Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

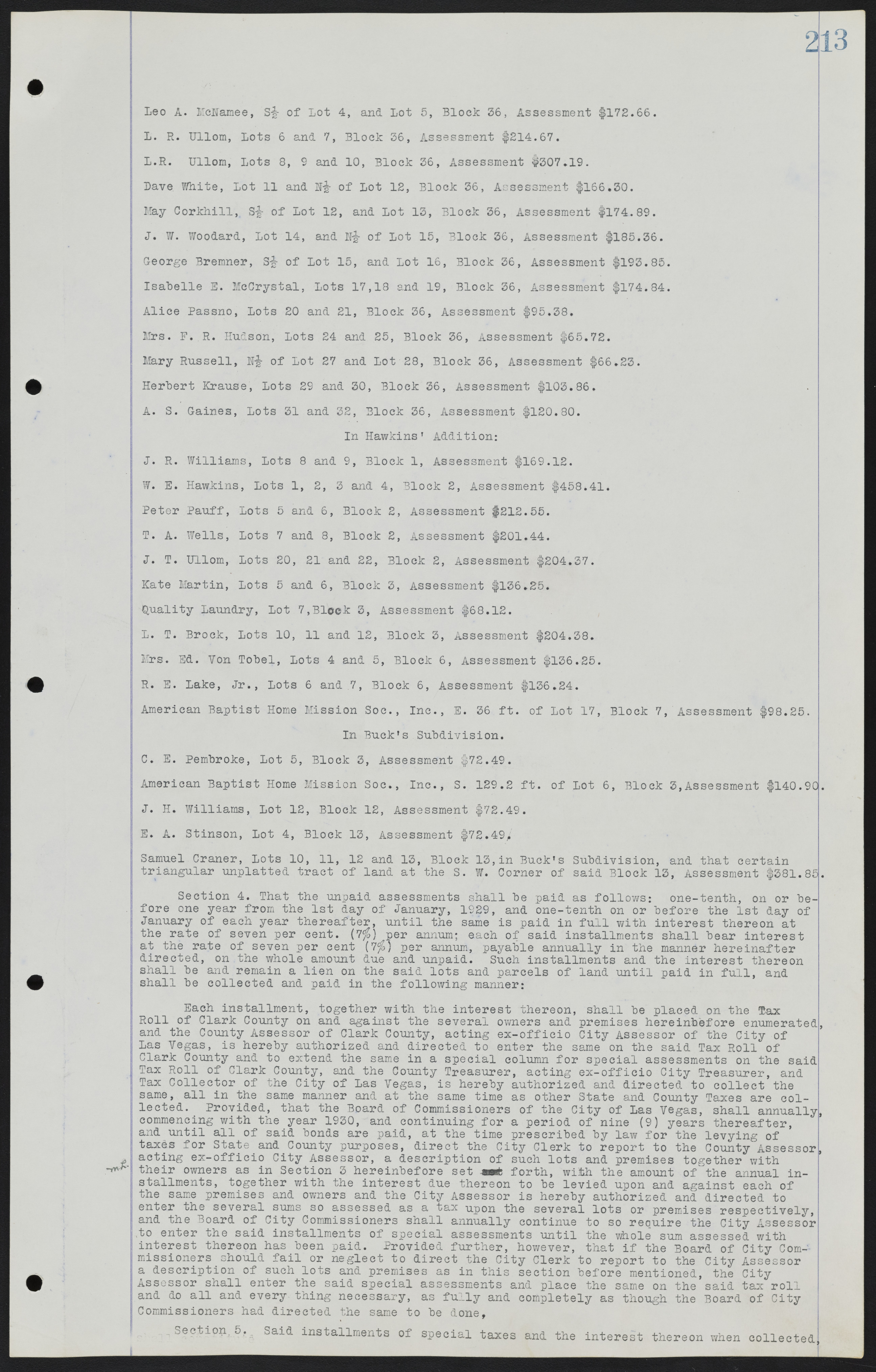

Leo A. McNamee, S½ of Lot 4, and Lot 5, Block 36, Assessment $172.66. L. R. Ullom, Lots 6 and 7, Block 36, Assessment $214.67. L. R. Ullom, Lots 8, 9 and 10, Block 36, Assessment $307.19. Dave White, Lot 11 and N½ of Lot 12, Block 36, Assessment $166.30. May Corkhill, S½ of Lot 12, and Lot 13, Block 36, Assessment $174.89. J. W. Woodard, Lot 14, and N½ of Lot 15, Block 36, Assessment $185.36. George Bremner, S½ of Lot 15, and Lot 16, Block 36, Assessment $193.85. Isabelle E. McCrystal, Lots 17,18 and 19, Block 36, Assessment $174.84. Alice Passno, Lots 20 and 21, Block 36, Assessment $95.38. Mrs. F. R. Hudson, Lots 24 and 25, Block 36, Assessment $65.72. Mary Russell, N½ of Lot 27 and Lot 28, Block 36, Assessment $66.23. Herbert Krause, Lots 29 and 30, Block 36, Assessment $103.86. A. S. Gaines, Lots 31 and 32, Block 36, Assessment $120.80. In Hawkins' Addition: J. R. Williams, Lots 8 and 9, Block 1, Assessment $169.12. W. E. Hawkins, Lots 1, 2, 3 and 4, Block 2, Assessment $458.41. Peter Pauff, Lots 5 and 6, Block 2, Assessment $212.55. T. A. Wells, Lots 7 and 8, Block 2, Assessment $201.44. J. T. Ullom, Lots 20, 21 and 22, Block 2, Assessment $204.37. Kate Martin, Lots 5 and 6, Block 3, Assessment $136.25. Quality Laundry, Lot 7,Block 3, Assessment $68.12. L. T. Brock, Lots 10, 11 and 12, Block 3, Assessment $204.38. Mrs. Ed. Von Tobel, Lots 4 and 5, Block 6, Assessment $136.25. II. 15. Lake, Jr., Lots 6 and 7, Block 6, Assessment $136.24. American Baptist Home Mission Soc., Inc., E. 36 ft. of Lot 17, Block 7, Assessment $98.25. In Buck's Subdivision. C. E. Pembroke, Lot 5, Block 3, Assessment $72.49. American Baptist Home Mission Soc., Inc., S. 129.2 ft. of Lot 6, Block 3, Assessment $140.90. J. H. Williams, Lot 12, Block 12, Assessment $72.49. E. A. Stinson, Lot 4, Block 13, Assessment $72.49. Samuel Craner, Lots 10, 11, 12 and 13, Block 13, in Buck's Subdivision, and that certain triangular unplatted tract of land at the S. W. Corner of said Block 13, Assessment $381.85. Section 4. That the unpaid assessments shall be paid as follows: one-tenth, on or before one year from the 1st day of January, 1929, and one-tenth on or before the 1st day of January of each year thereafter, until the same is paid in full with interest thereon at the rate of seven per cent. (7%) per annum; each of said installments shall bear interest at the rate of seven per cent (7%) per annum, payable annually in the manner hereinafter directed, on the whole amount due and unpaid. Such installments and the interest thereon shall be end remain a lien on the said lots and parcels of land until paid in full, and shall be collected and paid in the following manner: Each installment, together with the interest thereon, shall be placed on the Tax Roll of Clark County on and against the several owners and premises hereinbefore enumerated, and the County Assessor of Clark County, acting ex-officio City Assessor of the City of Las Vegas, is hereby authorized and directed to enter the same on the said Tax Roll of Clark County and to extend the same in a special column for special assessments on the said Tax Roll of Clark County, and the County Treasurer, acting ex-officio City Treasurer, and Tax Collector of the City of Las Vegas, is hereby authorized and directed to collect the same, all in the same manner and at the same time as other State and County Taxes are collected. Provided, that the Board of Commissioners of the City of Las Vegas, shall annually, commencing with the year 1930, and continuing for a period of nine (9) years thereafter, and until all of said bonds are paid, at the time prescribed by law for the levying of taxes for State and County purposes, direct the City Clerk to report to the County Assessor, acting ex-officio City Assessor, a description of such lots and premises together with their owners as in Section 3 hereinbefore set forth, with the amount of the annual installments, together with the interest due thereon to be levied upon and against each of the same premises and owners and the City Assessor is hereby authorized and directed to enter the several sums so assessed as a tax upon the several lots or premises respectively, and the Board of City Commissioners shall annually continue to so require the City Assessor to enter the said installments of special assessments until the whole sum assessed with interest thereon has been paid. Provided further, however, that if the Board of City Commissioners should fail or neglect to direct the City Clerk to report to the City Assessor a description of such lots and premises as in this section before mentioned, the City Assessor shall enter the said special assessments and place the same on the said tax roll and do all and every thing necessary, as fully and completely as though the Board of City Commissioners had directed the same to be done, Section. 5. Said installments of special taxes and the interest thereon when collected,