Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

Member of

More Info

Rights

Digital Provenance

Publisher

Transcription

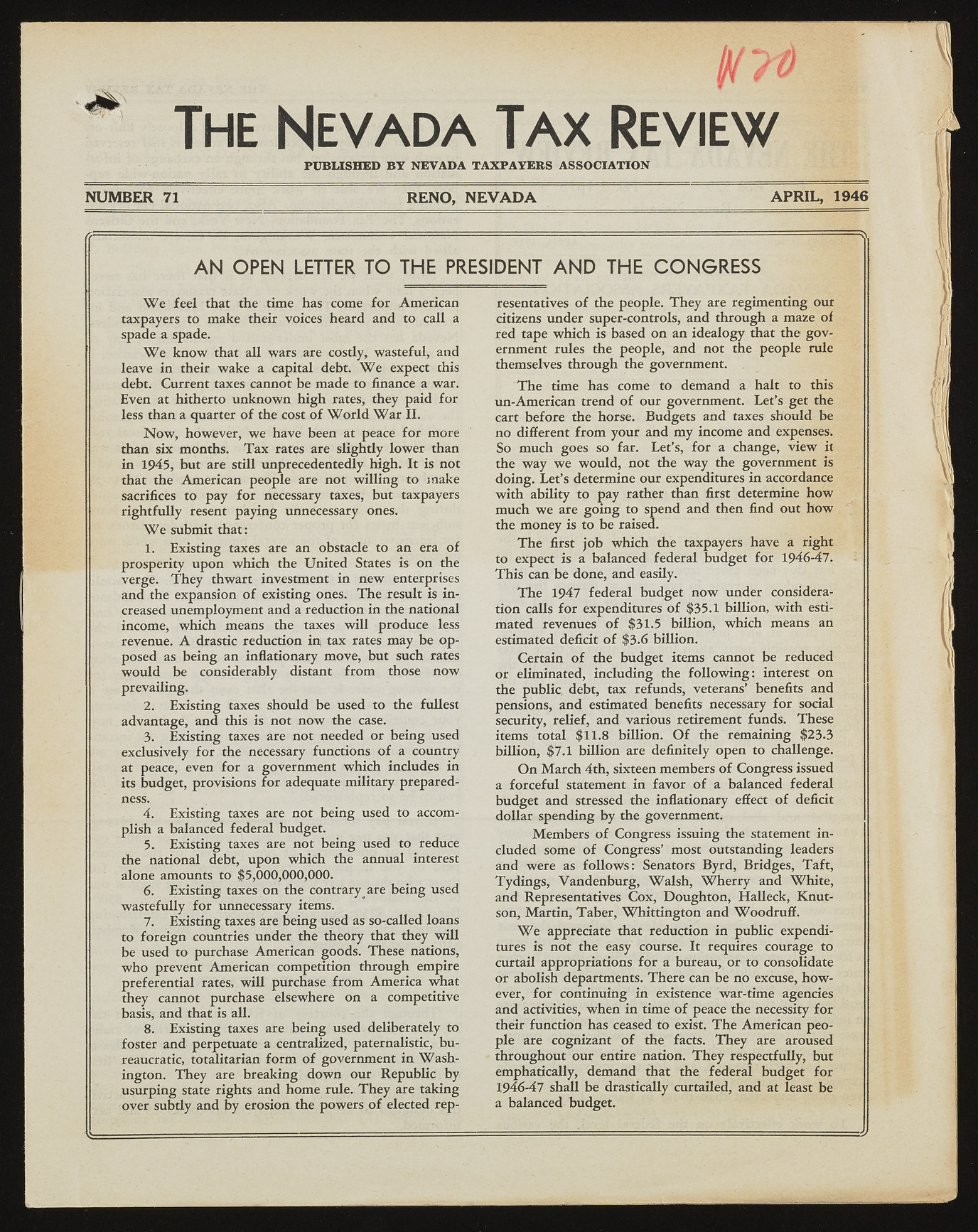

* The Nevada Tax Review PUBLISHED BY NEVADA TAXPAYERS ASSOCIATION NUMBER 71 RENO, NEVAD A APRIL, 1946 AN OPEN LETTER TO THE PRESIDENT AND THE CONGRESS W e fe e l that the time has come fo r Am erican taxpayers to make their voices heard and to call a spade a spade. W e k n o w that all w ars are costly, w asteful, and leave in their w ake a capital debt. W e expect this debt. Current taxes cannot be m ade to finance a w ar. Even at hitherto un k n ow n h ig h rates, they paid fo r less than a quarter o f the cost o f W o r l d W a r II. N o w , how ever, w e have been at peace fo r m ore than six months. T a x rates are slightly lo w e r than in 1945, bu t are still unprecedentedly high. It is not that the A m erican people are not w illin g to make sacrifices to pay fo r necessary taxes, bu t taxpayers rig h tfu lly resent payin g unnecessary ones. W e submit that: 1. Existing taxes are an obstacle to an era o f prosperity u pon w hich the U n ited States is on the verge. T h ey thw art investment in n ew enterprises and the expansion o f existing ones. T h e result is in creased unem ploym ent and a reduction in the national income, w hich means the taxes w ill produce less revenue. A drastic reduction inj tax rates m ay b e o p posed as bein g an inflationary m ove, but such rates w o u ld be considerably distant from those n o w prevailing. 2. Existing taxes should be used to the fullest advantage, and this is not n o w the case. 3. Existing taxes are not needed o r be in g used exclusively fo r the necessary functions o f a country at peace, even fo r a governm ent w hich includes in its budget, provisions fo r adequate m ilitary preparedness. 4 . Existing taxes are not b ein g used to accomplish a balanced federal budget. 5. Existing taxes are not bein g used to reduce the national debt, u pon w hich the annual interest alone amounts to $5,000,000,000. 6. E xisting taxes on the contrary are bein g used w astefully fo r unnecessary items. 7. Existing taxes are b ein g used as so-called loans to fo reign countries under the theory that they w ill be used to purchase Am erican goods. These nations, w h o prevent A m erican competition through empire preferential rates, w ill purchase from Am erica w hat they cannot purchase elsewhere on a competitive basis, and that is all. 8. Existing taxes are bein g used deliberately to foster and perpetuate a centralized, paternalistic, b u reaucratic, totalitarian fo rm o f governm ent in W a s h ington. T h e y are breakin g d o w n our R epublic by u surpin g state rights and hom e rule. T h e y are taking over subtly and by erosion the p o w e rs,o f elected representatives o f the people. T h ey are regim enting our citizens u nder super-controls, and through a maze ol red tape w h ich is based on an idealogy that the g o v ernment rules the people, and not the people rule themselves through the governm ent. T h e time has come to dem and a halt to this un-Am erican trend o f ou r governm ent. Let’s get the cart before the horse. Budgets and taxes should be no different fro m you r and my income and expenses. So m uch goes so far. Let’s, fo r a change, v ie w it the w ay w e w o u ld , n ot the w ay the governm ent is doin g. Let’s determine ou r expenditures in accordance w ith ability to pay rather than first determine h o w m uch w e are g o in g to spend and then find out h o w the m oney is to be raised. T h e first jo b w hich the taxpayers have a right to expect is a balanced federal bu dget fo r 1946-47. T h is can be done, and easily. T h e 1947 federal bu dget n o w under consideration calls fo r expenditures o f $35.1 billion, w ith estim ated revenues o f $31.5 billion , w hich means an estimated deficit o f $3.6 billion. Certain o f the b u dget items cannot be reduced o r eliminated, including the fo llo w in g : interest on the public, debt, tax refunds, veterans’ benefits and pensions, and estimated benefits necessary fo r social security, relief, an d various retirement funds. These items total $11.8 billion . O f the rem aining $23.3 billion , $7.1 b illio n are definitely open to challenge. O n M a rc h 4th, sixteen m embers o f Congress issued a fo rcefu l statement in fa v o r o f a balanced federal bu dget and stressed the inflationary effect o f deficit d o lla r spending by the governm ent. M em bers o f Congress issuing the statement in cluded some o f Congress’ most outstanding leaders and w ere as fo llo w s : Senators B yrd, Bridges, T a ft, T ydin gs, V a n d e n b u rg , W a ls h , W h e r r y and W h ite , and Representatives C o x, D o u g h to n , H alleck, K n u tson, M artin , T a b e r, W h ittin g to n and W o o d ru ff. W e appreciate that reduction in pu blic expenditures is not the easy course. It requires courage to curtail appropriations fo r a bureau, or to consolidate o r abolish departments. T h ere can be n o excuse, h o w ever, fo r continuing in existence w ar-tim e agencies and activities, w h en in time o f peace the necessity fo r their function has ceased to exist. T h e Am erican peop le are cognizant o f the facts. T h e y are aroused throughout ou r entire nation. T h ey respectfully, but emphatically, dem and that the federal bu d get fo r 1946-47 shall be drastically curtailed, and at least be a balanced budget.