Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

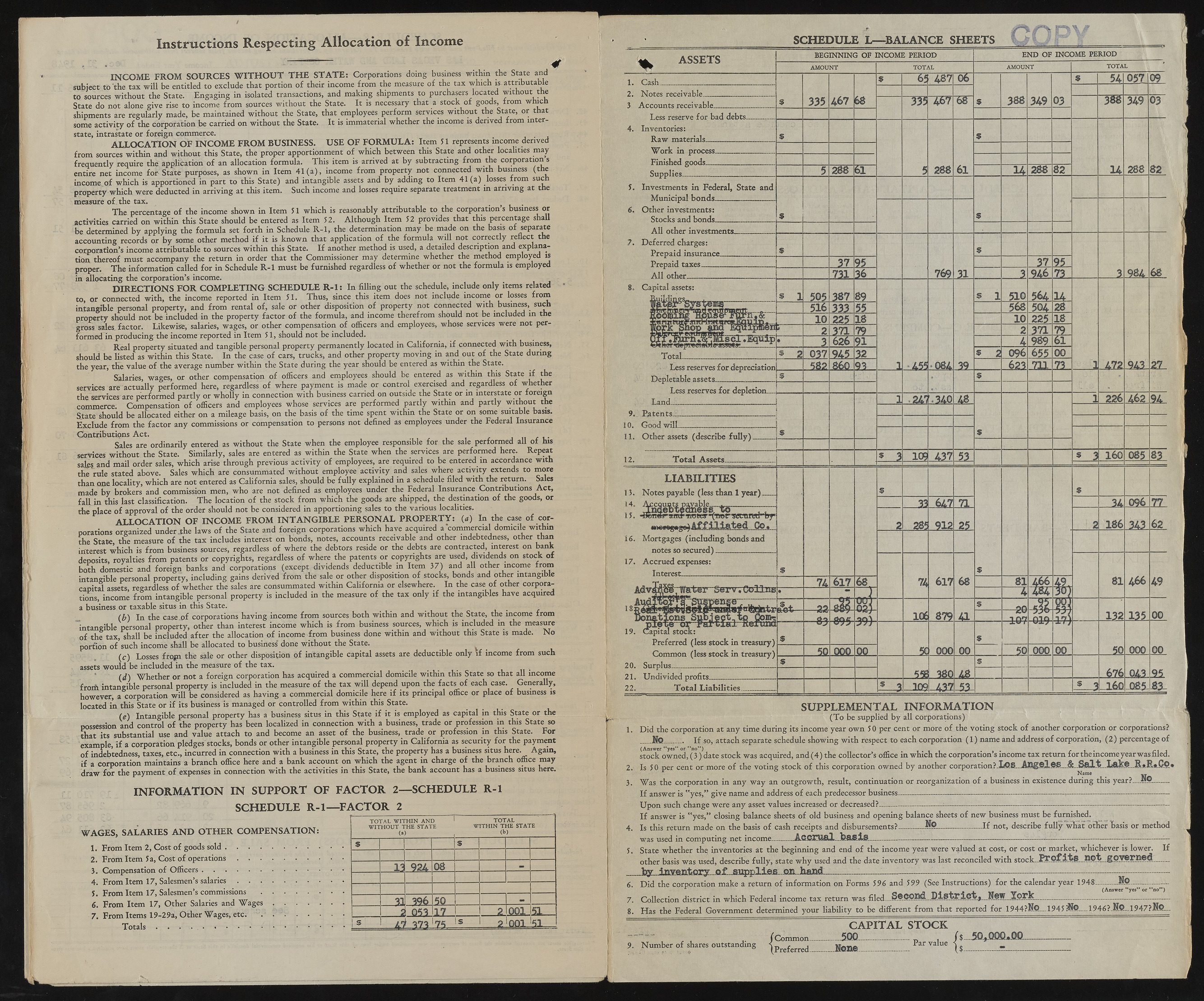

Instructions Respecting Allocation of Income INCOME FROM SOURCES W IT H O U T TH E STATE: Corporations doing business within the State and subject to the tax will be entitled to exclude that portion of their income from the measure of the tax which is. attributable to sources without the State. Engaging in isolated transactions, and making shipments to purchasers located without the State do not alone give rise to income from sources without the State. It is necessary that a stock of goods, irom which shipments are regularly made, be maintained without the State, that employees perform services without the State, or that some activity of the corporation be carried on without the State. It is immaterial whether the income is derived from interstate, intrastate or foreign commerce. A LLO C ATIO N OF INCOME FROM BUSINESS. USE OF FORM ULA: Item SI represents income derived from sources within and without this State, the proper apportionment of which between this State and other localities may frequently require the application of an allocation formula. This item is arrived at by subtractmg from the corporation s entire net income for-State purposes, as shown in Item 41(a), income from property not connected with business (the income of which is apportioned in part to this State) and intangible assets and by adding to Item 41 (a) losses from such property which were deducted in arriving at this item. Such income and losses require separate treatment m arriving at the measure o f . the tax. The percentage o f the income shown in Item 51 which is reasonably attributable to the corporation’s business or activities carried on within this. State should be entered as Item 52. Although Item 52 provides that this percentage shall be determined by applying the formula set forth in Schedule R -l, the determination may be made on the basis of separate accounting records or by some other method if it is known that application of the formula will not correctly reflect the corporation’s income attributable to sources within this State. If another method is used, a detailed description and explanation’ thereof must accompany the return in order that the Commissioner may determine whether the method employed is proper. The information called for in Schedule R -l must be furnished regardless of whether or not the formula is employed in allocating the corporation’s income. ? . ? DIRECTIO NS FOR COM PLETING SCHEDULE R - l : In filling out the schedule, include only items related to, or connected with, the income reported in Item 51. Thus, since this item does not include income or losses from intangible personal property, and from rental of, sale or other disposition of property not connected with business, such property should not be included in the property factor of the formula, and income therefrom should not be included in the gross sales, factor. Likewise, salaries, wages, or other compensation of officers and employees, whose services were not performed in producing the income reported in Item 51, should not be included. Real property situated and tangible personal property permanently located in California, if connected with business, should he listed as within this State. In the case of cars, trucks, and other property moving in and out of the State during the year, the value of the average number within the State during the year should be entered as within the State. Salaries, wages, or other compensation of officers and employees should be entered as within this State if the services are actually performed here, regardless of where payment is made or control exercised and regardless of whether the services are performed partly or wholly in connection with business carried on outside the State or in interstate or foreign commerce. Compensation o f officers and employees whose services are performed partly within and partly without the State should be allocated either on a mileage basis, on the basis of the time spent within the State or on some suitable basis. Exclude from the factor any commissions or compensation to persons not defined as employees under the Federal Insurance Contributions Act. Sales are ordinarily entered as without the State when the employee responsible for the sale performed all of his services without the State. Similarly, sales are entered as within the State when the services are performed here. Repeat safe, and mail order sales, which arise through previous activity of employees, are required to be entered in accordance with the rule stated above. Sales which are consummated without employee activity and sales where activity extends to more than one locality, which are not entered as California sales, should be fully explained in a schedule filed with the return. Sales made by brokers and commission men, who are not defined as employees under the Federal Insurance Contributions Act, fall in this last classification. The location of the stock from which the goods are shipped, the destination of the goods, or the place of approval of the order should not be considered in apportioning sales to the various localities. A LL O C AT IO N OF INCOME FROM IN TAN G IBLE PERSONAL PRO PERTY: (a) In the case o f corporations organized under .the laws of the State and foreign corporations which have acquired a commercial domicile within the State the measure of the tax includes interest on bonds, notes, accounts receivable and other indebtedness, other than interest which is from business sources, regardless of where the debtors reside or the debts are contracted, interest on bank deposits, royalties from patents or copyrights, regardless of where the patents or copyrights are used, dividends on stock of both domestic and foreign banks and corporations (except dividends deductible in Item 37) and all other income from intangible personal property, including gains derived from the sale or other disposition o f stocks, bonds and other intangible capital assets, regardless of whether the sales are consummated within California or elsewhere. In the case of other corporations, income from intangible personal property is included in the measure of the tax only if the intangibles have acquired a business, or taxable situs in this State. (b) In the case o f corporations having income from sources both within and without the State, the income from Intangible personal property, other than interest income which is from business sources, which is included in the measure of the tax, shall be included after the allocation of income from business done within and without this State is made. No portion of such income shall be allocated to business* done without the State. (c ) Losses frojn the sale or other disposition of intangible capital assets are deductible only if income from such . assets would be included in the measure of the tax. (d) Whether or not a foreign corporation has acquired a commercial domicile within this State so that all income fr o * intangible personal property is included in the measure of the tax will depend upon the facts of each case. Generally, however, a corporation will be considered as having a commercial domicile here if its principal office or place of business is located in this State or if its business is managed or controlled from within this State. (e) Intangible personal property has a business situs in this State if it is employed as capital in this State or the possession and control o f the property has been localized in connection with a business, trade or profession in this State so that its substantial use and value attach to and become an asset o f the business, trade or profession in this State. For example, if a corporation pledges stocks, bonds or other intangible personal property in California as security for the payment of indebtedness, taxes, etc., incurred in connection with a business in this State, the property has a business situs here. Again, if a corporation maintains a branch office here and a bank account on which the agent in charge of the branch office may draw for the payment of expenses in connection with the activities in this State, the bank account has a business situs here. INFORMATION IN SUPPORT OF FACTOR 2— SCHEDULE R -l SCHEDULE R -l— FACTOR 2 WAGES, SALARIES A N D OTH ER COM PENSATION: 1. From Item 2, Cost of goods sold . . . . 2. From Item 5a, Cost of operations . . . 3. Compensation of Officers . . . . • • 4. From Item 17, Salesmen’s salaries . . . 5. From Item 17, Salesmen’s commissions 6. From Item 17, Other Salaries and Wages 7. From Items 19-29a, Other Wages, etc. . Totals ................................................ TO TAL W ITH IN AND W ITH OU T THE STATE (a) TOTAL W ITH IN THE STATE (b ) $ 9 11 924 08 - 396 50 — £ 053 17 2 Hoo | $ & ™ 75 $ 2 001. 51 SCHEDULE L— BALANCE SHEETS 5 | ASSETS BEGINNING OF INCOME PERIOD END OF INCOME PERIOD AM OUNT TOTAL AMOUNT TOTAL $ 335 467 68 9 6f 487 06 9 388 349 03 $ 54 057 09 3 Accounts receivable 335~ W 7 1 M 349 03 4. Inventories: Raw materials * 5 288 61 9 14 288 82 Work in process Finished goods 5 288 6l 14 288 82 5. Investments in Federal, State and 9 9 6. Other investments: Stocks and bonds 7. Deferred charges: Prepaid insurance 9 769 31 9 ____ 1 984 68 Prepaid taxes 37 95 37 95 All other 733- 36 _i 946 73 8. Capital assets: $ 1 505 387 89 »A55>084 9 l 51© 564 14 1 472M2- 27 ____ < 516 333 55 568 504 28 10 225 18 10 225 18 P— ~ el. Equip• 2 371 79 2 371 79- _! 626 91 4 989 6l Total 9 2 037 945 32 « 2 096 655 00 Less reserves for depreciation 86o 93 623 711 73 Depletahle assets 9 » 9 1 .241 .340 48 9 1 226 462 94_ 10. Good will 11. Other assets (describe fully) 9 12. Total Assets................ ? L $ 3 10^ 437 53 9 3 160 085 83 LIABILITIES 13. Notes payable (less than 1 year)___ | $ 9 $ I14, . AXcncoduen btts epaayhaebl se r —t o - . .....,. ..,. .. 31 647 73, 34 096 77 15. TOtey“(upr^etTireu-py f I l i a / b e d Q©»-. 2 28J 912 25 2 186 343 62 16. Mortgages (including bonds and notes so secured ) 17. Accrued expenses: Interest 74 617 68 74 617 68 81 466 81 466 49 A d v f f P i , ~W a t e r ^ S e r v T C o H n B • j ! ~4 484:% 9 A txr- 106 879 4 1 9 m D o n a t i o n s fioBfcf f l o r 132 135 00 AW 1 0 7 010 19. (Capital stock: Preferred (less stock in treasury) Common (less stock in treasury) 9 OJJ w Jfyj 5C 000 00 9 ± f 7 50 000 00 50 000 00 50 000 00 9 55R 380 4 3 9 _ £ 2 £ _04125. 9 0 10Q /, 37 53 .* 3, 160 085-S3- ----- - . . v m 1. 2. 3. 4. 9. SUPPLEMENTAL INFORMATION (To be supplied by all corporations) Did the corporation at any time during its income year own 50 per cent or more of the voting stock of another corporation or corporations? __ If so, attach separate schedule showing with respect to each corporation (1) name and address o f corporation, (2) percentage of (Answer "yes” or "n o ” ) i i t . r i • i stock owned, (3) date stock was acquired, and (4) the collector’s office in which the corporation s income tax return for the mcome year was filed. Is 50 per cent or more of the voting stock of this corporation owned by another corporation?.I(QS„^Sg©lSfi-__&„Ssli__IiSl£®__R»_R*.G.O« Was the corporation in any way an outgrowth, result, continuation or reorganization of a business in existence during this year?—-!*©------ If answer is "yes,” give name and address of each predecessor business-— ---------------------------------------—--------------- ,--------------------------------------- Upon such change were any asset values increased or decreased?-!— -i-------------—•—-------— -—|------------— ------- ---------- *— -— — -------------------- If answer is "yes,” closing balance sheets of old business and opening balance sheets of new business must be furnished. Is this return made on the basis o f cash receipts and disbursements?— -------|—|— If not, describe fully "what* other basis or method was used in computing net income— __Accrual basis_______ — i— .— _ — -------- --------------------- — — - — •— __--------- State whether the inventories at the beginning and end of the income year were valued at cost, or cost or market, whichever is lower. If other basis was used, describe fully, state why used and the date inventory was last reconciled with stock_-ITof it8..not._gpV®rned------ by inventory of supplies-QiL-haBd------------------------— ------- I--------------- ------ Did the corporation make a return of information on Forms 596 and 599 (See Instructions) for the calendar year 1948------ -Np_„^.L— t. - (Answer **yes” or **no**) Collection district in which Federal income tax return was filed---H®©-©.8&--«i§^-4^#---S^R--XOTk-------.—_____-------------- ------------ -------- Has the Federal Government determined your liability to be different from that reported for 1944?KO— -1945 .1946? NO___1947?lSfe— CAPITAL STOCK ~ (Common__ ____. m i - - - - n , j J M i f t J i ___________ Number of shares outstanding : N ane 1 ar valuc | $_____ - _____________