Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

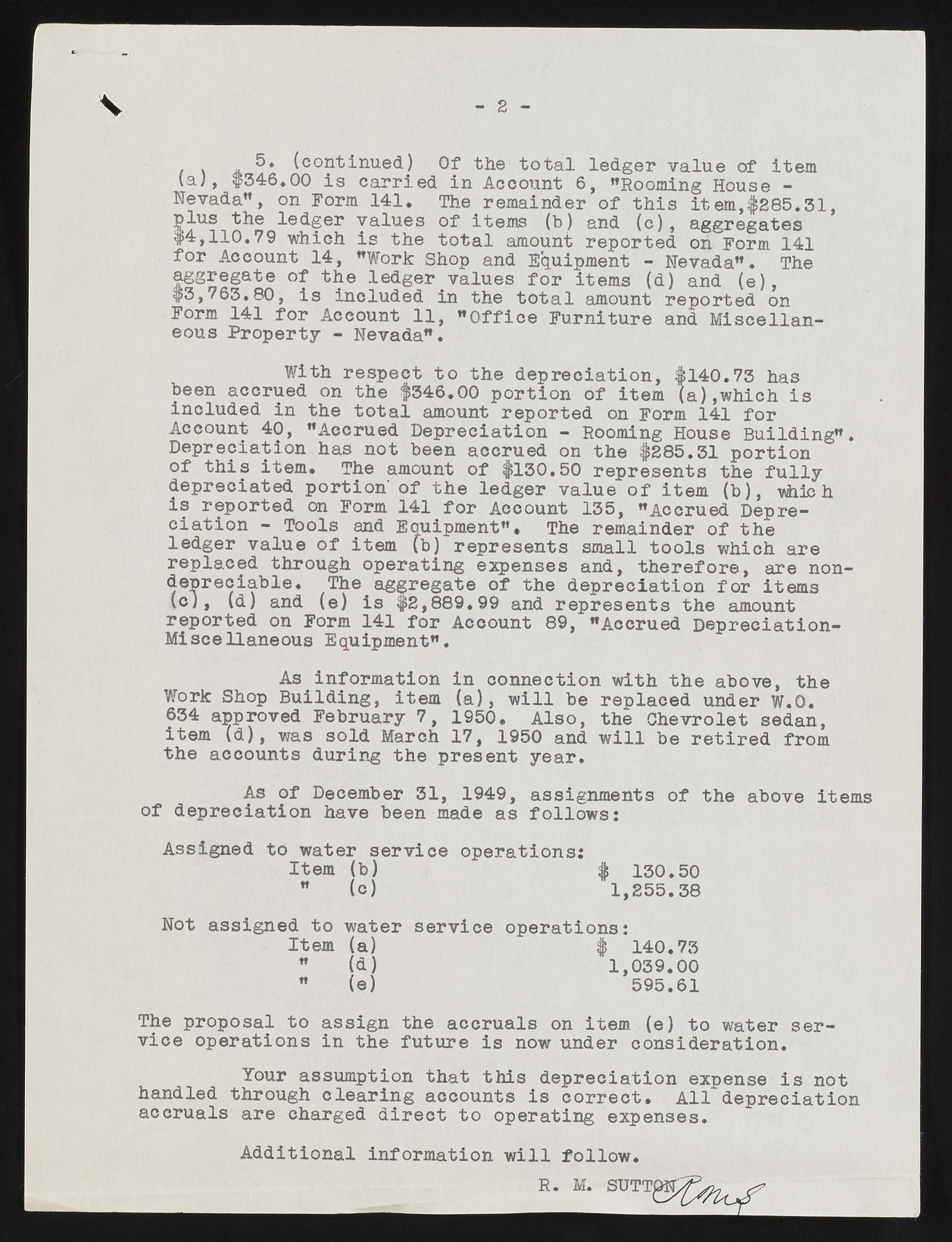

V 2 . . 5. (continued) Of the total (a), #346.00 is carried in Account 6,l e"dRgoero mviangl uHeo uofs e it-em Nevada", on Form 141. The remainder of this item,$285.31, P^-Us "the ledger values of items (b) and (c), aggregates $4,110.79 which is the total amount reported oh Form 141 for Account 14, "Work Shop and Equipment - Nevada". The aggregate of the ledger values for items (d) and (e), $3,763.80, is included in the total amount reported on Feoorusm P1r4o1p efrort yA c- cNoeuvnatd a1"1., "Office Furniture and MiscellanWith respect to the depreciation, $140.73 has been accrued on the $346.00 portion of item (a),which is included in the total amount reported on Form 141 for Account 40, "Accrued Depreciation - Rooming House Building". Depreciation has not been accrued on the $285.31 portion of this item. The amount of $130.50 represents the fully depreciated portion' of the ledger value of item (b), vhlc h is reported on Form 141 for Account 135, "Accrued Depreciation - Tools and Equipment". The remainder of the ledger value of item fb) represents small tools which are replaced through operating expenses and, therefore, are nondepreciable. The aggregate of the depreciation for items tc), (d) and (e) is $2,889.99 and represents the amount reported on Form 141 for Account 89, "Accrued Depreciation- Miscellaneous Equipment". As information in connection with the above, the Work Shop Building, item (a), will be replaced under W.Q. 634 approved February 7, 1950. Also, the Chevrolet sedan, item (d), was sold March 17, 1950 and will be retired from the accounts during the present year. As of December 31, 1949, assignments of the above items of depreciation have been made as follows: Assigned to water service operations; Item (b) $ 130.50 " (c) 1,255.38 Not assigned to water service operations: Item (a) $ 140.73 " (<i) 1,039.00 " (e) 595.61 The proposal to assign the accruals on item (e) to water service operations in the future is now under consideration. Your assumption that this depreciation expense is not handled through clearing accounts is correct. All depreciation accruals are charged direct to operating expenses. Additional information will follow. R. M. SUTT