Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

Member of

More Info

Rights

Digital Provenance

Publisher

Transcription

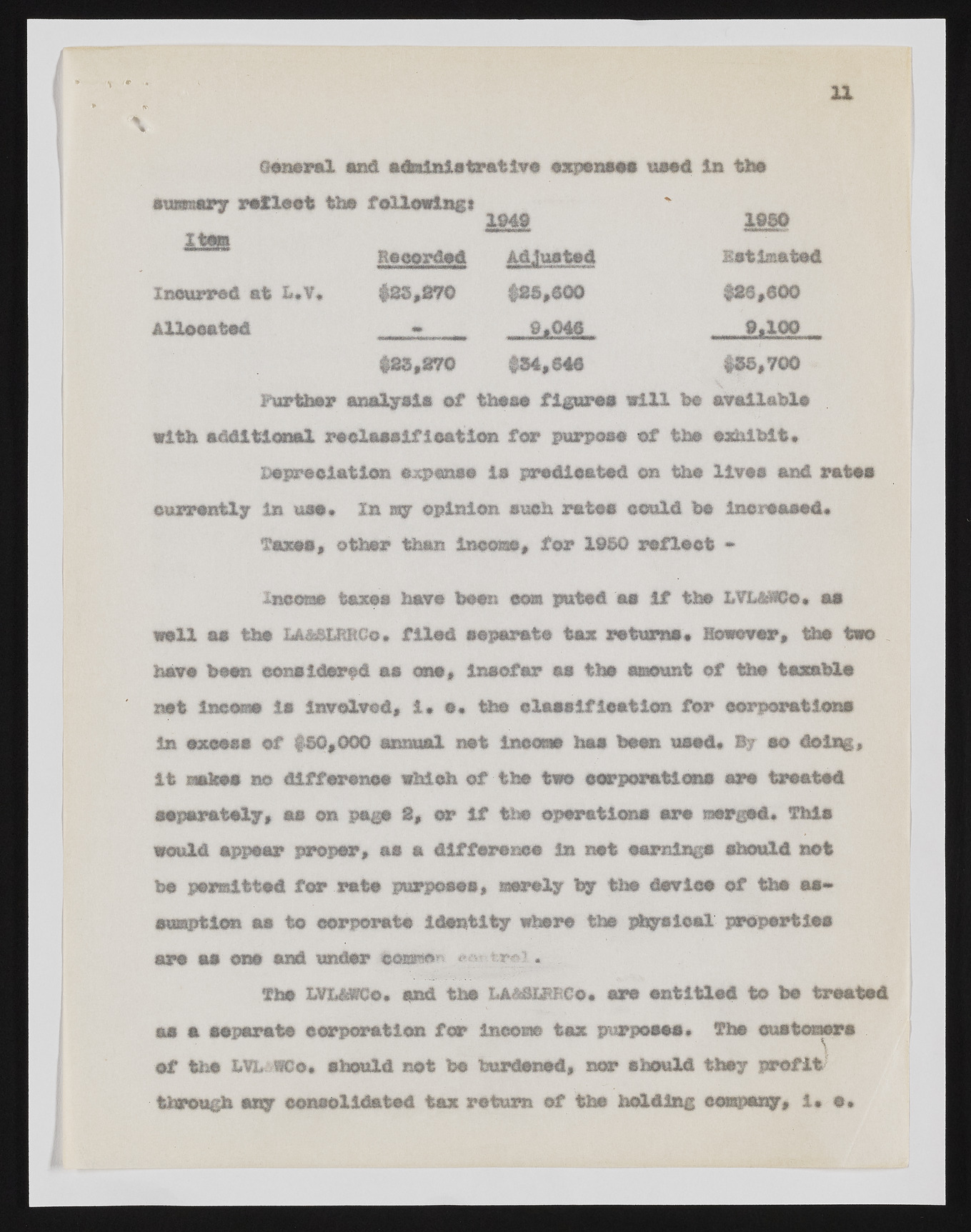

'T.'/W m General and adalnia trat ive expense# nisti, in the I suwtery reflect the following* % 1950 WWt*WMi|sw6P Item 1049 Recorded Estimated Incurred at h*V* #23,870 $85,600 #86,600 allocated ^ - 9,046 - SalOO $95,870 #54,646 155,700 Further analysis of these figures will be available with additional reclassification for purpose of the exhibit* isepreelatien expense is predicated en the lives and rates in use. in m? minim such rates could be increased* Taxes, other than income, for 1950 afloat * income taxes hare been cobs puted as If the as well as the LA&&LERCO* filed separate tax returns* However, the two have been cornsIderfd ae one, insofar aa the amount of the taxable net ineeae la involved, i# e* the classification for corporations In excess of 150,000 annual net income has been used* % a# doing, it makes no difference which of the two corporation* are treated separately, as on page 8, or if the operations are isaergod* This would appear proper, as a difference in net earnings should not two permitted for .rate purposes, merely by the devise of the as- sumption as to corporate identity where the physical' properties are as one and under Oowhen e^twei« . the LVXJsWCo* and the LAAStFECo* are entitled to be treated &e a separate corporation for Income tax pmpoaes* The customer# . of the feVLiCo* should not fee burdened, nor should they profife through any consolidated tax return of the holding company, 1# e*