Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

Member of

More Info

Rights

Digital Provenance

Publisher

Transcription

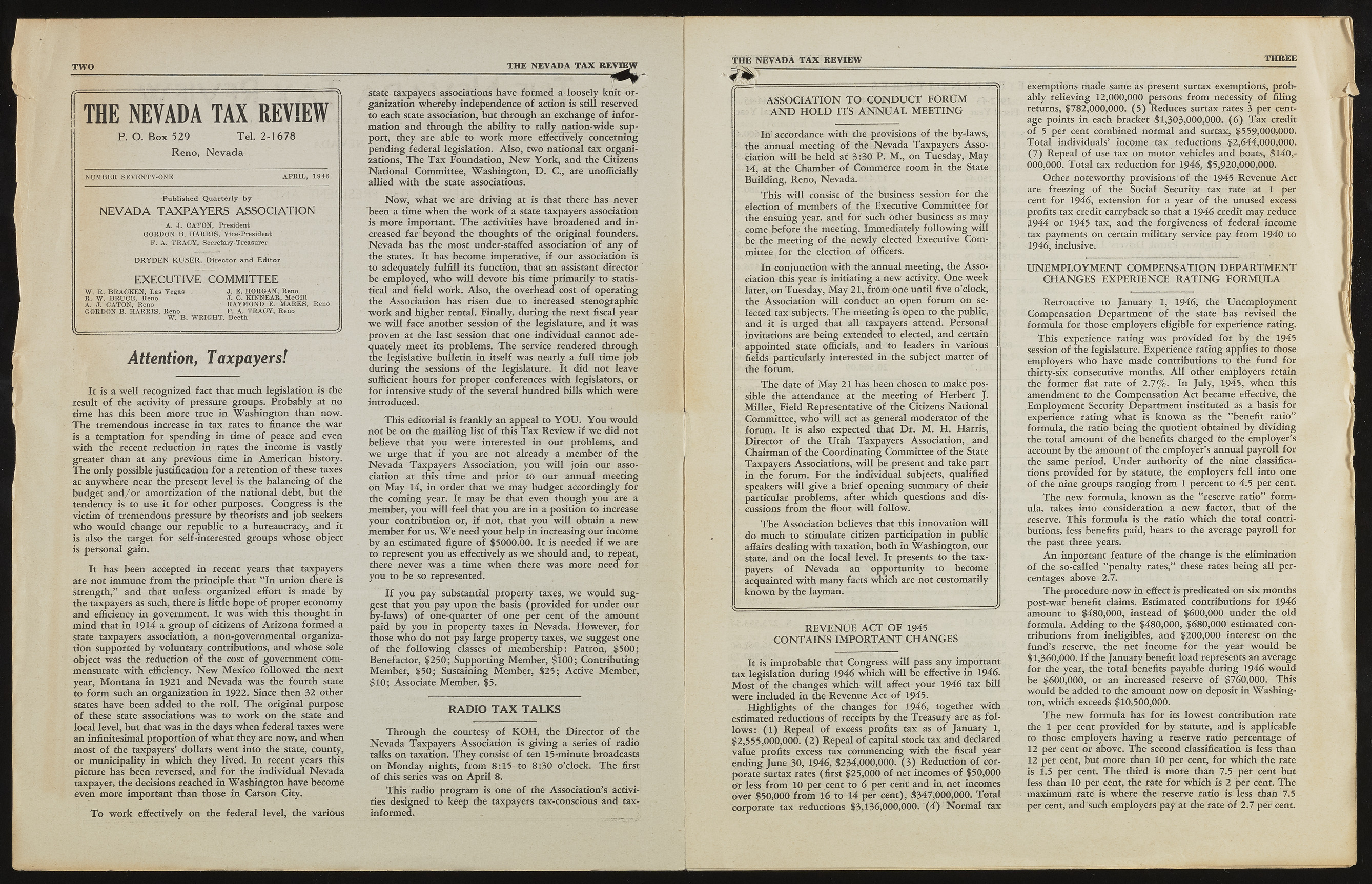

TWO f THE NEVADA TAX REVIEW P .O .B ox 529 Tel. 2-1678 Reno, Nevada NUMBER SEVENTY-ONE APRIL, 1916 Published Quarterly by NEVADA TAXPAYERS ASSOCIATION A. J. CATON, President GORDON B. HARRIS, Vice-President F. A. TRACY, Secretary-Treasurer DRYDEN KUSER, Director and Editor EXECUTIVE COMMITTEE W. R. BRACKEN, Las Vegas . J. E. HORGAN, Reno R. W. BRUCE, Reno J. 0. KINNEAR, McGill A. J. CATON, Reno RAYMOND E. MARKS, Reno GORDON B. HARRIS, Reno F. A. TRACY, Reno W. B. WRIGHT. Deeth ----- ? Attention, Taxpayers! It is a w e ll recognized fact that m uch legislation is the result o f the activity o f pressure groups. P ro b a b ly at no time has this been m ore true in W a sh in g to n than n ow . T h e trem endous increase in tax rates to finance the w a r is a tem ptation fo r spending in time o f peace and even w ith the recent reduction in rates the income is vastly greater than at any previous time in Am erican history. T h e on ly possible justification fo r a retention o f these taxes at anyw here near the present level is the balan cin g o f the bu dget a n d / o r amortization o f the national debt, bu t the tendency is to use it fo r other purposes. Congress is the victim o f trem endous pressure b y theorists an d jo b seekers w h o w o u ld change ou r republic to a bureaucracy, and it is also the target fo r self-interested grou ps w hose object is personal gain. It has been accepted in recent years that taxpayers are not im m une fro m the principle that " I n u n ion there is strength,” and that unless- organized effort is m ade by the taxpayers as such, there is little hope o f prop er economy an d efficiency in governm ent. It w as w ith this thought in m in d that in 1914 a g ro u p o f citizens o f A riz o n a fo rm ed a state taxpayers association, a non-governm ental organization supported by voluntary contributions, and w hose sole object w as the reduction o f the cost o f governm ent commensurate w ith efficiency. N e w M e x ic o fo llo w e d the next year, M o n tan a in 1921 an d N e v a d a w as the fou rth state to fo rm such an organization in 1922. Since then 32 other states have been added to the ro ll. T h e o rigin al purpose o f these state associations w as to w o rk on the state and local level, bu t that w as in the days w h en federal taxes w ere an infinitesimal prop ortion o f w h at they are n ow , an d w h en m ost o f the taxpayers’ dollars w en t into the state, county, o r m unicipality in w h ich they lived. In recent years this picture has been reversed, an d fo r the in dividu al N e v a d a taxpayer, the decisions reached in W a sh in g to n have become even m ore im portant than those in Carson City. T o w o rk effectively on the federal level, the various THE NEVADA TAX REVIEW state taxpayers associations have fo rm ed a loosely knit o rganization w h ereby independence o f action is still reserved to each state association, bu t through an exchange o f in fo rm ation an d th rou gh the ability to rally nation-w ide support, they are able to w o rk m ore effectively concerning p e n d in g federal legislation. A lso , tw o national tax organ izations, T h e T a x Foundation, N e w Y o r k , and the Citizens N a tio n a l Committee, W a sh in g to n , D . C., are unofficially allied w ith the state associations. N o w , w h at w e are d riv in g at is that there has never been a time w h en the w o rk o f a state taxpayers association is m ore im portant. T h e activities have broadened and in creased fa r beyond the thoughts o f the origin al founders. N e v a d a has the most under-staffed association o f any o f the states. It has become imperative, i f our association is to adequately fu lfill its function, that an assistant director be em ployed, w h o w ill devote his time prim arily to statistical and field w ork . A lso , the overhead cost o f operating the Association has risen due to increased stenographic w o rk and h igher rental. Finally, d u rin g the next fiscal year w e w ill face another session o f the legislature, and it w as proven at the last session that one in dividu al cannot adequately meet its problem s. T h e service rendered through the legislative bulletin in itself w as nearly a fu ll time jo b d u rin g the sessions o f the legislature. It d id not leave sufficient hours fo r prop er conferences w ith legislators, or fo r intensive study o f the several hundred bills which w ere introduced. T h is editorial is fran k ly an appeal to Y O U . Y o u w o u ld not be on the m ailin g list o f this T a x R eview if w e d id not believe that you w ere interested in ou r problem s, and w e u rge that i f you are not already a m em ber o f the N e v a d a Taxpayers Association, you w ill join ou r association at this time and p rio r to ou r annual m eeting on M a y 14, in order that w e m ay bu d get accordingly fo r the com ing year. It may be that even though you are a m em ber, you w ill feel that you are in a position to increase your contribution or, i f not, that you w ill obtain a n ew m em ber fo r us. W e need your help in increasing our income b y an estimated figu re o f $5000.00. It is needed i f w e are to represent you as effectively as w e should and, to repeat, there never w as a time w h en there w as m ore need fo r you to be so represented. I f you pay substantial property taxes, w e w o u ld su ggest that you p ay u pon the basis (p ro v id e d fo r u nder our b y -la w s ) o f one-quarter o f one p er cent o f the amount p aid by you in property taxes in N e v a d a . H o w e v e r, fo r those w h o d o not pay la rg e property taxes, w e suggest one o f the fo llo w in g classes o f m em bership: Patron, $500; Benefactor, $250; S upportin g M em ber, $100; C ontributing M em ber, $50; Sustaining M em ber, $25; A ctive M em ber, $10; Associate M em ber, $5. RADIO TAX TALKS T h ro u g h the courtesy o f K O H , the D irector o f the N e v a d a T axpayers Association is g iv in g a series o f radio talks on taxation. T h e y consist o f ten 15-minute broadcasts on M o n d a y nights, fro m 8:15 to 8:30 o ’clock. T h e first o f this series w as on A p r il 8. T h is radio p ro gram is one o f the Association’s activities designed to keep the taxpayers tax-conscious and tax-inform ed. THE NEVADA TAX REVIEW THREE A S S O C I A T I O N T O C O N D U C T F O R U M A N D H O L D IT S A N N U A L M E E T I N G I n ; accordance w ith the provisions o f the by-laws, the annual m eeting o f the N e v a d a T axpayers A sso ciation w ill be held af 3:30 P . M ., on Tuesday, M a y 14, at the C ham ber o f Com m erce room in the State B u ild in g, R eno, N ev ad a. T h is w ill consist o f the business session fo r the election o f mem bers o f the Executive Committee fo r the ensuing year, and fo r such other business as may come before the m eeting. Im m ediately fo llo w in g w ill be the m eeting o f the new ly elected Executive C o m mittee fo r the election o f officers. In conjunction w ith the annual meeting, the A sso ciation this year is initiating a n ew activity. O n e week later, on Tuesday, M a y 21, from one until five o ’clock, the Association w ill conduct an open foru m on selected tax subjects. T h e m eeting is open to the public, and it is u rged that all taxpayers attend. Personal invitations are bein g extended to elected, and certain appointed state officials, an d to leaders in various fields particularly interested in the subject matter o f the forum . T h e date o f M a y 21 has been chosen to make possible the attendance at the m eeting o f H erbert J. M ille r, F ield Representative o f the Citizens N a tio n a l Committee, w h o w ill act as general m oderator o f the forum . It is also expected that D r . M . H . H arris, D irector o f the U ta h T axpayers Association, and C hairm an o f the C oordin atin g Committee o f the State T axpayers Associations, w ill be present and take part in the forum . F o r the in dividu al subjects, qualified speakers w ill g iv e a b rie f open in g summary o f their particular problem s, after w hich questions and discussions from the floor w ill fo llo w . T h e Association believes that this innovation w ill d o much to stimulate citizen participation in public affairs dealin g w ith taxation, both in W a sh in g to n , our state, and on the local level. It presents to the taxpayers o f N e v a d a an opportunity to become acquainted w ith m any facts w hich are not customarily k n ow n b y the layman. R E V E N U E A C T O F 1945 C O N T A I N S I M P O R T A N T C H A N G E S It is im probable that Congress w ill pass any im portant tax legislation d u rin g 1946 w hich w ill b e effective in 1946. M o st o f the changes w hich w ill affect your 1946 tax b ill w ere included in the Revenue A c t o f 1945. H ig h lig h ts o f the changes fo r 1946, together w ith estimated reductions o f receipts b y the Treasury are as fo llo w s : ( 1 ) R epeal o f excess profits tax as o f January 1, $2,555,000,000. ( 2 ) R epeal o f capital stock tax and declared value profits excess tax com m encing w ith the fiscal year ending June 30, 1946, $234,000,000. ( 3 ) Reduction o f corporate surtax rates (first $25,000 o f net incomes o f $50,000 o r less from 10 p er cent to 6 per cent and in net incomes over $50,000 from 16 to 14 per cen t), $347,000,000. T o ta l corporate tax reductions $3,136,000,000. ( 4 ) N o r m a l tax exemptions m ade same as present surtax exemptions, p ro b ably relieving 12,000,000 persons fro m necessity o f filing returns, $782,000,000. ( 5 ) Reduces surtax rates 3 per cent-age points in each bracket $1,303,000,000. ( 6 ) T a x credit o f 5 per cent com bined norm al and surtax, $559,000,000. T o ta l individuals’ income tax reductions $2,644,000,000. ( 7 ) R epeal o f use tax on m otor vehicles and boats, $140,- 000,000. T o ta l tax reduction fo r 1946, $5,920,000,000. O th er notew orthy p ro v isio n s'o f the 1945 Revenue A ct are freezing o f the Social Security tax rate, at 1 per cent fo r 1946, extension fo r a year o f the unused excess profits tax credit carryback so that a 1946 credit may reduce jl944 or 1945 tax, and the forgiveness o f fe d e ra l income tax payments on certain m ilitary service pay fro m 1940 to 1946, inclusive. U N E M P L O Y M E N T C O M P E N S A T I O N D E P A R T M E N T C H A N G E S E X P E R I E N C E R A T I N G F O R M U L A Retroactive to January 1, 1946, the U nem ploym ent Com pensation D epartm ent o f the state has revised the fo rm u la fo r those em ployers eligible fo r experience rating. T h is experience ratin g w as p rovided fo r by the 1945 session o f the legislature. Experience ratin g applies to those em ployers w h o have m ade contributions to the fu n d fo r thirty-six consecutive months. A l l other em ployers retain the form er flat rate o f 2 .7 % . I n July, 1945, w h en this amendment to the Com pensation A c t became effective, the Em ploym ent Security D epartm ent instituted as a basis fo r experience rating w hat is k n o w n as the "ben efit ratio” form ula, the ratio bein g the quotient obtained by dividin g the total am ount o f the benefits charged to the em ployer’s account by the am ount o f the em ployer’s annual payroll fo r the same period. U n d e r authority o f the nine classifications pro vid ed fo r by statute, the em ployers fe ll into one o f the nine grou ps ra n g in g from 1 percent to 4.5 per cent. T h e n ew form ula, k n o w n as the "reserve ratio” fo rm ula, takes into consideration a n ew factor, that o f the reserve. T h is fo rm u la is the ratio w hich the total contributions, less benefits paid, bears to the average p ay ro ll fo r the past three years. A n im portant feature o f the change is the elim ination o f the so-called "pen alty rates,” these rates b ein g a ll percentages above 2.7. T h e procedure n o w in effect is predicated on six months post-w ar benefit claims. Estimated contributions fo r 1946 am ount to $480,000, instead o f $600,000 under the o ld form ula. A d d in g to the $480,000, $680,000 estimated contributions fro m ineligibles, and $200,000 interest on the fu n d ’s reserve, the net income fo r the year w o u ld be $1,360,000. I f the January benefit lo ad represents an average fo r the year, the total benefits payable d u rin g 1946 w o u ld be $600,000, o r an increased reserve o f $760,000. T h is W ou ld be added to the am ount n o w on deposit in W a s h in g ton, which exceeds $10,500,000. T h e n ew form u la has fo r its low est contribution rate the 1 per cent pro vid ed fo r by statute, an d is applicable to those em ployers h avin g a reserve ratio percentage o f 12 per cent o r above. T h e second classification is less than 12 per cent, bu t m ore than 10 per cent, fo r w hich the rate is 1.5 per cent. T h e third is m ore than 7.5 per cent but less than 10 p e r cent, the rate fo r w hich is 2 per cent. T h e m axim um rate is w h ere the reserve tatio is less than 7.5 per cent, and such em ployers pay at the rate o f 2.7 p e r cent.