Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

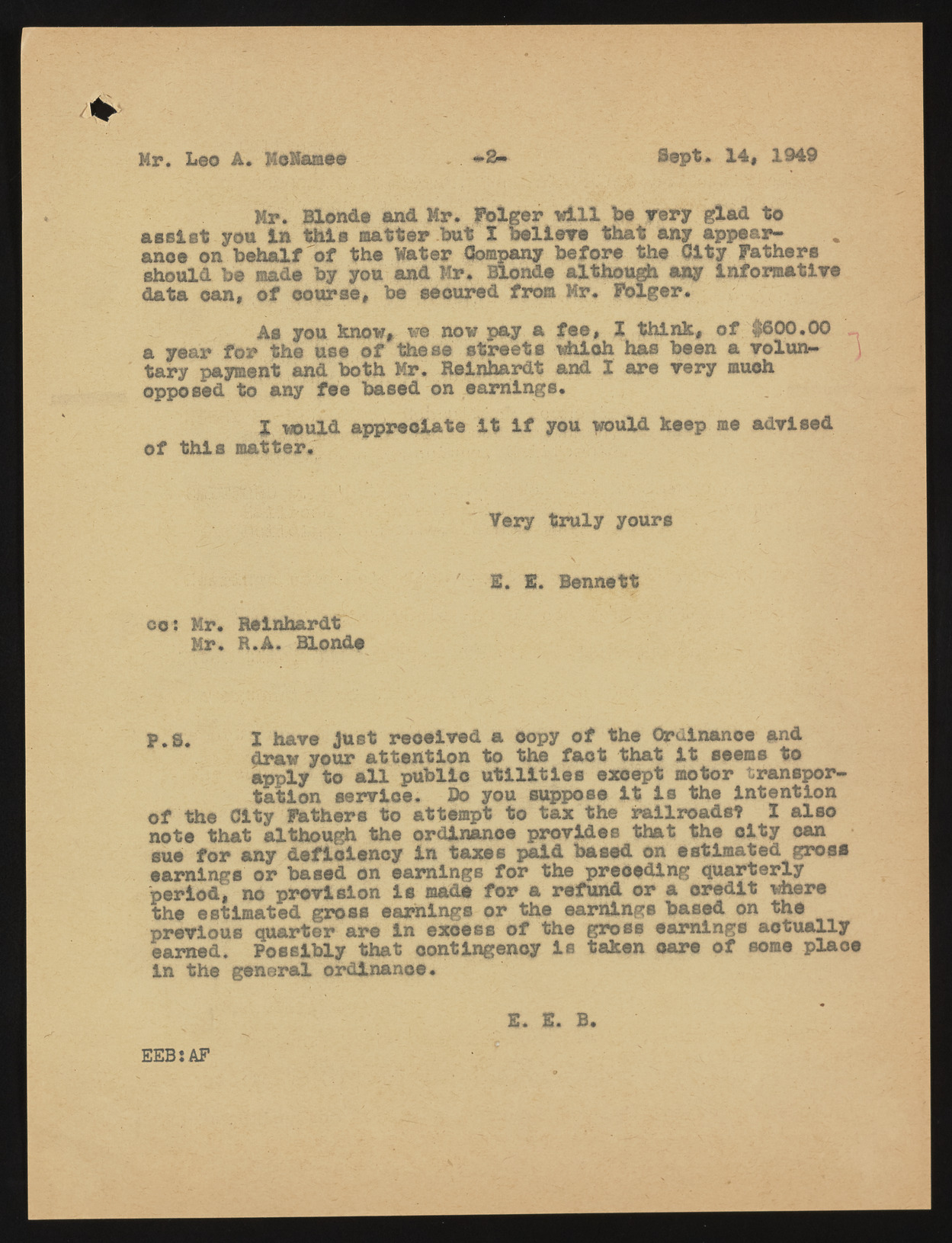

Hr. Leo A. HoHamee Sept* 14, 1949 * Mr. Blonde and Mr. Folger will be Tory glad to assist you In this matter but I bellere that any appear- anoe on behalf of the Water Company before the Olty Fathers should be made by you and Mr. Blonde although any Informative data can, of course, be scoured from Mr. Folger. As you know, we now pay a fee, 1 think, of $600.00 a year for the use of these streets which has been a voluntary payment and both Mr. Reinhardt and 1 are very much opposed to any fee based on earnings. | would appreciate It If you would keep me advised of this matter. Very truly yours E. E. Bennett co • Mr. Reinhardt Mr. R.A. Blonde p.S. 1 have Just received a copy of the Ordinance and draw your attention to the faot that It seems to apply to all public utilities except motor transportation service. Do you suppose It Is the intention of the Olty Fathers to attempt to tax the railroads? I also note that although the ordlnanoe provides that the olty can sue for any deflolenoy in taxes paid based on estimated gross earnings or based on earnings for the preceding quarterly period, no provision le mad# for a refund or a credit where the estimated gross earnings or the earnings based on the previous quarter are In excess of the gross earnings actually earned. Possibly that contingency Is taken care of some place In the general ordlnanoe. E. E. B. vS'V - Jfcg ? V • -V • t \ ' _ . ' '•*' EEBSAF