Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

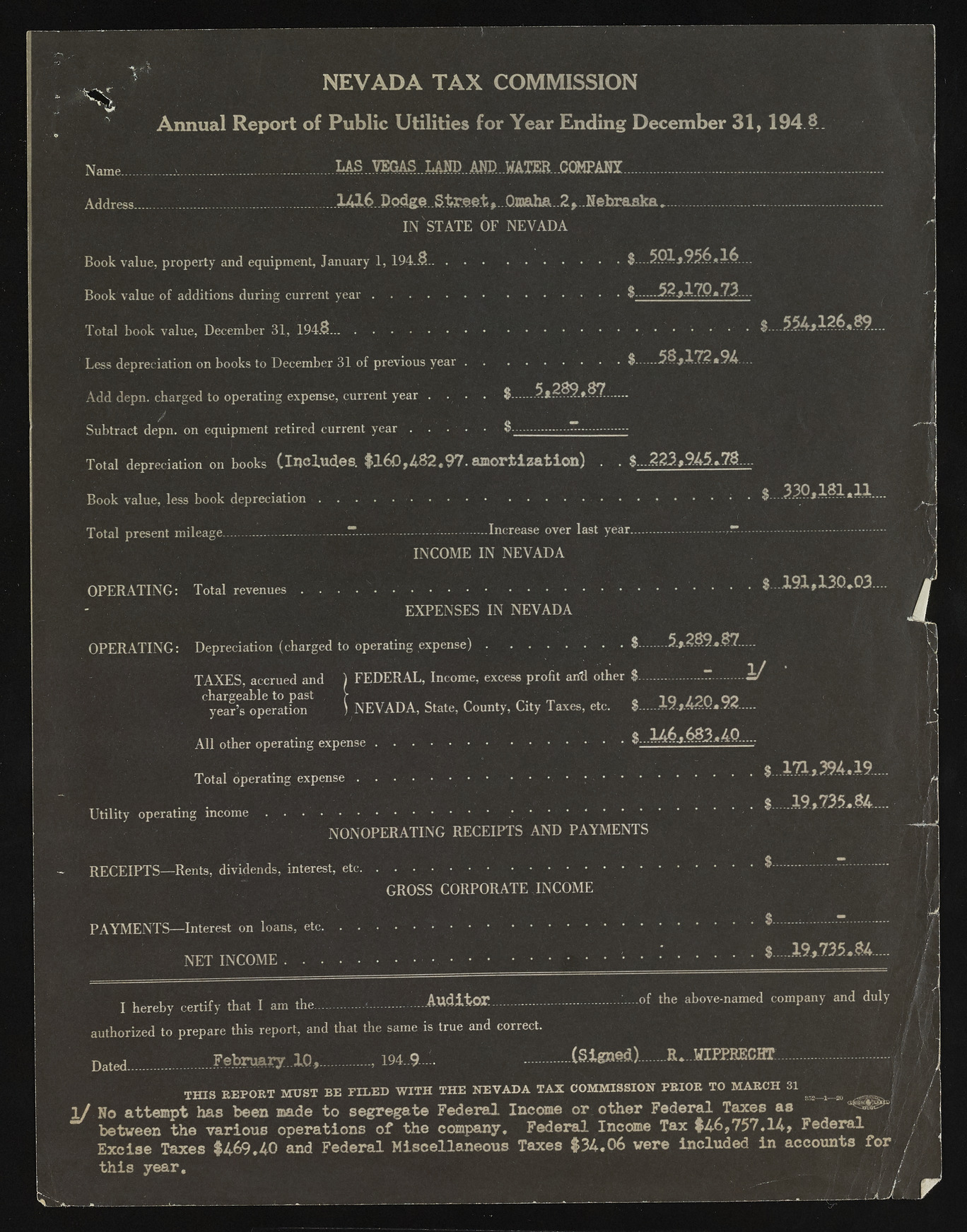

N E V A D A T A X C O M M I S S I O N * A n n u a l R e p o r t o f P u b l i c U t i l i t i e s f o r Y e a r E n d i n g D e c e m b e r 3 1 , 1 9 4 ?.. Nam e............ ............................................ ................................................................................................................................................... Address.......... ....... ..................... 1 4 1 6 P c x i g © . . S t r ^ ^ .......................... ..................... ......... IN ST A T E OF N E V A D A Book value, property and equipment, January 1, 194.3..................... ..... . . . . . $ -..5 .Q l.»9 5 -6 *l6 .. Book value of additions during current year ......................................................... ..... • &..... 5.2jl.?P«.73.... Total book value, December 31, 194.8.......................... . . • • • • • • • . . . . . . . . - 5 5 4 * 1 ? 6 « 8 9 ... Less depreciation on books to December 31 of previous y e a r ..........................................$....... e OgQ A dd depn. charged to operating expense, current year . . . . $ 7-*--f - Subtract depn. on equipment retired current year . . . . • $..............~ ............. Total depreciation on books ( i n c l u d e s . $ 1 6 0 , 4 8 2 . 9 7 . a m o r t i z a t i o n ) . . $...2 2 3 ,9 4 5 ..? 8 ... Book value, less book d e p re c ia tio n .................... ............................................................. $....33Q.*.1...1*11...- Total present mileage........ ..... ..................“ .......... ......... ............ Increase over last year....................................... ............................. IN C O M E IN N E V A D A O P E R A T IN G : Total revenues .................................................. ...... $ 1 9 1 ,1 3 0 * 0 3 .... - E X P E N S E S IN N E V A D A O P E R A T IN G : Depreciation (charged to operating e x p e n s e )........................... $....... 5.,2.89*.87..... T A X E S, accrued and 1 F E D E R A L , Income, excess profit anti other $........ ....... - ......... y • ^ e a r^ o p e ra tfo n ) N E V A D A , State, County, City Taxes, etc. $.... 19».42Q *92..... A ll other operating e x p e n s e .............................. ............................... * $ . 1 4 6 , 6 8 3 * AQ..... % 1 . . $ 1 7 1 , 3 9 4 . 1 9 ... . . . . . l l . $.... 1 9 ,7 3 5 *8 4 ..... Utility operating income .............................................................• • ' ’ N O N O P E R A T IN G R E C E IP T S A N D P A Y M E N T S RECEIPTS— Rents, dividends, interest, etc............................................................. ..... «$ ............ - GROSS C O R P O R A T E IN C O M E « . —........... P A Y M E N T S — Interest on loans, etc. ................................................................. N E T IN C O M E . . ............................... ................................................................. $....... 1 9 , ? 3 5 * . 8 4 - - I hereby certify that I am the...;......... --.......... MitOT. ....................... - of the above-named company and duly authorized to prepare this report, and that the same is true and correct. Date<j February.10,...., 194.9.-. ... (Signed). R...MIEPBECHT...... THIS REPORT MUST BE PILED WITH THE NEVADA TAX COMMISSION PRIOR TO MARCH 31 ^ ^ 1 / N o a t t e m p t h a s b e e n m ad e t o s e g r e g a t e F e d e r a l In c o m e o r o t h e r F e d e r a l T a x e s a s b e t w e e n t h e v a r i o u s o p e r a t i o n s of t h e c o m p a n y « F e d e r a l In c o m e T a x F e d e r a l E x c i s e T a x e s $ 4 6 9 .4 0 a n d F e d e r a l M i s c e l l a n e o u s T a x e s $ 3 4 . 0 6 w e r e i n c l u d e d i n a c c o u n t s f o r t h i s y e a r .