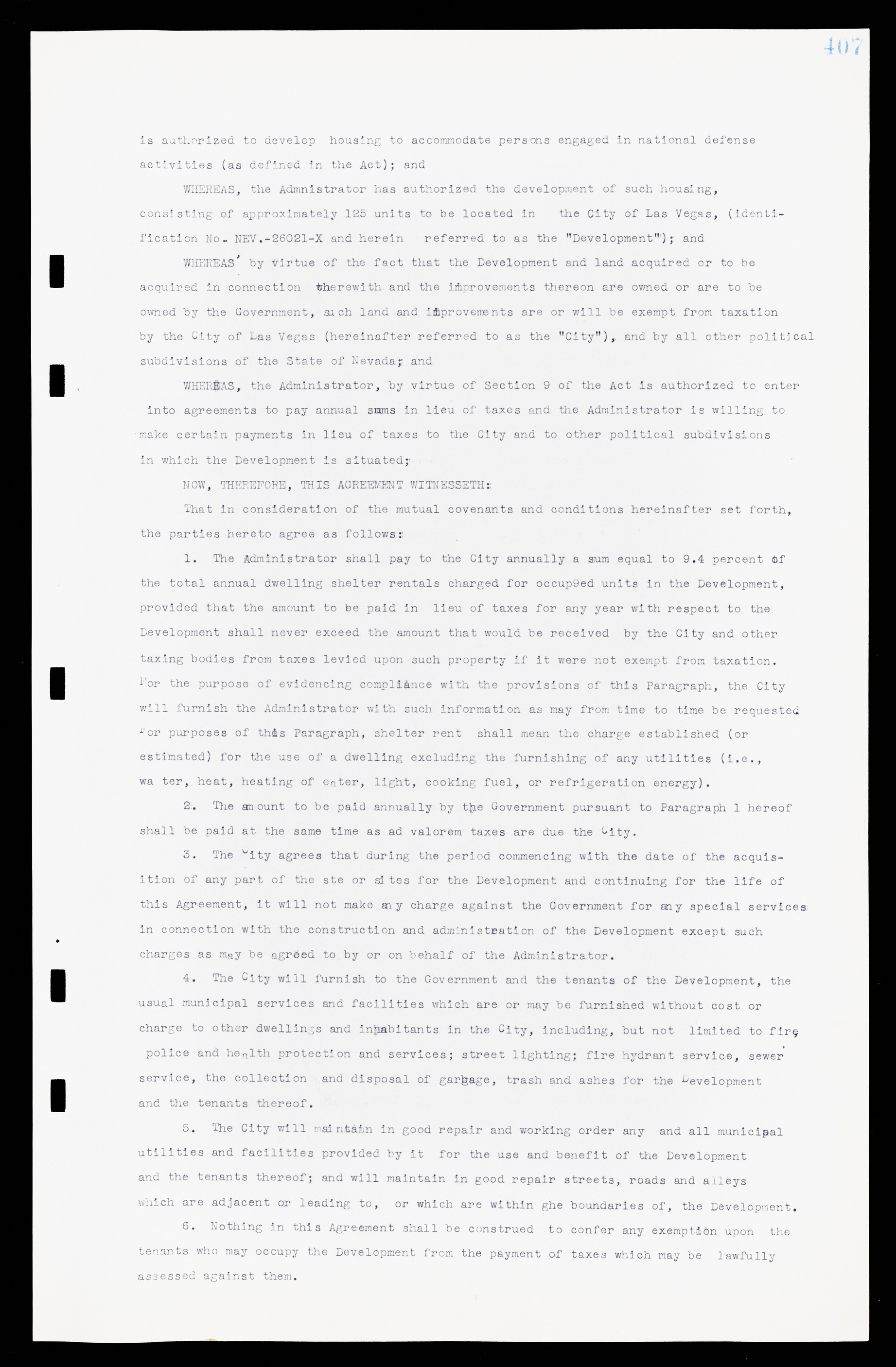

is authorized to develop housing to accommodate persons engaged in national defense activities (as defined in the Act); and WHEREAS, the Administrator has authorized the development of such housing, consisting of approximately 125 units to be located in the City of Las Vegas, (identification No. NEV.-26021-X and herein referred to as the "Development"); and WHEREAS by virtue of the fact that the Development and land acquired or to be acquired in connection therewith and the improvements thereon are owned or are to be owned by the Government, such land and improvements are or will be exempt from taxation by the City of Las Vegas (hereinafter referred to as the "City"), and by all other political subdivisions of the State of Nevada; and WHEREAS, the Administrator, by virtue of Section 9 of the Act is authorized to enter into agreements to pay annual sums in lieu of taxes and the Administrator is willing to make certain payments in lieu of taxes to the City and to other political subdivisions in which the Development is situated; NOW, THEREFORE, THIS AGREEMENT WITNESSETH: That in consideration of the mutual covenants and conditions hereinafter set forth, the parties hereto agree as follows: 1. The Administrator shall pay to the City annually a sum equal to 9.4 percent of the total annual dwelling shelter rentals charged for occupied units in the Development, provided that the amount to be paid in lieu of taxes for any year with respect to the Development shall never exceed the amount that would be received by the City and other taxing bodies from taxes levied upon such property if it were not exempt from taxation. For the purpose of evidencing compliance with the provisions of this Paragraph, the City will furnish the Administrator with such information as may from time to time be requested For purposes of this Paragraph, shelter rent shall mean the charge established (or estimated) for the use of a dwelling excluding the furnishing of any utilities (i.e., water, heat, heating of eater, light, cooking fuel, or refrigeration energy). 2. The amount to be paid annually by the Government pursuant to Paragraph 1 hereof shall be paid at the same time as ad valorem taxes are due the City. 3. The City agrees that during the period commencing with the date of the acquisition of any part of the site or sites for the Development and continuing for the life of this Agreement, it will not make any charge against the Government for any special services in connection with the construction and administration of the Development except such charges as may be agreed to by or on behalf of the Administrator. 4. The City will furnish to the Government and the tenants of the Development, the usual municipal services and facilities which are or may be furnished without cost or charge to other dwellings and inhabitants in the City, including, but not limited to fire, police and health protection and services; street lighting; fire hydrant service, sewer service, the collection and disposal of garbage, trash and ashes for the Development and the tenants thereof. 5. The City will maintain in good repair and working order any and all municipal utilities and facilities provided by it for the use and benefit of the Development and the tenants thereof; and will maintain in good repair streets, roads and alleys which are adjacent or leading to, or which are within the boundaries of, the Development. 6. Nothing in this Agreement shall be construed to confer any exemption upon the tenants who may occupy the Development from the payment of taxes which may be lawfully assessed against them.