Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

Member of

More Info

Rights

Digital Provenance

Publisher

Transcription

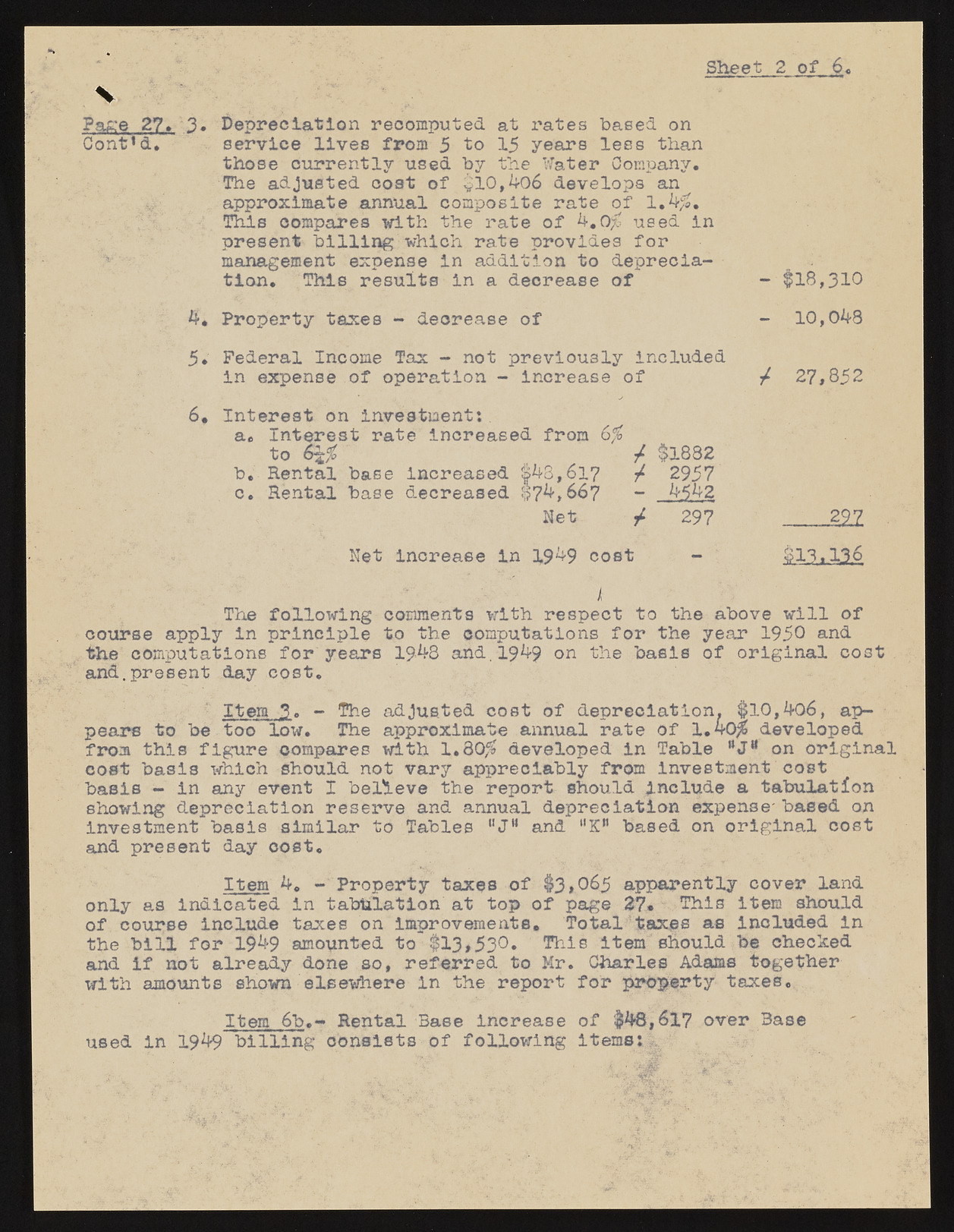

Sheet 2 of 6 . '% Page 27. 3. Depreciation recomputed at rates based on Cont1d. service lives from 5 to 15 years lees than those currently used by the Water Company. The adjusted cost of $10,406 develops an approximate annual composite rate of 1.4;t. This compares with the rate of 4.0;£ used in present billing which rate provides for v management expense in addition to depreciation. This results in a decrease of - $18,310 4* Property taxes - decrease of - 10,048 5. Federal Income Tax - not previously included in expense of operation - Increase of / 27,852 6. Interest on Investment: a. Interest rate increased from to / $1882 b. Rental base Increased |43,6l7 / 2957 c. Rental base decreased 874,667 - 4542 Net / 297 m Net increase in 1949 cost - 818.136 1 The following comments with respect to the above will of course apply in principle to the computations for the year 1950 and the computations for years 1948 and.1949 on the basis of original cost and.present day cost. Item 3. - The adjusted cost of depreciation. $10,406, appears to be too low. The approximate annual rate of 1.4o$ developed from this figure compares with 1.80^ developed in Table “J11 on original cost basis which should not vary appreciably from investment cost basis — in any event I believe the report should Include a tabulation showing depreciation reserve and annual depreciation expense' based on Investment basis similar to Tables 0J* and "K” based on original cost and present day cost. Item 4. - Property taxes of $3»065 apparently cover land only as indicated in tabulation at top of page 27* This item should of course Include taxes on improvements. Total taxes as Included In the bill for 1949 amounted to $13,530. This item should be checked and If not already done so, referred to Mr. Charles Adams together with amounts shown elsewhere in the report for property taxes. Item 6b.- Rental Base Increase of $48,617 over Base used in 1949 billing oonaists of following items:,.